Assessing Firefly Aerospace (FLY) Valuation After Class Action Lawsuits And Alpha Rocket Setback

Why Firefly Aerospace is Suddenly in the Spotlight

Firefly Aerospace (FLY) has drawn intense attention after multiple law firms announced class action lawsuits alleging misleading disclosures around demand for its Spacecraft Solutions and the readiness of its Alpha rocket program.

The complaints center on statements tied to Firefly's August 2025 IPO and subsequent disclosures, following disappointing financial results and an Alpha Flight 7 mission issue that coincided with sharp share price declines.

See our latest analysis for Firefly Aerospace.

Firefly’s legal troubles are unfolding against a backdrop of sharp swings in the stock, with a 30 day share price return of 33.52% and a 90 day share price return of 14.68% decline, leaving year to date share price return at 11.32% and suggesting momentum has recently picked up again.

If this kind of volatility has your attention, it can be helpful to compare Firefly with other US-listed aerospace and defense stocks that are also exposed to space and defense demand trends.

With lawsuits hanging over the IPO story, rapid revenue and net income growth figures, and the share price trading about 40% below the average analyst target and at a roughly 45% intrinsic discount, is there mispricing here, or is the market already baking in future growth?

Price-to-Sales of 37.9x: Is it justified?

On a P/S basis, Firefly Aerospace looks expensive at 37.9x compared with both peers and the wider US Aerospace & Defense industry, even with the last close at $26.45.

The P/S ratio compares the company’s market value to its revenue and is often used for earlier stage or unprofitable businesses where earnings do not yet tell the full story. For Firefly, which is currently loss making but has revenue forecasts, this puts the focus squarely on how much investors are paying for each dollar of sales.

Statements indicate FLY is considered good value when compared with an internal fair value estimate, and that it is trading below a DCF based fair value of $47.99. However, the high P/S ratio suggests the market is already assigning a rich revenue multiple for a business that is still unprofitable. That tension between discounted cash flow estimates and a premium sales multiple underlines how much of the debate rests on future growth and the path to profitability, rather than current earnings.

Compared with a peer average P/S of 5.1x and a US Aerospace & Defense industry average of 3.7x, Firefly’s 37.9x multiple is several times higher, implying investors are pricing in a much stronger revenue trajectory than for many competitors that operate in the same sector.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 37.9x (OVERVALUED)

However, you still have to weigh the class action lawsuits and the current net loss of US$395.833 million, as either of these factors could pressure sentiment further.

Find out about the key risks to this Firefly Aerospace narrative.

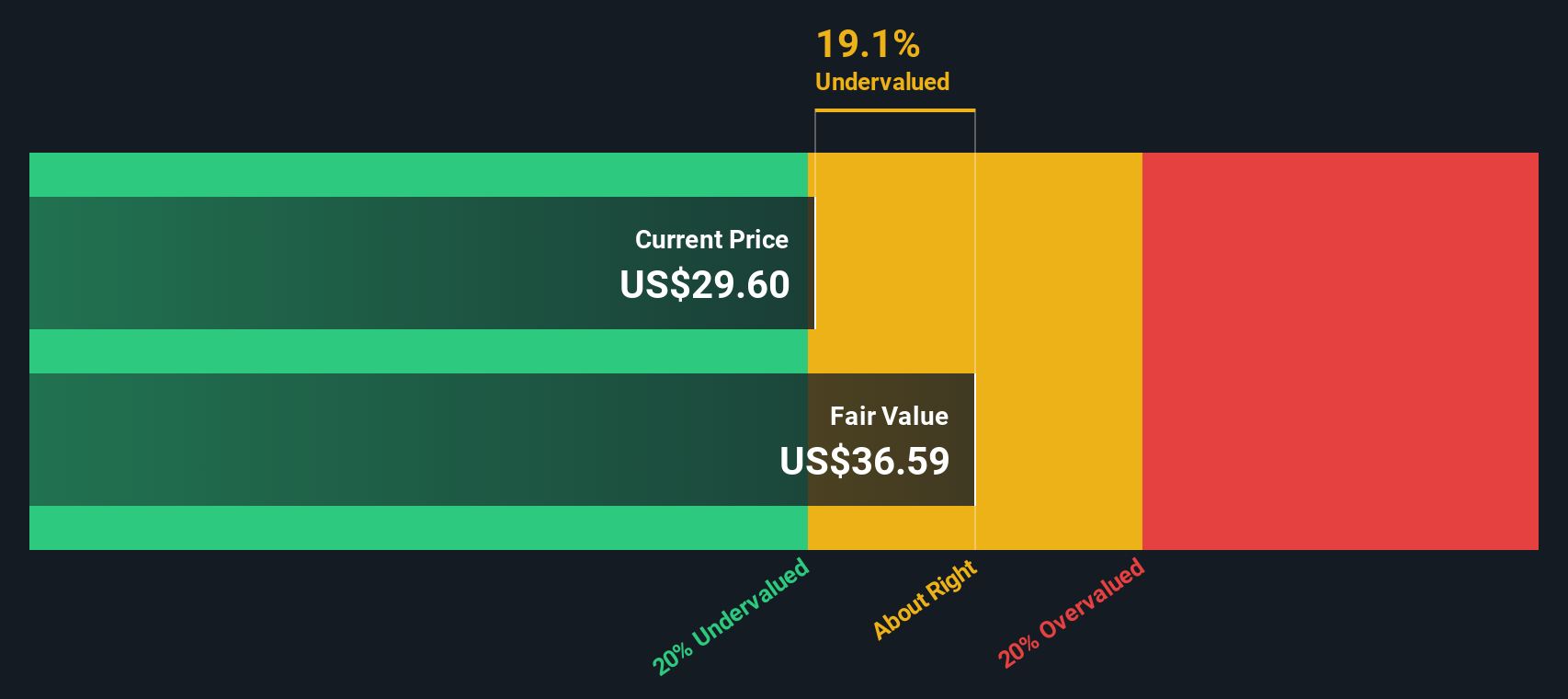

Another Angle: DCF Says FLY Looks Undervalued

While the 37.9x P/S ratio makes Firefly look expensive next to a 5.1x peer average and 3.7x sector average, our DCF model points the other way, with a fair value estimate of US$47.99 versus the current US$26.45. That gap suggests either pessimism on execution or a potential mispricing. Which side of that tradeoff do you think is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Firefly Aerospace for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Firefly Aerospace Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to work from your own checks, you can build a fresh view in just a few minutes, Do it your way.

A great starting point for your Firefly Aerospace research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas beyond Firefly?

If Firefly has sparked your interest, do not stop there. Broaden your watchlist with focused stock ideas that match the kind of opportunities you actually care about.

- Target steady portfolio income by scanning these 11 dividend stocks with yields > 3% that can help anchor your returns with regular cash payouts.

- Hunt for compelling price tags across the market with these 877 undervalued stocks based on cash flows, where current valuations sit below cash flow based estimates.

- Position yourself early in long term technology shifts by reviewing these 29 quantum computing stocks that are working on next generation computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal