Does Coinbase (COIN) Upgrading to an “Everything Exchange” Clarify or Complicate Its Core Strategy?

- In recent days, Coinbase Global has received a Buy upgrade from Goldman Sachs and other upbeat analyst research, highlighting the company’s shift toward crypto infrastructure, subscription services, and a broader “everything exchange” model spanning crypto, equities, derivatives, and prediction markets.

- At the same time, Coinbase is pausing peso-to-USDC conversions and local banking rails in Argentina while continuing crypto-to-crypto trading, underscoring both its global expansion ambitions and the operational and regulatory trade-offs of moving into new markets and asset classes.

- We’ll now examine how Goldman Sachs’ focus on Coinbase’s growing infrastructure and services revenue reshapes the company’s existing investment narrative.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Coinbase Global Investment Narrative Recap

To own Coinbase Global, you need to believe crypto markets, tokenized assets, and blockchain payments become mainstream and that Coinbase can convert its trading-heavy model into a broader infrastructure and services platform. The Goldman Sachs upgrade reinforces that diversification story and supports the current catalyst around growing subscription and services revenue, while Argentina’s peso pause highlights that regulatory and operational uncertainty across markets remains a key near term risk.

Goldman’s upgrade, tied to Coinbase’s push into infrastructure, subscriptions, and an “everything exchange” that includes equities, derivatives, and prediction markets, is particularly relevant here because it directly addresses the biggest open question in the story: whether Coinbase can build a more durable, less trading dependent revenue mix that supports the broader tokenization and onchain payments thesis over time.

Yet for all this optimism, investors should also understand how rising regulatory and compliance demands could...

Read the full narrative on Coinbase Global (it's free!)

Coinbase Global's narrative projects $8.5 billion revenue and $2.1 billion earnings by 2028.

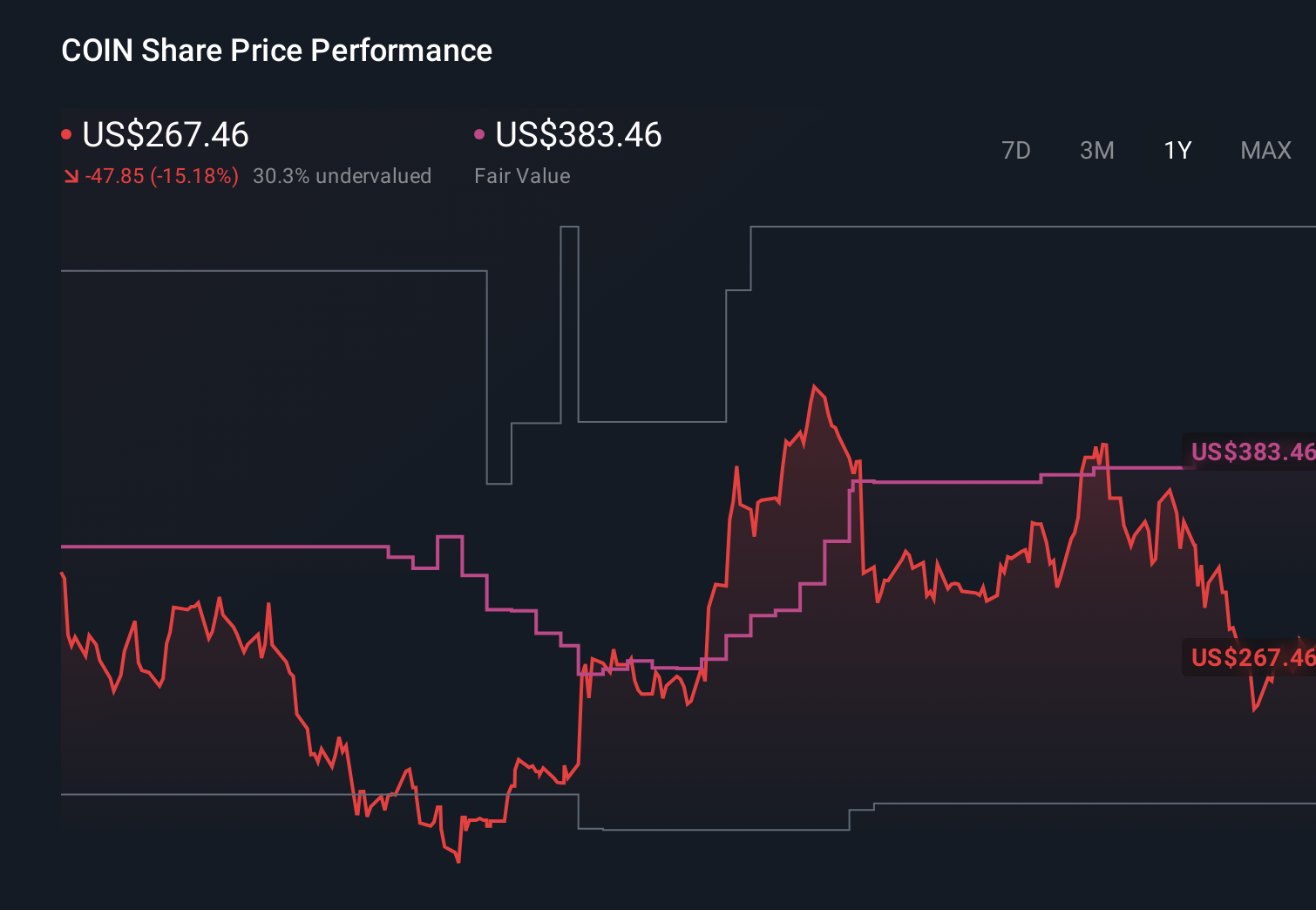

Uncover how Coinbase Global's forecasts yield a $383.46 fair value, a 53% upside to its current price.

Exploring Other Perspectives

The 28 fair value estimates from the Simply Wall St Community span roughly US$110 to US$510 per share, showing how far apart individual viewpoints can be. Against that backdrop, Coinbase’s reliance on successfully growing higher margin infrastructure and services revenue is a key factor that could influence which of these scenarios looks more realistic over time, so it is worth weighing several of these perspectives side by side.

Explore 28 other fair value estimates on Coinbase Global - why the stock might be worth over 2x more than the current price!

Build Your Own Coinbase Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coinbase Global research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Coinbase Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coinbase Global's overall financial health at a glance.

No Opportunity In Coinbase Global?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal