3 Stocks Estimated To Be Up To 49.5% Below Intrinsic Value Offering Investment Potential

As the U.S. stock market experiences mixed movements, with major indices like the Dow Jones and S&P 500 setting fresh all-time highs, investors are navigating a landscape marked by geopolitical developments and fluctuating oil prices. In this environment, identifying undervalued stocks—those trading below their intrinsic value—can offer potential investment opportunities for those looking to capitalize on market inefficiencies amidst these dynamic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Workiva (WK) | $86.63 | $166.66 | 48% |

| WesBanco (WSBC) | $34.44 | $68.74 | 49.9% |

| VTEX (VTEX) | $3.59 | $7.05 | 49.1% |

| Sea (SE) | $142.89 | $276.12 | 48.2% |

| QXO (QXO) | $23.98 | $47.77 | 49.8% |

| Perfect (PERF) | $1.78 | $3.43 | 48.1% |

| Investar Holding (ISTR) | $26.85 | $52.57 | 48.9% |

| Huntington Bancshares (HBAN) | $18.30 | $36.07 | 49.3% |

| CNB Financial (CCNE) | $26.16 | $50.77 | 48.5% |

| Aptiv (APTV) | $82.61 | $163.72 | 49.5% |

Here we highlight a subset of our preferred stocks from the screener.

Grab Holdings (GRAB)

Overview: Grab Holdings Limited operates as a provider of superapps across Southeast Asia, including countries such as Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam with a market capitalization of approximately $20.80 billion.

Operations: Grab Holdings Limited generates revenue through its superapp services across Southeast Asia, encompassing various sectors such as mobility, deliveries, and financial services.

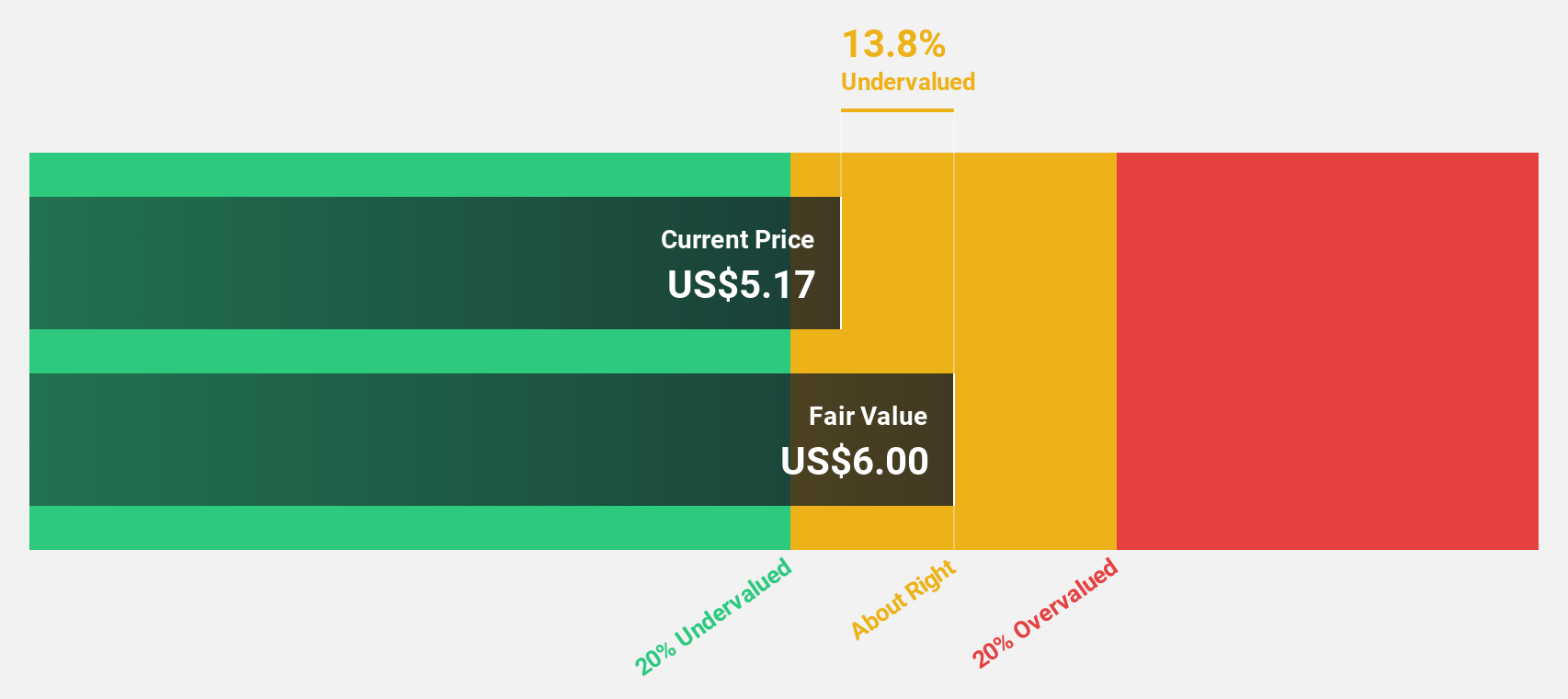

Estimated Discount To Fair Value: 29.2%

Grab Holdings is trading at US$5.27, below its estimated fair value of US$7.44, suggesting undervaluation based on cash flows. The company forecasts revenue growth of 15.7% annually, outpacing the U.S. market's growth rate of 10.5%. Earnings are expected to grow significantly at 33.1% per year over the next three years, surpassing market expectations of 16%. Recent strategic partnerships in autonomous vehicle technology and board changes may bolster future performance and operational capabilities.

- In light of our recent growth report, it seems possible that Grab Holdings' financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Grab Holdings stock in this financial health report.

Aptiv (APTV)

Overview: Aptiv PLC designs, manufactures, and sells vehicle components for the automotive and commercial vehicle markets globally, with a market cap of approximately $17.40 billion.

Operations: Aptiv's revenue segments include Advanced Safety and User Experience, which generated $5.75 billion.

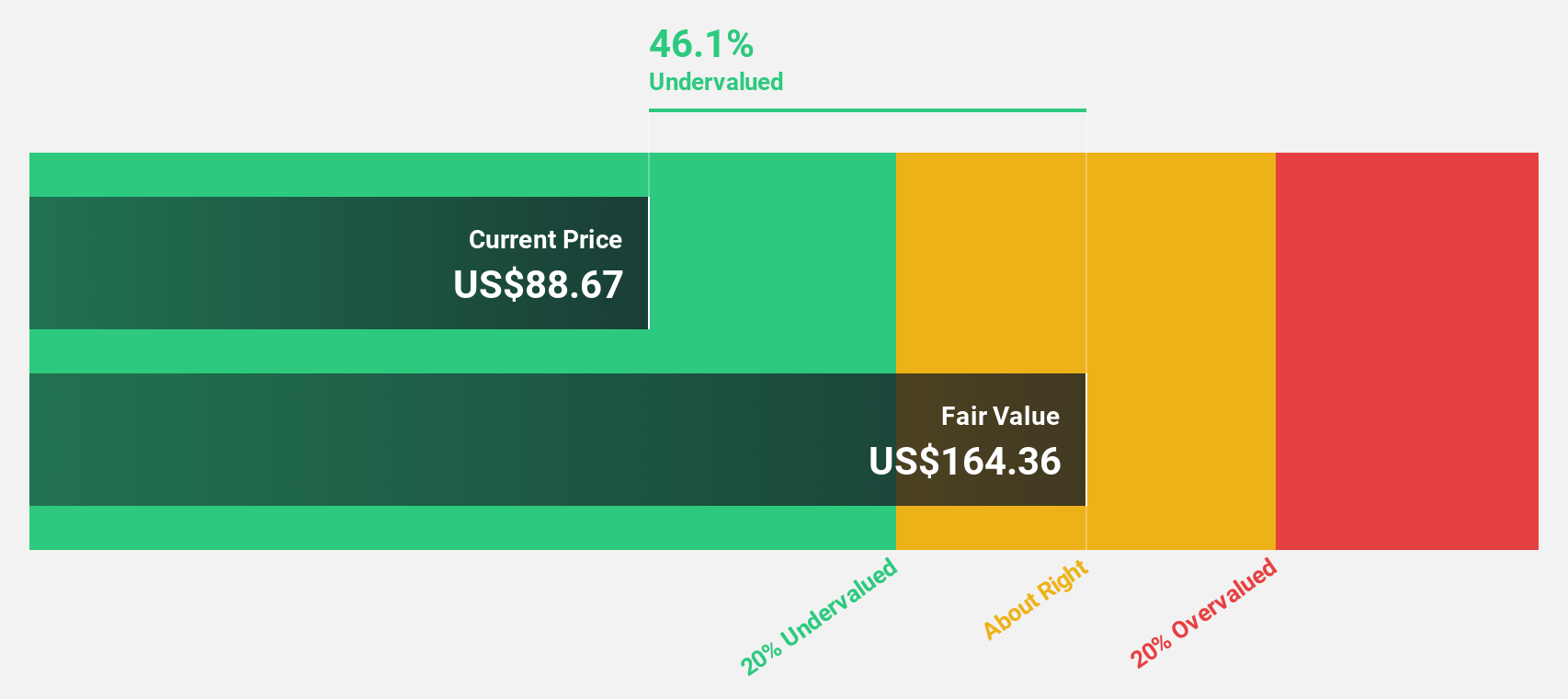

Estimated Discount To Fair Value: 49.5%

Aptiv's current trading price of US$82.61 is significantly below its estimated fair value of US$163.72, pointing to potential undervaluation based on cash flows. Despite high debt levels and recent profit margin declines, earnings are projected to grow at an impressive 85.6% annually over the next three years, far exceeding market averages. Recent strategic alliances in advanced driver assistance systems and AI-powered robotics highlight Aptiv's commitment to innovation and may enhance long-term growth prospects.

- Our comprehensive growth report raises the possibility that Aptiv is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Aptiv.

Corpay (CPAY)

Overview: Corpay, Inc. is a payments company that facilitates the management of vehicle-related expenses, lodging expenses, and corporate payments for businesses and consumers in the United States, Brazil, the United Kingdom, and internationally with a market cap of $21.59 billion.

Operations: The company's revenue segments include $2.06 billion from vehicle payments, $1.50 billion from corporate payments, and $477.92 million from lodging payments.

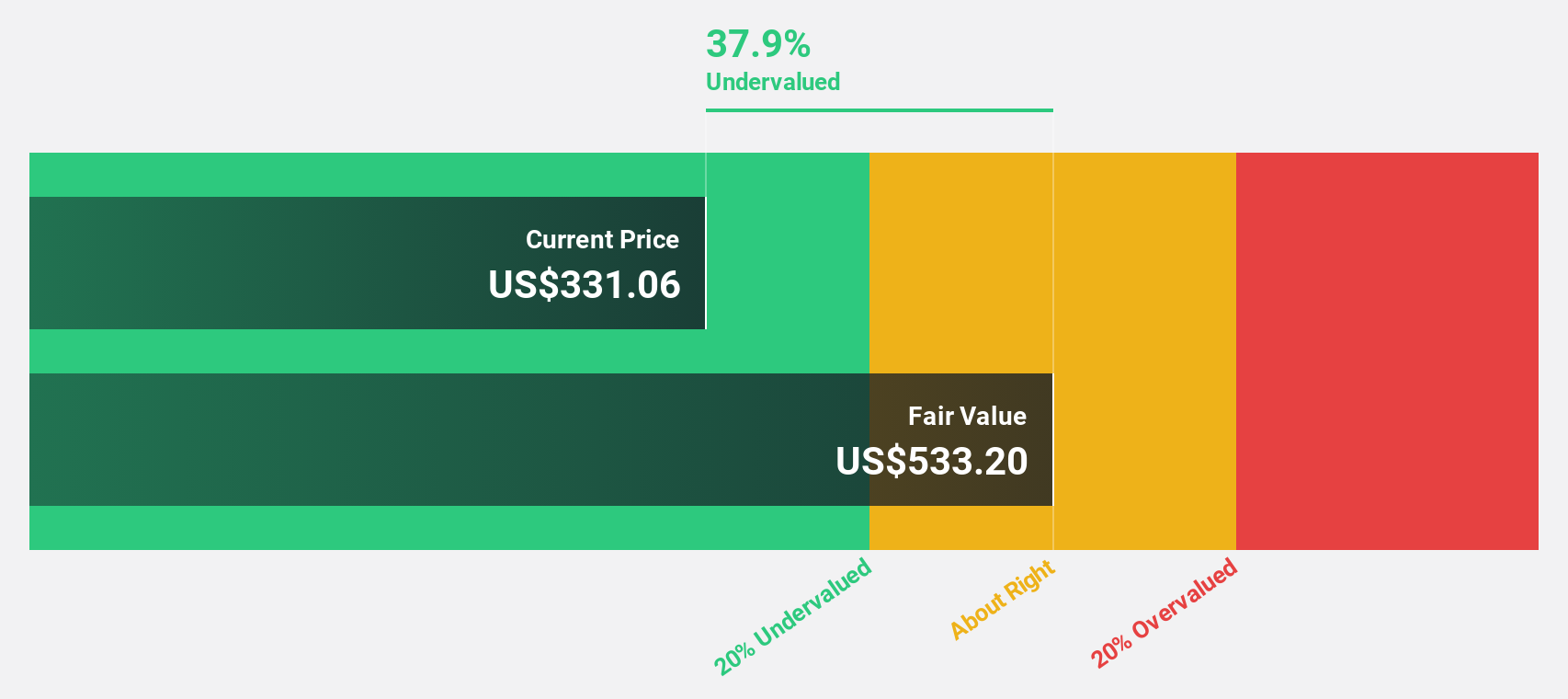

Estimated Discount To Fair Value: 37.7%

Corpay is trading at US$317.63, significantly below its estimated fair value of US$509.56, indicating potential undervaluation based on cash flows. Despite concerns about debt coverage by operating cash flow, Corpay's earnings are projected to grow at a robust 20.1% annually over the next three years, outpacing the broader U.S. market growth rate. Recent initiatives like USCIS Navigator and strategic partnerships further solidify its position in payment solutions and foreign exchange services.

- The analysis detailed in our Corpay growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Corpay's balance sheet health report.

Taking Advantage

- Investigate our full lineup of 184 Undervalued US Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal