Assessing Shift4 Payments (FOUR) Valuation After Credit Amendment And Interest Expense Reduction

Shift4 Payments (FOUR) amended its first lien credit agreement on January 5, 2026, repricing about $997.5m of senior secured term loans and lowering interest margins on both SOFR based and base rate borrowings.

See our latest analysis for Shift4 Payments.

Alongside the refinancing, Shift4 Payments has also announced a cash dividend on its Series A mandatory convertible preferred stock. The equity story has been mixed, with a 1 day share price return of 3.00%, a 1 year total shareholder return decline of 37.80%, and a 3 year total shareholder return of 9.62%.

If the credit amendment has you thinking about where capital is flowing in payments and fintech, it could be a good moment to scan high growth tech and AI stocks for other ideas in the space.

With the stock down about 38% over the past year and trading around a 41% discount to the average analyst price target, the key question is whether Shift4 is undervalued at this level or whether the market is already pricing in its future growth.

Most Popular Narrative: 31.3% Undervalued

Compared to the last close at $65.88, the most followed narrative points to a higher fair value, built around ambitious growth and margin expectations.

The cross sell opportunity across the combined customer bases of newly acquired companies (e.g., bringing Shift4's payment products into Global Blue's luxury retail clients, or introducing Global Blue's DCC product to Shift4 hotels/restaurants) creates a substantial embedded pipeline for incremental revenue and sustained organic growth over multiple years.

Curious what kind of revenue ramp and margin lift would justify that higher fair value? The narrative leans on aggressive compounding, richer spreads and a future earnings multiple usually linked to premium financial software names. Want to see how those ingredients fit together into one valuation story?

Result: Fair Value of $95.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can break if international integrations stumble or if higher leverage and preferred stock drag on earnings and limit flexibility.

Find out about the key risks to this Shift4 Payments narrative.

Another View: DCF Paints A Different Picture

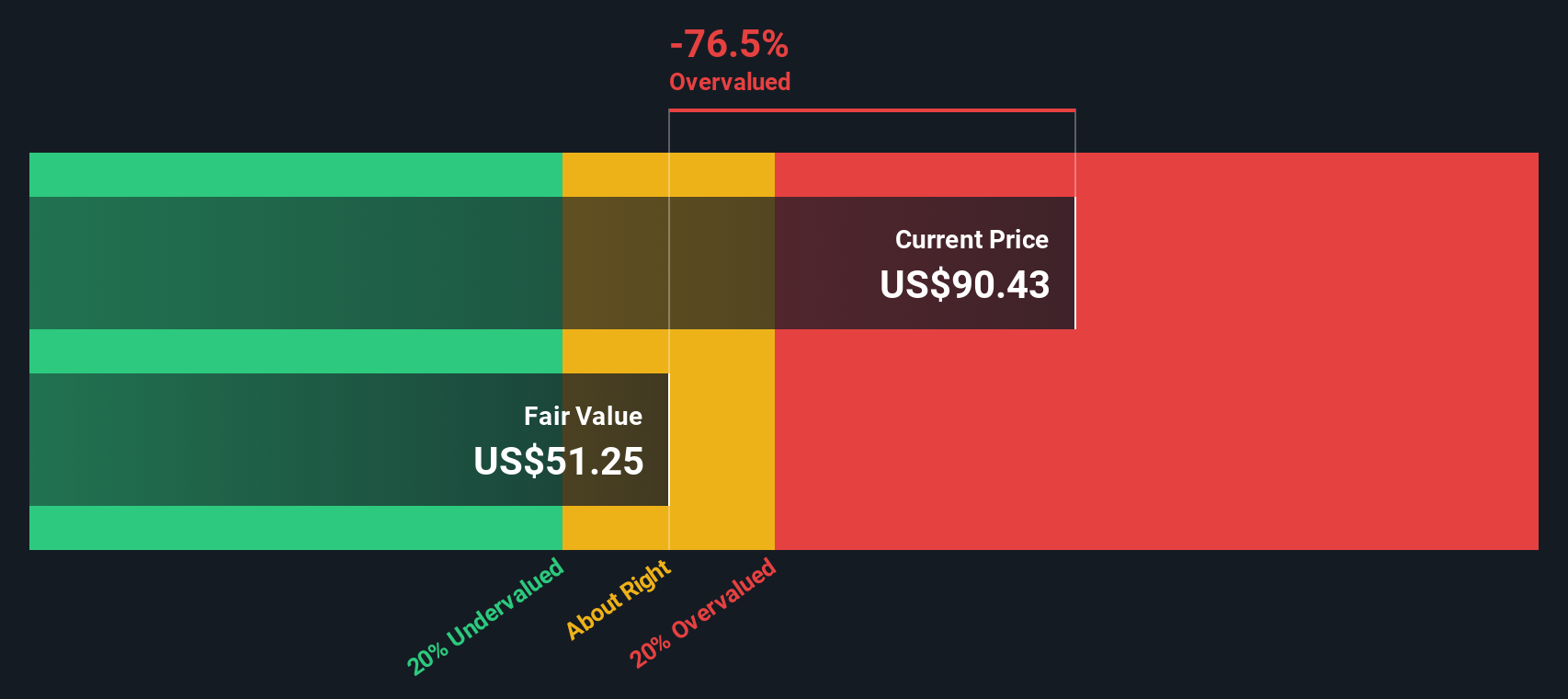

While the consensus narrative points to a fair value of $95.86 and labels Shift4 as undervalued, our DCF model lands closer to $53.17. With the shares at $65.88, that implies the stock is trading above this estimate. This raises a simple question: which set of assumptions do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shift4 Payments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shift4 Payments Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a full Shift4 story in just a few minutes, starting with Do it your way.

A great starting point for your Shift4 Payments research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Shift4 has sparked fresh questions about where to put your capital next, do not stop here. Broaden your opportunity set with a few focused stock idea lists.

- Spot emerging high risk high reward ideas by scanning these 3556 penny stocks with strong financials for companies that might still be off most investors' radar.

- Target the intersection of growth and technology by reviewing these 25 AI penny stocks that are tied to artificial intelligence themes across different sectors.

- Hunt for price mismatches by checking these 877 undervalued stocks based on cash flows that appear cheap when compared to their underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal