A Look At Constellation Energy (CEG) Valuation After NRC Approval For Digital Nuclear Upgrade

Constellation Energy (CEG) just received U.S. Nuclear Regulatory Commission approval for a first of its kind Digital Modernization Project at its Limerick Clean Energy Center, putting fresh attention on the stock’s nuclear footprint.

See our latest analysis for Constellation Energy.

The NRC approval lands during a softer patch for Constellation Energy’s share price, with a 90 day share price return of 4.43% decline and year to date share price return of 3.19% decline. This contrasts with the 1 year total shareholder return of 39.48% and 3 year total shareholder return of about 3.4x, which suggest longer term momentum has been strong; recent headlines around funding a Calpine acquisition with US$2.75b of new debt, which coincided with a single day drop of more than 3% in the share price, show how investors are weighing growth initiatives against added balance sheet risk.

If you are looking beyond utilities tied to nuclear and AI data center demand, it could be a good moment to scan healthcare stocks for other potential opportunities in a very different part of the market.

So with short term returns under pressure, a large debt funded Calpine deal, and fresh regulatory support for nuclear upgrades, is Constellation Energy quietly offering value or are markets already pricing in years of future growth?

Most Popular Narrative: 11.3% Undervalued

The most followed narrative sees Constellation Energy’s fair value at about US$399.93 per share versus the last close of US$354.58. This frames a modest upside case built around nuclear backed cash flows and long term contracts.

Strategic investments and progress in nuclear plant restarts (Crane Clean Energy Center), upgrades (900MW in engineering), and selective M&A (Calpine acquisition) provide visible avenues for substantial capacity additions and operational synergies. These developments are described as enhancing EBITDA and free cash flow over the medium to long term.

Curious what earnings power, margin profile, and future P/E multiple are baked into that fair value? The narrative leans on ambitious profit and revenue assumptions over several years. Want to see how those moving parts fit together into a US$399.93 figure?

Result: Fair Value of $399.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can change quickly if nuclear regulation tightens or data center customers pause long term deals, which could challenge those earnings and P/E assumptions.

Find out about the key risks to this Constellation Energy narrative.

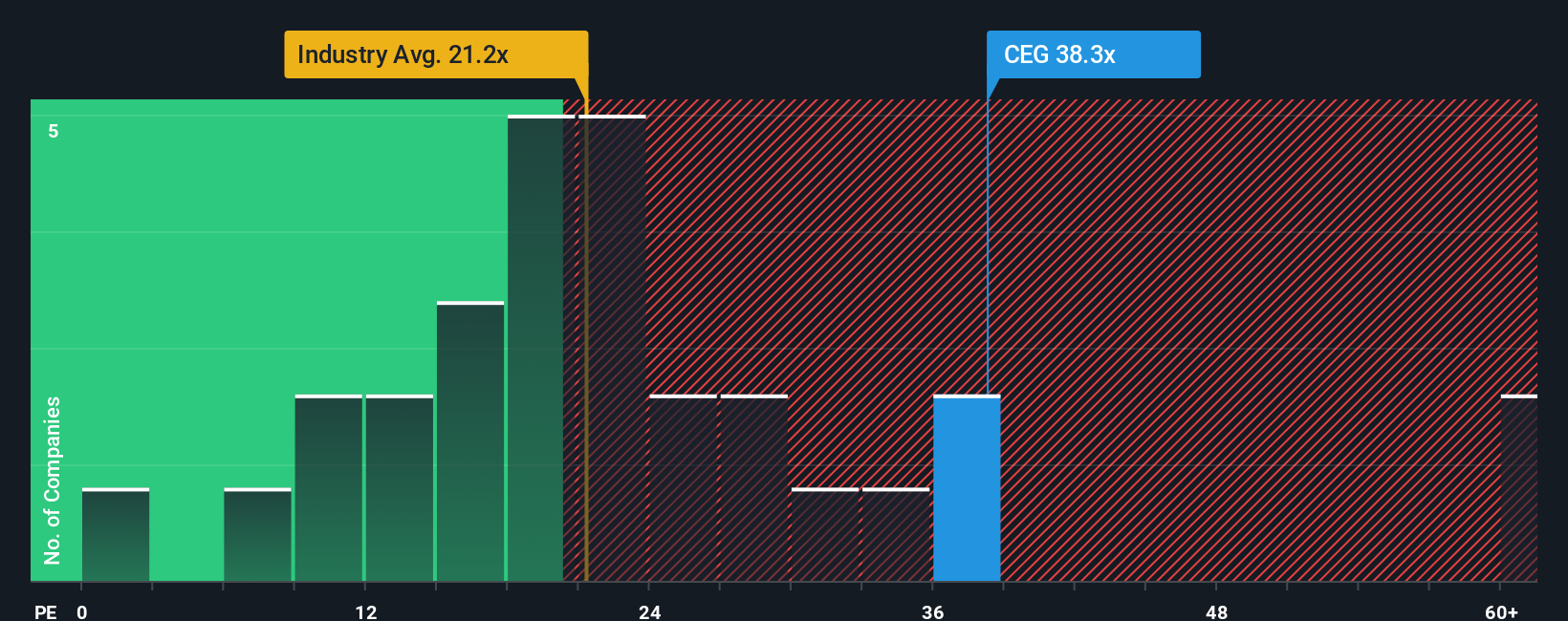

Another Angle: Premium P/E Sends a Different Signal

The 11.3% undervaluation story sits uncomfortably next to Constellation Energy’s P/E of 40.4x, which is roughly double the US Electric Utilities industry at 20.2x and above its own estimated fair ratio of 34.1x. That kind of gap points to valuation risk if expectations cool. Which story do you think wins out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Constellation Energy Narrative

If the assumptions here do not quite fit how you see Constellation Energy, you can test the data yourself and shape a custom view in minutes: Do it your way.

A great starting point for your Constellation Energy research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Constellation Energy is on your watchlist, do not stop there. Broaden your opportunity set with curated stock ideas built from real numbers, not hype.

- Target income potential by scanning these 11 dividend stocks with yields > 3% that might help you build a steadier stream of shareholder payouts across different sectors.

- Spot high growth themes early by checking out these 25 AI penny stocks positioned around artificial intelligence, data infrastructure, and related technologies.

- Hunt for mispriced names by reviewing these 877 undervalued stocks based on cash flows that currently trade below what their cash flows may suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal