Assessing TechnipFMC (FTI) Valuation After Securing A Large EPCIC Contract For bp’s Tiber Development

TechnipFMC (FTI) is back in focus after securing a large integrated Engineering, Procurement, Construction, and Installation contract from bp for the greenfield Tiber development in the Gulf of America.

See our latest analysis for TechnipFMC.

The contract news comes after a period of strong share price momentum, with TechnipFMC’s 90 day share price return of 27.48% and 5 year total shareholder return of 434.57%, which together point to sustained investor interest.

If this kind of contract win has your attention, it could be a good moment to see what else is out there with aerospace and defense stocks.

With a 1 year total return of 51.12% and an intrinsic discount estimate of 36.55%, TechnipFMC sits at an interesting crossroads. Is the recent contract win already reflected in the price, or is the market still underestimating future growth?

Most Popular Narrative Narrative: 2.6% Overvalued

With TechnipFMC last closing at $48.34 against a narrative fair value of $47.10, the current share price sits slightly above that estimate, which puts more focus on the assumptions behind the model.

Continued investment and leadership in subsea innovation (for example, all-electric subsea systems, hybrid flexible pipe, and CO2 capture technology) position TechnipFMC to capture value from both conventional oil & gas projects and the rising demand for energy transition infrastructure such as CCS and hydrogen, fostering top-line diversification and potential future margin upside.

Curious what earnings path, margin profile, and future P/E multiple need to line up for this valuation to work? The narrative leans on a specific revenue run rate, higher profitability, and a premium forward multiple that sits above the broader energy services group. The full set of numbers is where the story really gets interesting.

Result: Fair Value of $47.10 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on offshore project activity staying on track and Subsea margins holding up, while energy transition pressures could still weigh on long term oil and gas demand.

Find out about the key risks to this TechnipFMC narrative.

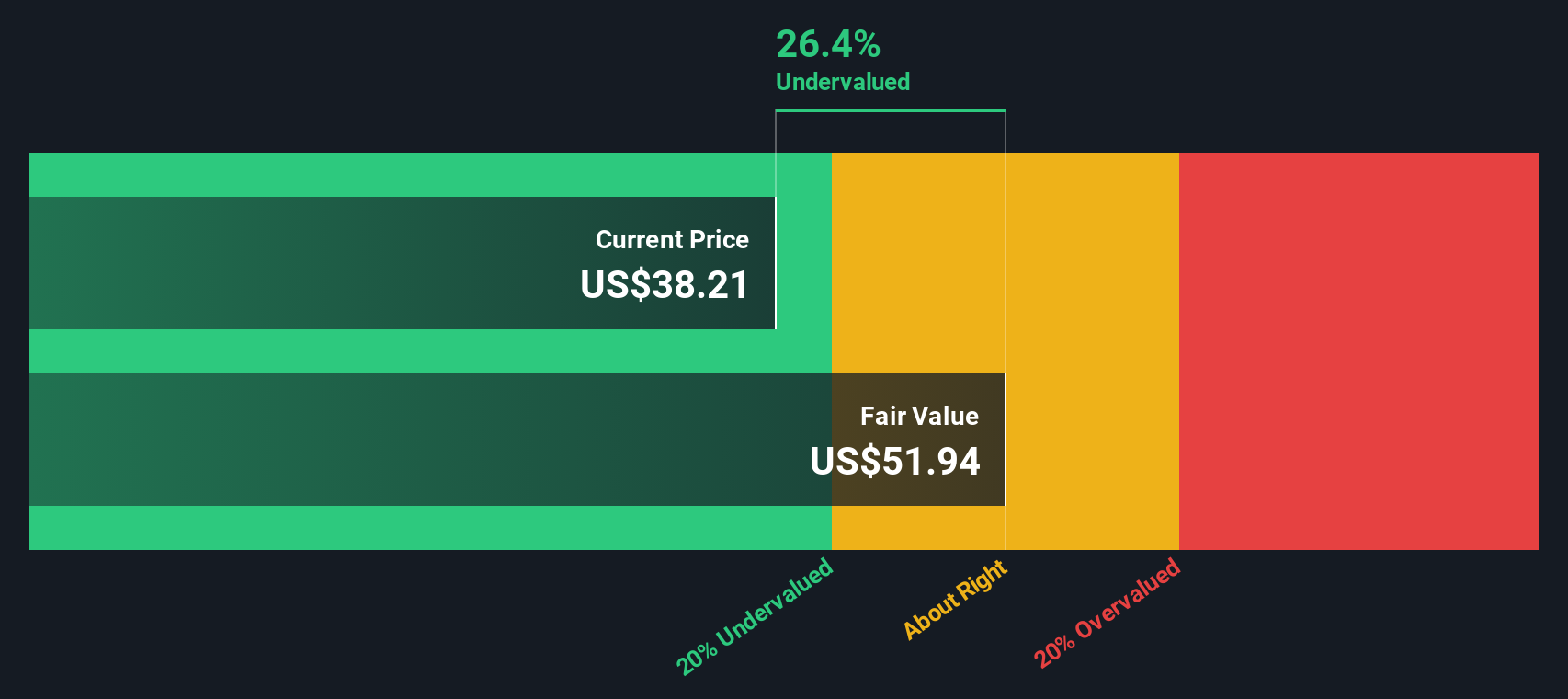

Another View: SWS DCF Points To Undervaluation

While the narrative fair value of $47.10 flags TechnipFMC as 2.6% overvalued, our DCF model presents an estimate of $76.19 instead. At a current price of $48.34, that is a 36.6% discount. Which story feels closer to how you see the next few years playing out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TechnipFMC for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TechnipFMC Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom TechnipFMC view in just a few minutes by starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding TechnipFMC.

Looking for more investment ideas?

If TechnipFMC has sparked your curiosity, do not stop here. The real edge comes from comparing it with other focused opportunities across different themes and risk profiles.

- Spot early stage opportunities that still pass basic quality checks by scanning these 3556 penny stocks with strong financials for ideas that might otherwise slip under your radar.

- Position your portfolio for the AI trend by zeroing in on these 26 AI penny stocks that are already building real products around artificial intelligence.

- Hunt for mispriced ideas by filtering for these 877 undervalued stocks based on cash flows that trade below estimated cash flow based worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal