Chevron (CVX) Valuation Check After Venezuela Military Operation And Sanctions Shift

Crisp, high stakes geopolitics are suddenly front and center for Chevron (CVX) after the U.S. military operation in Venezuela, the capture of its president, and Washington’s pledge to open the country’s vast oil reserves to American companies.

See our latest analysis for Chevron.

The Venezuela headlines arrived after a sharp intraday swing, with a 1 day share price return of a 4.46% decline contrasted with a 30 day share price return of 4.36% and a 1 year total shareholder return of 9.5%. This suggests momentum has recently cooled, while longer term holders have still seen gains.

If this kind of geopolitical story has your attention, it could be a good moment to widen your watchlist and check out aerospace and defense stocks as another way to look at how markets are reacting to global risk.

With Chevron trading at about $156.54, sitting roughly 9% below the average analyst price target and showing a very large gap to some intrinsic value estimates, you have to ask yourself: is there a mispricing here, or are markets already baking in years of future growth?

Most Popular Narrative: 9% Undervalued

Chevron’s most followed narrative places fair value at roughly US$172, slightly above the last close of US$156.54 and frames that gap around long term cash generation.

Accelerating structural cost reductions ($2-3 billion targeted by end-2026) and increased capital efficiencies from major project delivery, digitalization, and organizational streamlining are set to drive industry-leading net margins and higher free cash flow conversion.

Curious what underpins this valuation? It is based on modest revenue growth, wider profit margins, and a richer future earnings multiple than the sector. Want the full playbook behind those assumptions?

Result: Fair Value of $172.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on Chevron managing project execution and geopolitical exposure, while also addressing the risk that a slow shift beyond hydrocarbons drags on long term earnings power.

Find out about the key risks to this Chevron narrative.

Another View: Earnings Multiple Sends A Different Signal

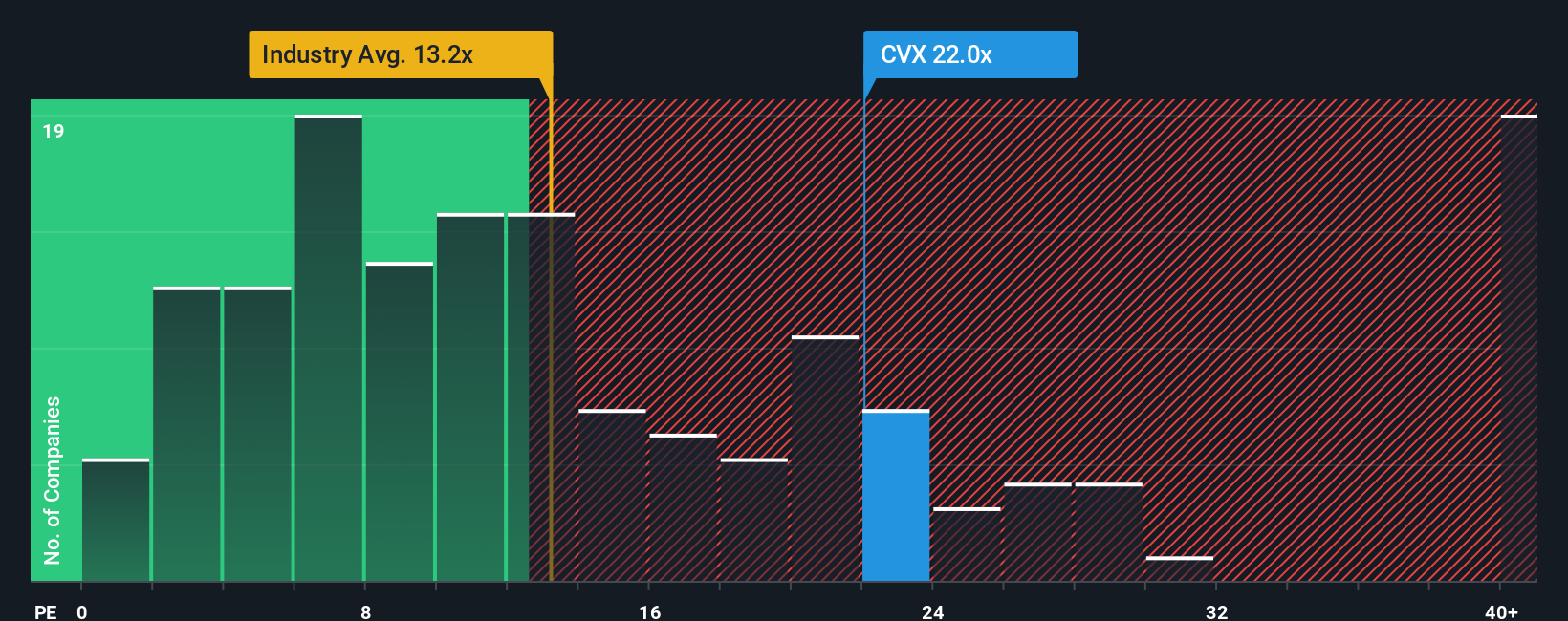

That 9% gap to fair value looks appealing, but the P/E of 24.7x tells a more cautious story. It sits above the US Oil and Gas industry at 13.1x, above peers at 22.4x, and even slightly above a 24.6x fair ratio. This points to limited margin for error if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chevron Narrative

If this take does not quite fit your view and you would rather lean on your own checks and charts, you can build a fresh Chevron story in just a few minutes with Do it your way

A great starting point for your Chevron research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Chevron has sharpened your focus, do not stop here. Broaden your opportunity set with a few targeted screens that surface very different types of potential candidates.

- Target potential high-upside names by scanning these 3556 penny stocks with strong financials that already have stronger financial footing than many investors might expect.

- Ride the AI wave more thoughtfully by checking out these 25 AI penny stocks that are directly tied to real products, services, and commercial adoption.

- Zero in on mispriced cash generators with these 877 undervalued stocks based on cash flows, where discounted cash flow metrics highlight companies the market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal