Cameco’s Valuation After Policy Support And Long Term U.S. Nuclear Fuel Contracts

Recent North American policy support for uranium and nuclear fuel supply, including long term U.S. Department of Energy enrichment contracts, has sharpened investor attention on Cameco (TSX:CCO) and its exposure across the nuclear fuel chain.

See our latest analysis for Cameco.

The current share price of CA$141.01 sits against a 1 year total shareholder return of 90.64% and a 5 year total shareholder return of roughly 7x. A 90 day share price return of 17.19% and 7 day share price return of 12.67% suggest recent momentum has been building as policy support and sector partnerships refocus attention on Cameco’s position in the nuclear fuel chain.

If policy backed uranium themes have caught your eye, it can be useful to see what else is moving in related areas such as aerospace and defense stocks.

With Cameco up roughly 7x in 5 years and trading near CA$141.01, the key question now is whether today’s price still leaves room for upside, or if the market is already pricing in years of future growth.

Most Popular Narrative: 6.5% Undervalued

With Cameco at CA$141.01 and the most followed narrative pointing to a fair value of about CA$150.81, the gap is modest but meaningful.

Momentum in utility contracting is building, but current volumes are subdued; as uncovered utility uranium needs through 2045 accumulate, the eventual surge in term contracting is expected to drive material price and volume upside, improving both Cameco's revenue growth and pricing power (with likely gains to net margins).

Curious what kind of revenue path and margin profile sit behind that valuation gap? The narrative leans on stronger earnings power and a rich future earnings multiple. Want the full story behind those assumptions and how they stack up over the next few years? Read on to see what is priced into that CA$150.81 fair value.

Result: Fair Value of $150.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on new reactor projects actually reaching final investment decision, and on Cameco avoiding further production or delivery setbacks at key uranium assets.

Find out about the key risks to this Cameco narrative.

Another View: Rich Multiple, Different Message

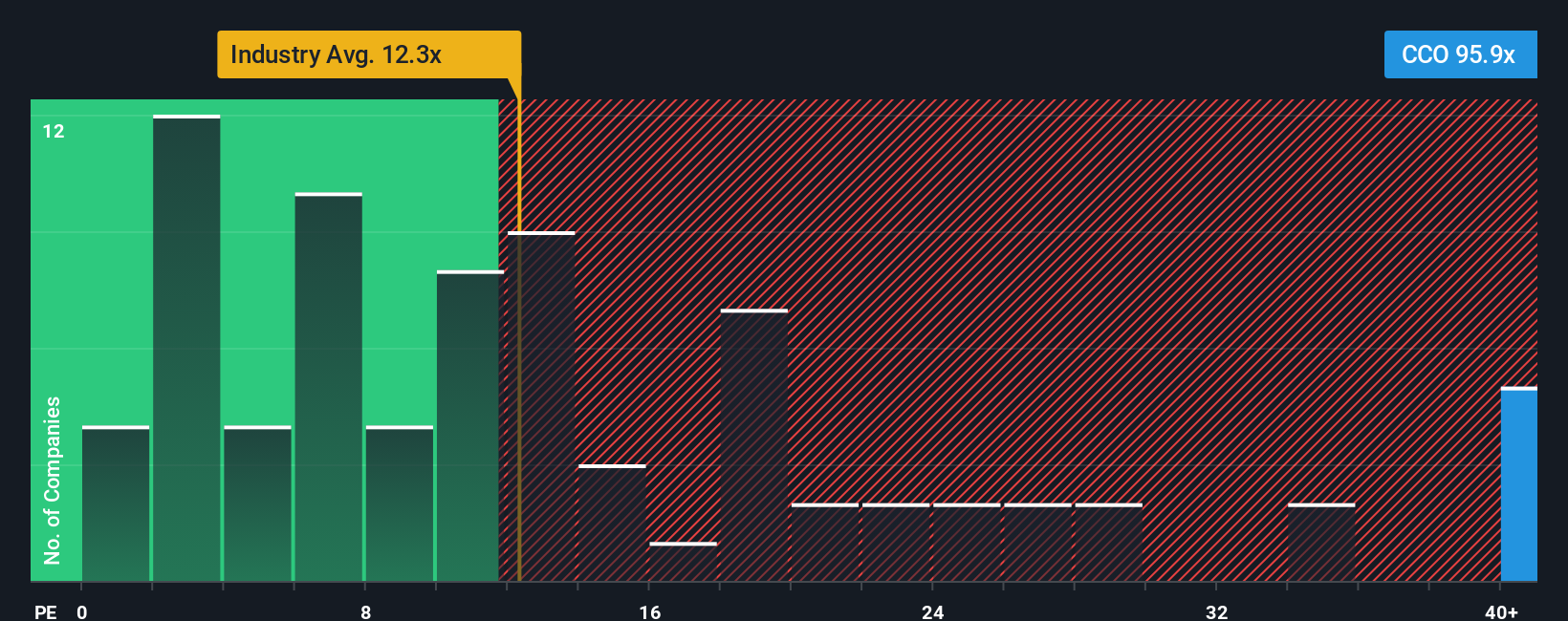

That 6.5% undervaluation story sits uncomfortably next to Cameco’s current P/E of 116.7x. That is far above both the Canadian Oil and Gas industry at 14.5x and peers at 15.7x, and even the fair ratio estimate of 20.3x. This points to a lot of optimism already in the price.

Put simply, if the market leans back toward that 20.3x fair ratio or closer to industry and peer levels, today’s share price could face pressure. The question for you is whether future earnings and cash flows will be strong enough to keep this premium in place.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cameco Narrative

If you see the numbers differently or prefer to weigh the assumptions yourself, you can stress test the data and Do it your way in just a few minutes.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cameco.

Looking for more investment ideas?

If Cameco is already on your radar, do not stop here. The real edge often comes from comparing a few strong but very different opportunities side by side.

- Spot potential value candidates fast by scanning these 878 undervalued stocks based on cash flows that may trade at prices below what their cash flows suggest.

- Target future focused themes by checking out these 25 AI penny stocks that are tied to artificial intelligence trends across multiple sectors.

- Lock in potential income ideas by reviewing these 11 dividend stocks with yields > 3% that currently offer yields above 3% for portfolio cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal