Discovering Hidden Opportunities in US Stocks

As the Dow Jones and S&P 500 reach new all-time highs, the U.S. stock market continues to capture investors' attention amidst mixed economic signals, including a weakening labor market and geopolitical developments. In this dynamic environment, identifying promising small-cap stocks can offer valuable opportunities for growth, particularly when these companies demonstrate resilience and potential in sectors poised for expansion.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Security Federal | 20.04% | 5.77% | 1.59% | ★★★★★★ |

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

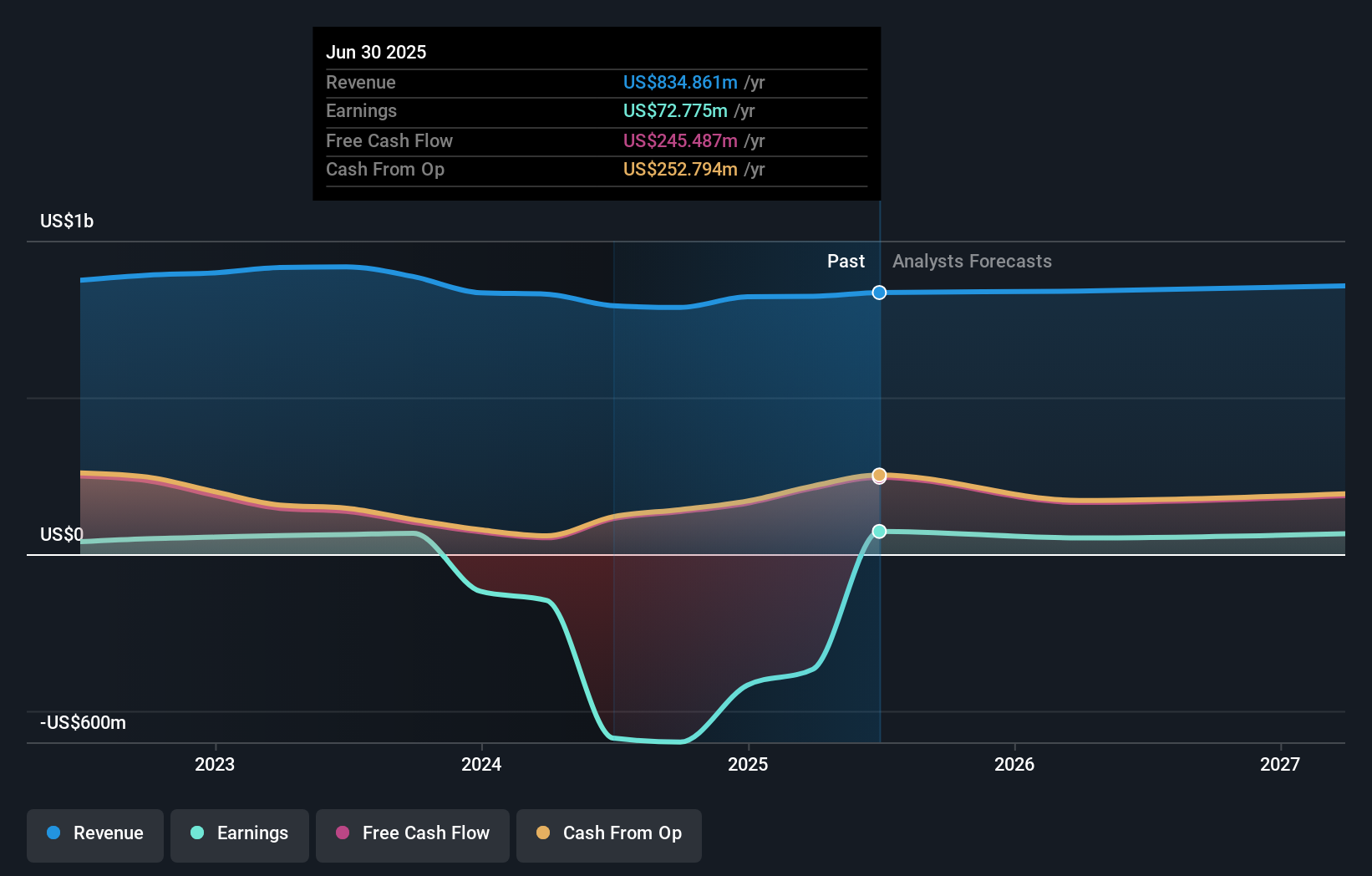

NetScout Systems (NTCT)

Simply Wall St Value Rating: ★★★★★★

Overview: NetScout Systems, Inc. offers service assurance and cybersecurity solutions to safeguard digital business services globally, with a market cap of approximately $1.96 billion.

Operations: Revenue primarily comes from the Computer Networks segment, totaling $862.77 million.

NetScout Systems, a player in cybersecurity and service assurance, is riding the AI wave with innovations that promise to boost revenue and margins. The company has no debt, having reduced its debt-to-equity ratio from 23.2% five years ago to zero today. It trades at 37.5% below estimated fair value, suggesting potential upside for investors seeking value plays. Recent buybacks saw the repurchase of over 3 million shares for $73.48 million, indicating confidence in its market position. Despite these strengths, challenges like cloud migration risks may impact legacy products' stability and current margin expectations amidst evolving industry dynamics.

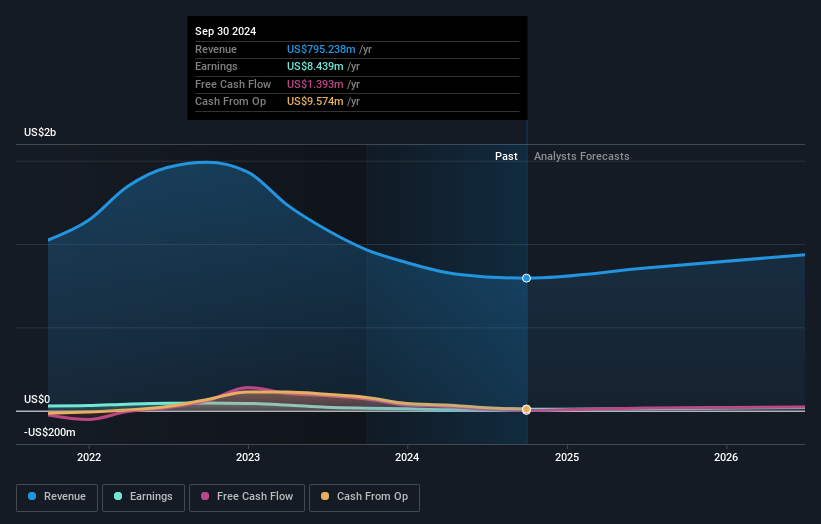

Radiant Logistics (RLGT)

Simply Wall St Value Rating: ★★★★★★

Overview: Radiant Logistics, Inc. is a third-party logistics company offering technology-enabled global transportation and value-added logistics services in the United States and Canada, with a market cap of $303.44 million.

Operations: Radiant Logistics generates revenue primarily from its transportation services, with air freight contributing $925.79 million.

Radiant Logistics, a nimble player in the logistics sector, has shown impressive earnings growth of 80.2% over the past year, outpacing its industry peers. The company's debt to equity ratio improved significantly from 22.6% to 13.2% in five years, reflecting prudent financial management. Trading at 40.9% below estimated fair value suggests potential upside for investors eyeing undervalued opportunities. Recent earnings reported sales of US$226 million but net income fell to US$1.29 million from US$3.38 million a year earlier, indicating some profitability challenges despite high-quality past earnings and robust interest coverage at 11.9 times EBIT.

- Click here to discover the nuances of Radiant Logistics with our detailed analytical health report.

Understand Radiant Logistics' track record by examining our Past report.

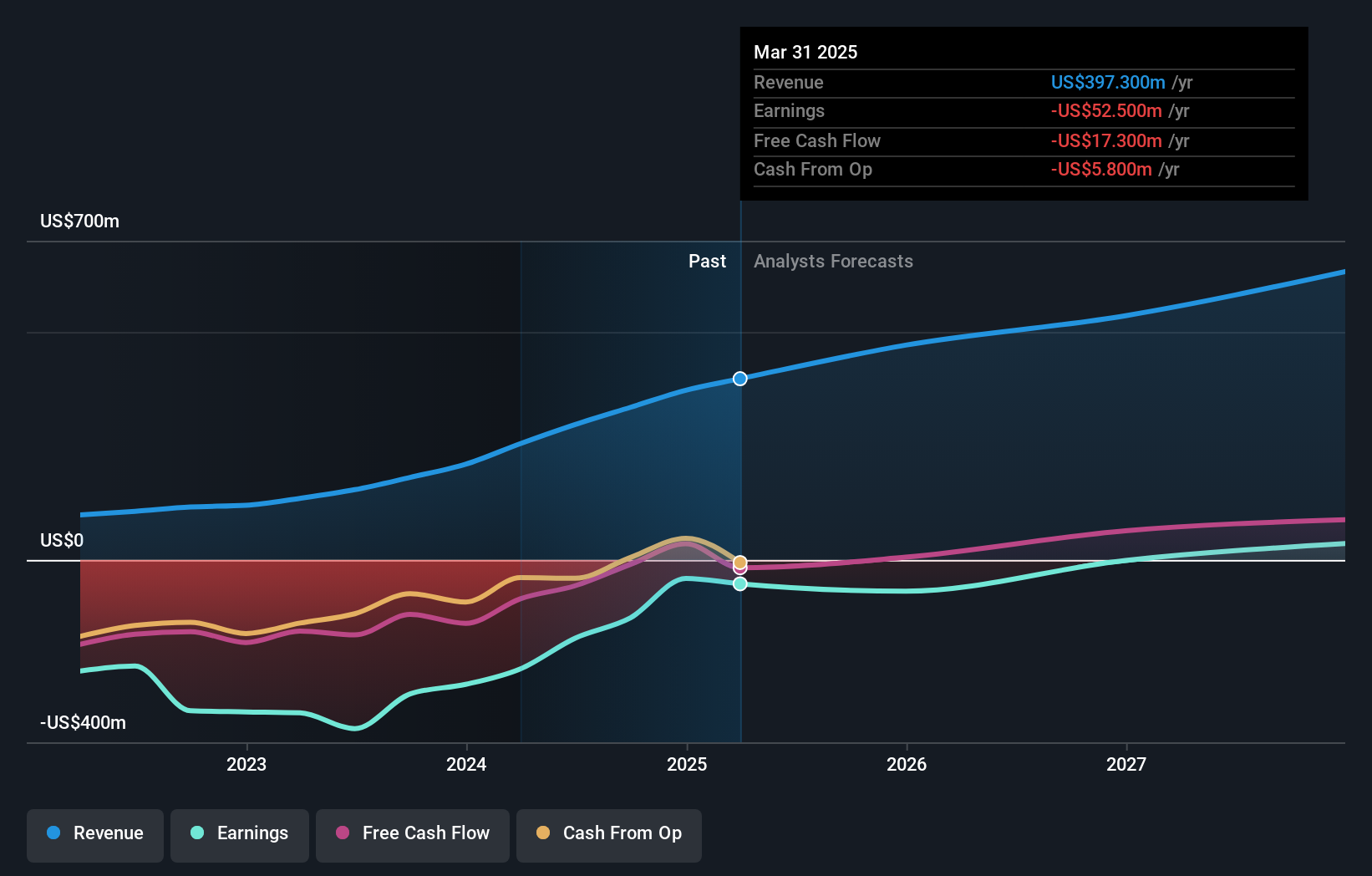

Hippo Holdings (HIPO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hippo Holdings Inc. offers property and casualty insurance products to individuals and businesses in the United States, with a market capitalization of $775 million.

Operations: Hippo Holdings generates revenue primarily through premiums from its property and casualty insurance products. The company has reported a net profit margin of -10% in recent periods, indicating that it is currently operating at a loss.

Hippo Holdings, a dynamic player in the insurance space, has seen significant shifts recently. The company turned profitable last year, driven by a notable one-off gain of US$136M and improved financial metrics like a reduced debt-to-equity ratio from 131.2% to 11.4% over five years. Its price-to-earnings ratio stands at 8.3x, below the US market average of 19.1x, suggesting value potential amidst industry challenges such as climate change impacts and rising reinsurance costs. Recently raising its earnings guidance for 2025 due to stronger top-line growth and disciplined expenses further underscores its strategic positioning in the evolving insurance landscape.

Key Takeaways

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 297 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal