Agios Pharmaceuticals (AGIO) Valuation Check After Recent RISE UP Data And Analyst Target Revisions

Agios Pharmaceuticals stock: recent performance context

Agios Pharmaceuticals (AGIO) has seen mixed share performance recently, with a small move over the past week, a modest decline over the past month, and a sharper drop over the past 3 months.

See our latest analysis for Agios Pharmaceuticals.

At a share price of $27.47, Agios has a modest year to date share price return of 1.07%. However, the 90 day share price return of a 35.52% decline and the 1 year total shareholder return of a 21.78% loss suggest momentum has been fading as the market reassesses its growth potential and risks.

If you are comparing Agios with other drug makers, it can help to see what else is out there in the sector, including healthcare stocks tailored to this space.

So with Agios trading at $27.47, carrying a reported intrinsic discount and a low value score of 2, should you see an overlooked opportunity here, or assume the market is already pricing in its future growth?

Most Popular Narrative: 23.7% Undervalued

With Agios shares at $27.47 and the most followed fair value estimate at $36.00, the narrative points to a sizeable valuation gap backed by specific growth and margin assumptions.

Analysts have lifted their aggregate fair value estimate for Agios Pharmaceuticals to $36.00 from $32.13, citing updated revenue and margin assumptions. This follows mixed views on the recent RISE UP data and new Street targets that range widely from US$20 to US$48, alongside Citi's fresh US$38 initiation and a near term FDA catalyst watch.

Curious what kind of future revenue surge and margin reset sit behind that higher fair value? Or how a premium future P/E and a relatively low discount rate fit into the story? The full narrative walks through those moving parts, step by step, and shows how they compare with today’s share price.

Result: Fair Value of $36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on PYRUKYND extending into new indications without major setbacks, and on high R&D spending not keeping Agios locked into deep losses.

Find out about the key risks to this Agios Pharmaceuticals narrative.

Another View: Expensive On Sales Today

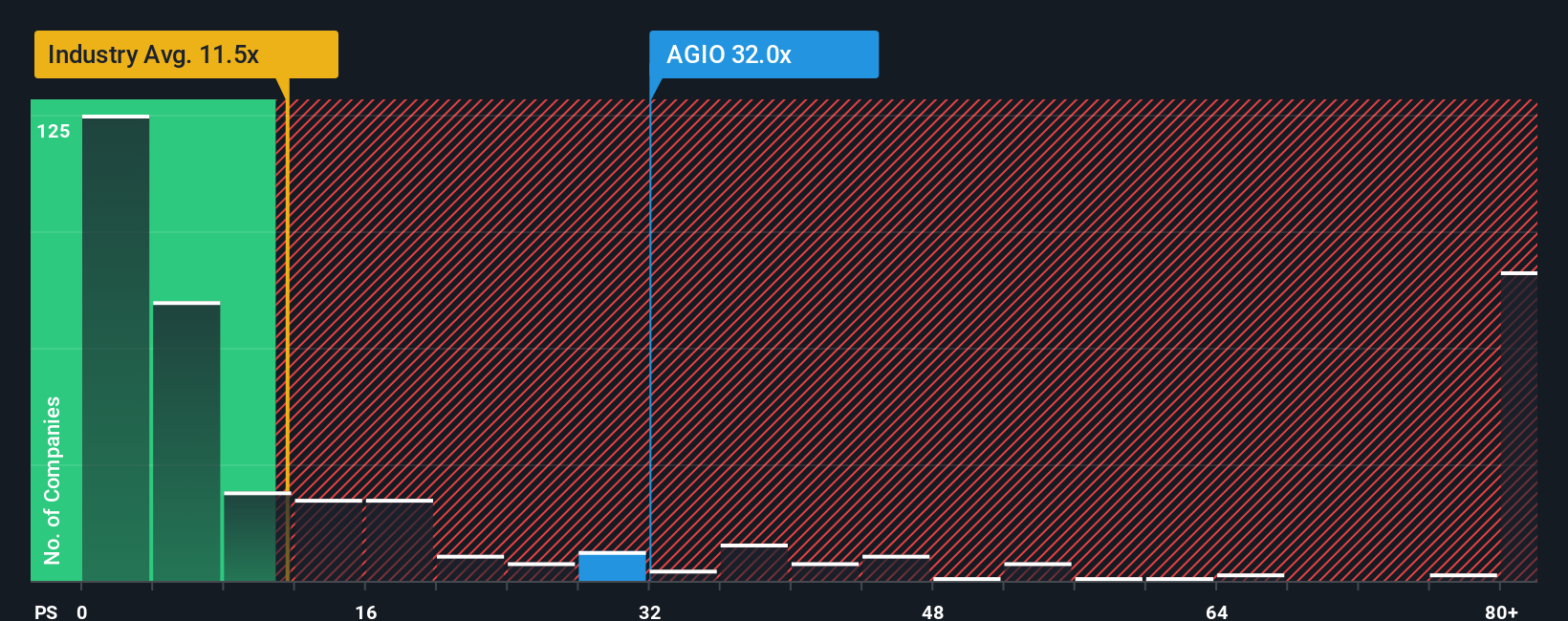

The fair value story built on long term growth assumptions sits alongside a very different message from current sales based pricing. Agios trades on a P/S of 35.8x, compared with 11.5x for the US Biotechs industry and 7.1x for peers, while the fair ratio is 0x.

That gap suggests the market is paying a high price for future potential rather than present revenues. This raises a simple question for you: are you comfortable tying your thesis mainly to what might happen years from now rather than what the business is delivering today?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Agios Pharmaceuticals Narrative

If you see the numbers differently or prefer to lean on your own research, you can build a complete view in just a few minutes, starting with Do it your way.

A great starting point for your Agios Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you could miss opportunities that fit your style even better, so take a few minutes to broaden your watchlist smartly.

- Spot potential turnaround names early by checking out these 3556 penny stocks with strong financials that pair low share prices with stronger financial underpinnings.

- Explore the AI trend in a more focused way by scanning these 25 AI penny stocks centered on companies tied to artificial intelligence themes.

- Look for potentially mispriced opportunities using these 877 undervalued stocks based on cash flows that highlight companies trading below estimates based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal