Assessing Whether Kinross Gold (TSX:K) Still Offers Value After Its Recent Strong Share Price Run

Kinross Gold (TSX:K) has been attracting fresh attention after recent share price moves, with the stock showing double digit returns over the past month and the past 3 months, prompting investors to reassess its current valuation.

See our latest analysis for Kinross Gold.

That short term strength, including a 7 day share price return of 7.2% and a 90 day share price return of 18.98%, sits alongside a very large 1 year total shareholder return and multi year gains that suggest momentum has been building rather than fading.

If Kinross Gold's recent run has you looking wider across the market, this could be a good moment to broaden your search with fast growing stocks with high insider ownership.

With Kinross Gold posting strong recent returns, modest annual revenue and net income growth, and trading close to analyst price targets and intrinsic estimates, you have to ask: is there real value left here, or is the market already pricing in future growth?

Most Popular Narrative: 9.6% Overvalued

Compared with the last close at CA$42.00, the most followed narrative points to a fair value of about CA$38.33, so it sees limited upside from here.

Analysts have modestly raised their price target on Kinross Gold to approximately 38.33 dollars from about 37.79 dollars, citing slightly higher expected profitability and valuation multiples. These factors more than offset somewhat softer long term revenue growth assumptions and a marginally higher discount rate.

Curious what is behind that higher profitability view and richer earnings multiple, even as growth expectations cool slightly? The narrative leans heavily on margin strength, disciplined capital returns and a specific long term earnings path. If you want to see which revenue and margin assumptions are doing the heavy lifting in that CA$38.33 fair value, the full story lays it all out.

Result: Fair Value of $38.33 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could be knocked off course if operating and capital costs climb faster than expected, or if permitting and regulatory setbacks slow key growth projects.

Find out about the key risks to this Kinross Gold narrative.

Another Take: Multiples Paint A Different Picture

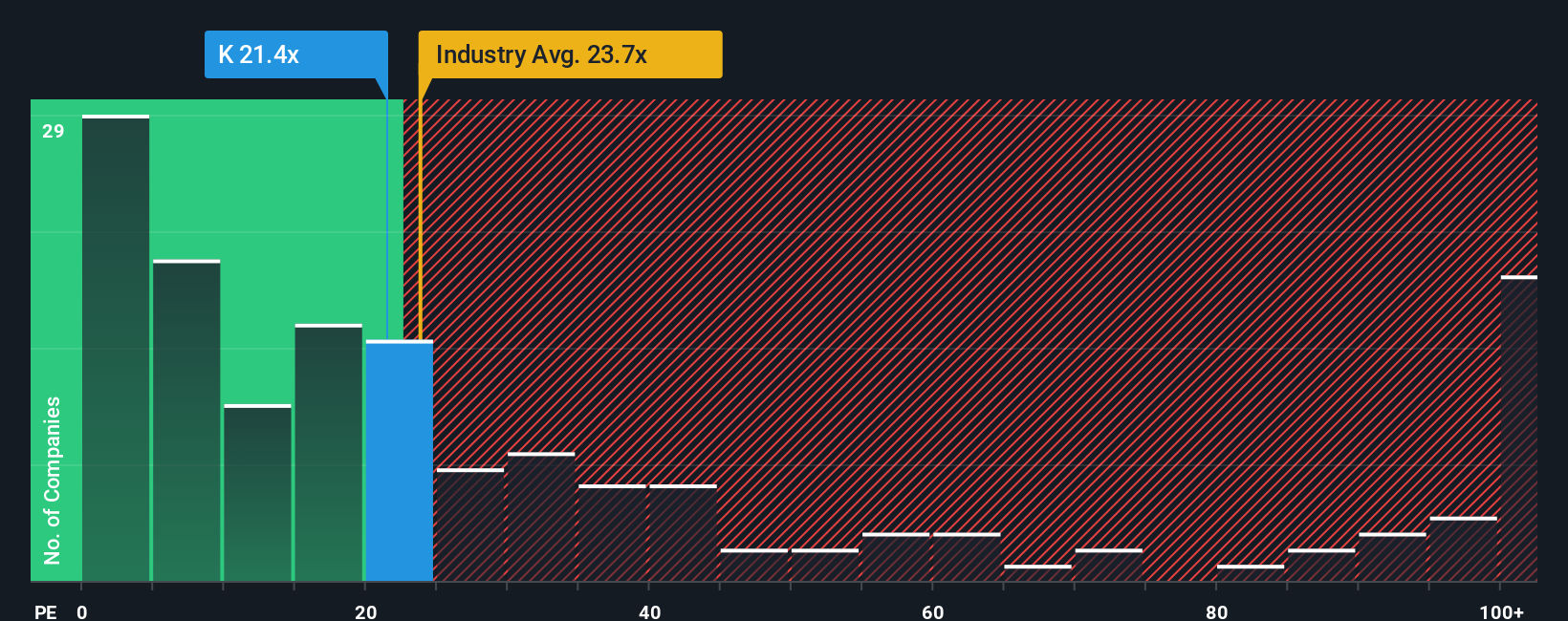

If the narrative points to Kinross Gold looking 9.6% overvalued against a CA$38.33 fair value, the simple earnings multiple tells a softer story. At a P/E of 20.9x, the shares sit below both the Canadian Metals and Mining industry at 23.3x and peer average at 42.1x, and close to a 21.3x fair ratio. That mix of slight discount to peers and near alignment with the fair ratio suggests less obvious excess in the price, but also less room for easy upside. The question is which signal you place more weight on.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinross Gold Narrative

If you see the numbers differently or simply prefer to run your own checks, you can rebuild the case yourself in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Kinross Gold.

Looking for more investment ideas?

If Kinross Gold has sharpened your focus, do not stop here. The Screener can help you quickly spot fresh ideas that match how you like to invest.

- Chase potential value gaps by scanning these 877 undervalued stocks based on cash flows where prices and cash flows look out of sync.

- Ride powerful tech trends by checking out these 25 AI penny stocks shaping the future of artificial intelligence.

- Target bold, early stage opportunities with these 3556 penny stocks with strong financials that still sit off most investors' radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal