Assessing Sarepta Therapeutics (SRPT) Valuation After Recent Share Price Rebound From Multi Year Lows

Why Sarepta Therapeutics is on investors’ radar today

Sarepta Therapeutics (SRPT) has drawn fresh attention after recent trading left the stock at a last close of $22.35, reflecting mixed short term returns and weaker performance over the past year and the past 3 months.

See our latest analysis for Sarepta Therapeutics.

For Sarepta, the recent 6.08% 1-day share price return and 3.86% 7-day share price return sit against a much weaker backdrop, with a 1-year total shareholder return decline of 82.30% and an 81.40% decline over three years. This suggests that recent momentum is building from a low base as investors reassess the risk and growth profile.

If Sarepta’s swings have you rethinking your sector exposure, this could be a useful moment to scan other healthcare stocks that match your risk and return preferences.

After such steep multi year declines, a 52% intrinsic discount estimate and recent positive short term returns raise a key question for you: is Sarepta now trading below its underlying potential, or is the market already pricing in future growth?

Most Popular Narrative: 8% Overvalued

On this view, Sarepta’s fair value of US$20.61 sits below the last close at US$22.35, which puts extra focus on how future cash flows are modeled.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.5x on those 2028 earnings, up from -29.9x today. This future PE is greater than the current PE for the US Biotechs industry at 15.3x.

Curious what earnings path could support a richer P/E than many biotech peers, even while revenue is modeled to contract for several years? The full narrative lays out the profit swing, margin shift, and valuation bridge that have to line up for this pricing to hold.

Result: Fair Value of $20.61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on sensitive fault lines, including safety scrutiny around ELEVIDYS, as well as any further delays or setbacks in gene therapy access and reimbursement decisions.

Find out about the key risks to this Sarepta Therapeutics narrative.

Another View: Ratio Signals Tell a Different Story

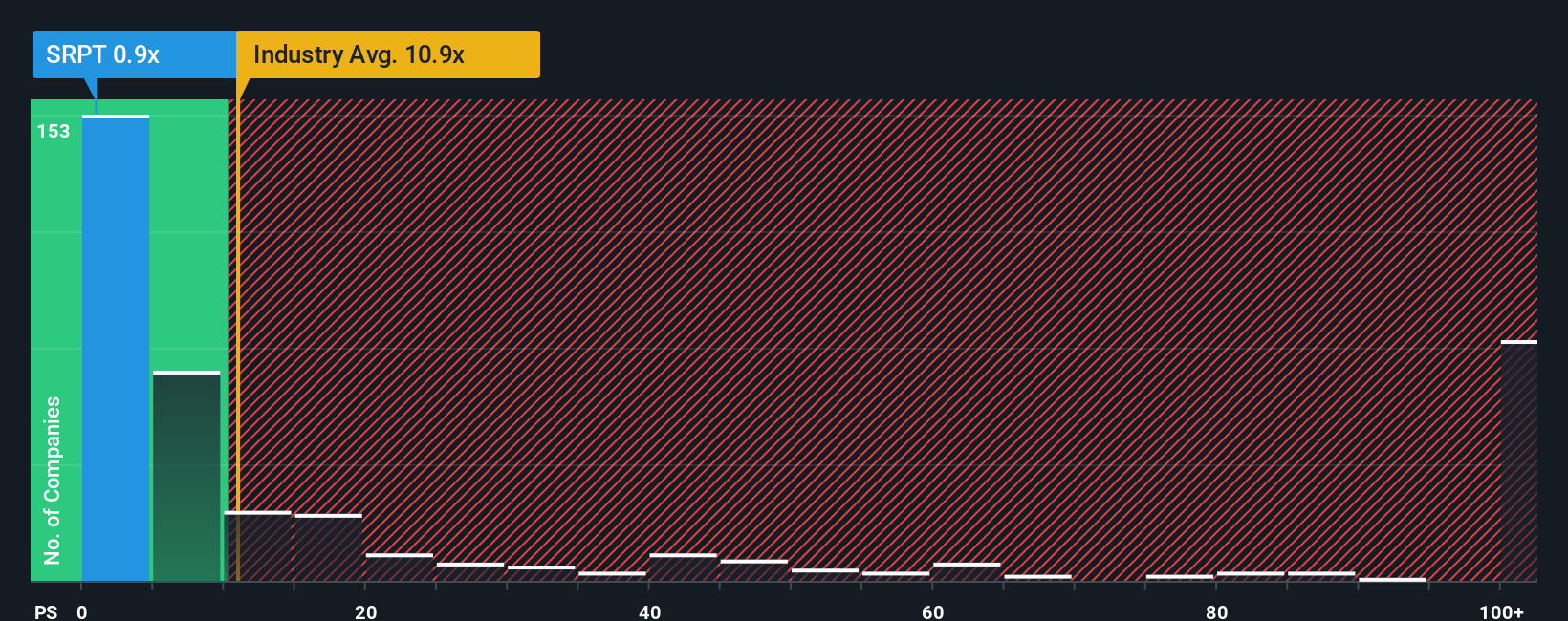

While the most popular narrative tags Sarepta as 8% overvalued on an earnings driven model, the sales based ratios look far more forgiving. Sarepta trades on a P/S of 1x, compared with 11.7x for the US Biotechs industry and 15.6x for close peers, even though the fair ratio sits a little lower at 0.9x.

That gap means the shares are slightly expensive versus the fair ratio, yet extremely cheap against the sector and peers. This points to a wide range of possible outcomes and raises a key question: should this be treated as a warning that sentiment is weak for a reason, or as potential room for sentiment to close the gap over time?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sarepta Therapeutics Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a custom Sarepta view in just a few minutes, starting with Do it your way.

A great starting point for your Sarepta Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Sarepta has sharpened your thinking, do not stop here. Broaden your watchlist with focused stock ideas that match the way you like to invest.

- Spot potential high growth opportunities early by scanning these 3554 penny stocks with strong financials that already show stronger financial footing than many expect from low priced names.

- Zero in on future facing themes by checking out these 26 AI penny stocks that tie artificial intelligence to real business models and measurable progress.

- Hunt for mispriced opportunities using these 876 undervalued stocks based on cash flows that filter for companies where current prices sit well below cash flow based estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal