Fluence Energy (FLNC) Valuation Check After AI Driven Storage Optimism And Analyst Upgrades

Fluence Energy (FLNC) has moved sharply into focus after its shares climbed more than 16% following upbeat guidance and supportive analyst commentary related to artificial intelligence driven power demand and grid modernization trends.

See our latest analysis for Fluence Energy.

That sharp move higher comes after a choppy stretch where the share price return is down 5.13% year to date but up 45.92% over 90 days, while the 1 year total shareholder return of 23.61% hints that recent momentum has picked up again.

If AI driven power demand has your attention, it could be a good moment to see what else is out there with high growth tech and AI stocks.

With Fluence Energy now trading above its average analyst price target and carrying a low value score, the key question is whether the recent AI fueled optimism still leaves upside on the table or whether markets are already pricing in future growth.

Most Popular Narrative Narrative: 45.8% Overvalued

The most followed narrative pegs Fluence Energy's fair value at US$14.97 per share, well below the last close of US$21.83, which creates a clear tension between model and market.

The growing backlog exceeding $4.9 billion, expanding international pipeline, and initial traction for next-generation products (e.g., Smartstack) are presented as setting the stage for an eventual rebound in order volumes, margin expansion from operational efficiencies, and a path back to positive free cash flow, as uncertainty recedes and the storage market resumes robust growth.

Curious what earnings path and margin profile are built into that fair value cut? The narrative references compounding revenue, rising profitability, and a future earnings multiple that many investors reserve for established sector leaders.

Result: Fair Value of $14.97 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still a real chance that extended tariff and trade uncertainty, or muted U.S. bookings, will keep revenue timing and margin progress under pressure.

Find out about the key risks to this Fluence Energy narrative.

Another Angle On Value

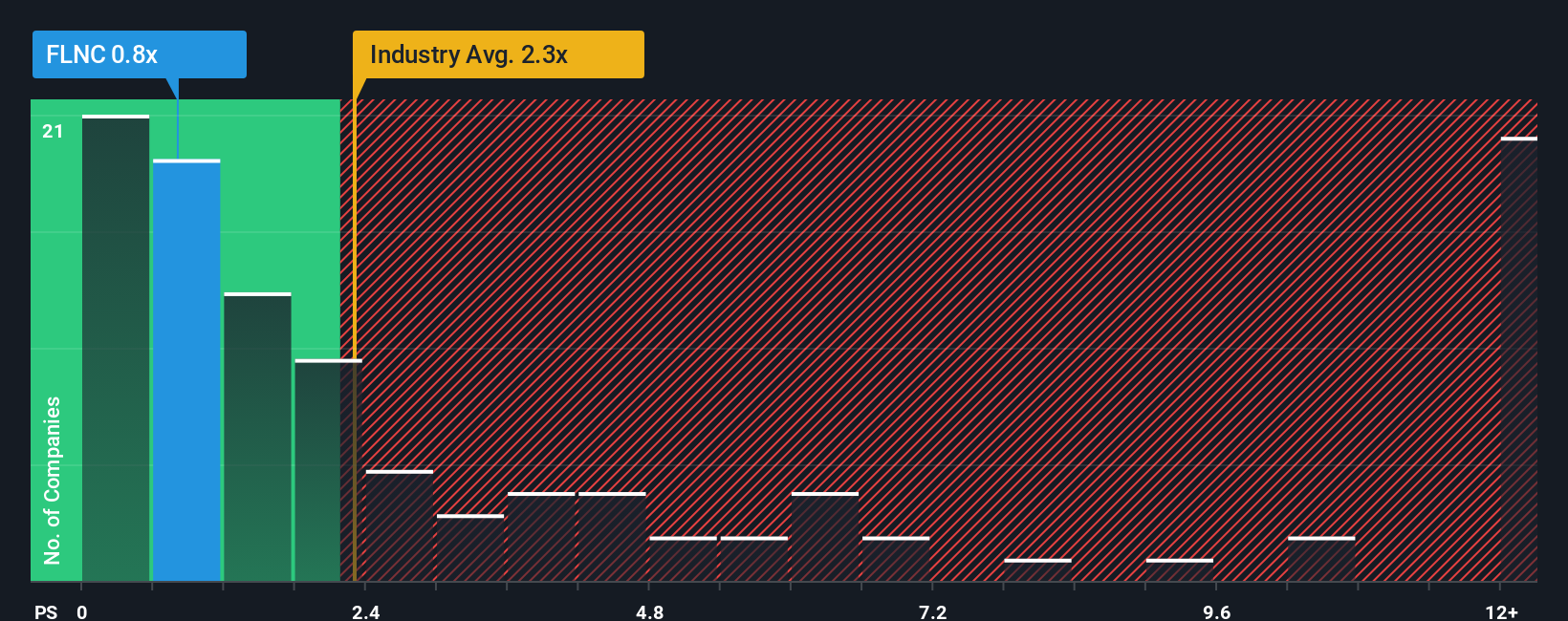

So far, the focus has been on a narrative driven fair value that points to Fluence Energy trading 45.8% above that estimate. On plain price to sales though, the story is quite different. At a P/S of 1.3x, Fluence sits well below the US Electrical industry average of 2.1x and our fair ratio of 2.4x.

If the market ever moved closer to that 2.4x fair ratio, the gap between today’s P/S and both peers and the model could point to valuation risk unwinding or a potential opportunity, depending on how the business performs. Which version of value do you think deserves more weight right now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fluence Energy Narrative

If you do not agree with this view or prefer to rely on your own analysis, you can develop a custom Fluence thesis in just a few minutes with Do it your way.

A great starting point for your Fluence Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready For More Investment Ideas?

If Fluence Energy has sharpened your focus, do not stop here. Widen your watchlist with targeted stock ideas that line up with the themes you care about most.

- Target potential value gaps by scanning these 877 undervalued stocks based on cash flows that may be priced below what their cash flows suggest.

- Consider the growth of data and automation with these 25 AI penny stocks that are tied to real business use cases, not just buzzwords.

- Review these 11 dividend stocks with yields > 3% that already offer yields above 3% today to help support your income stream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal