Top Insider-Owned Growth Companies To Watch In January 2026

As the U.S. stock market experiences mixed movements with the Dow Jones and S&P 500 reaching fresh all-time highs, investors are keeping a close eye on geopolitical developments and economic indicators such as employment data. In this environment, growth companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those who know the business best and may offer resilience amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| TNL Mediagene (TNMG) | 23% | 148.8% |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 59% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 32.2% | 100% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.5% | 43.6% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 135.5% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

Underneath we present a selection of stocks filtered out by our screen.

Clover Health Investments (CLOV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Clover Health Investments, Corp. offers Medicare Advantage plans in the United States and has a market cap of approximately $1.34 billion.

Operations: The company generates revenue primarily from its insurance segment, totaling $1.77 billion.

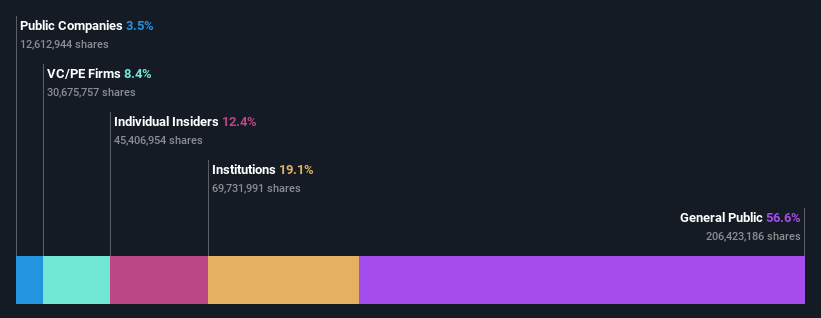

Insider Ownership: 21.1%

Revenue Growth Forecast: 17.4% p.a.

Clover Health Investments is poised for revenue growth at 17.4% annually, outpacing the US market's 10.5%. Despite reporting a net loss of US$24.38 million in Q3 2025, the company raised its full-year insurance revenue guidance to US$1.85 billion - US$1.88 billion, indicating strong potential growth and adaptability in its Medicare Advantage offerings. The departure of Chelsea Clinton from the board marks a significant transition as Clover continues to leverage its AI-powered platform for improved healthcare outcomes.

- Click here to discover the nuances of Clover Health Investments with our detailed analytical future growth report.

- Our valuation report unveils the possibility Clover Health Investments' shares may be trading at a discount.

Alpha Metallurgical Resources (AMR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Alpha Metallurgical Resources, Inc. is a mining company engaged in the production, processing, and sale of metallurgical and thermal coal in Virginia and West Virginia, with a market cap of $2.60 billion.

Operations: The company generates revenue from the production, processing, and sale of metallurgical coal amounting to -$730.93 million.

Insider Ownership: 12.8%

Revenue Growth Forecast: 12.1% p.a.

Alpha Metallurgical Resources exhibits substantial insider buying activity, indicating confidence in its growth prospects. Despite reporting a net loss of US$5.52 million in Q3 2025 and reduced annual revenue compared to the previous year, AMR is trading at 54.3% below its estimated fair value and anticipates significant earnings growth of over 100% annually. The company projects increased sales volumes for 2026, suggesting potential recovery and expansion within the metallurgical sector.

- Dive into the specifics of Alpha Metallurgical Resources here with our thorough growth forecast report.

- Our expertly prepared valuation report Alpha Metallurgical Resources implies its share price may be lower than expected.

SES AI (SES)

Simply Wall St Growth Rating: ★★★★★★

Overview: SES AI Corporation focuses on developing and producing AI-enhanced lithium metal and lithium-ion rechargeable battery technologies for a variety of applications, including electric vehicles, urban air mobility, drones, robotics, and battery energy storage systems; the company has a market cap of approximately $777.60 million.

Operations: SES AI Corporation's revenue segments are not specified in the provided text.

Insider Ownership: 12%

Revenue Growth Forecast: 68.2% p.a.

SES AI is positioned for significant growth, driven by its forecasted annual revenue increase of 68.2%, outpacing the US market. The company plans to become profitable within three years and has a high projected return on equity of 22.6%. Recent strategic moves include a collaboration with Top Material to enhance battery manufacturing in Korea and expansion efforts at its Chungju plant, aiming to meet rising demand from drone customers in the US and Europe.

- Get an in-depth perspective on SES AI's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of SES AI shares in the market.

Taking Advantage

- Unlock our comprehensive list of 212 Fast Growing US Companies With High Insider Ownership by clicking here.

- Contemplating Other Strategies? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal