“Little Farmer” is just right! The moderate recovery of the US labor market stabilizes expectations of interest rate cuts

The Zhitong Finance App learned that the latest “small farmers” data shows that the pace of recruitment by US companies rebounded slightly at a moderate pace in December, indicating that the US economy is still resilient until 2026, which is expected to lay a major foundation for the US economy to completely achieve a “soft landing” — according to Wall Street financial giants such as Goldman Sachs and Morgan Stanley, the macro-dominant narrative of the “soft landing” of the US economy is expected to heat up significantly in 2026 — that is, the US economy is expected to grow faster than expected by the market.

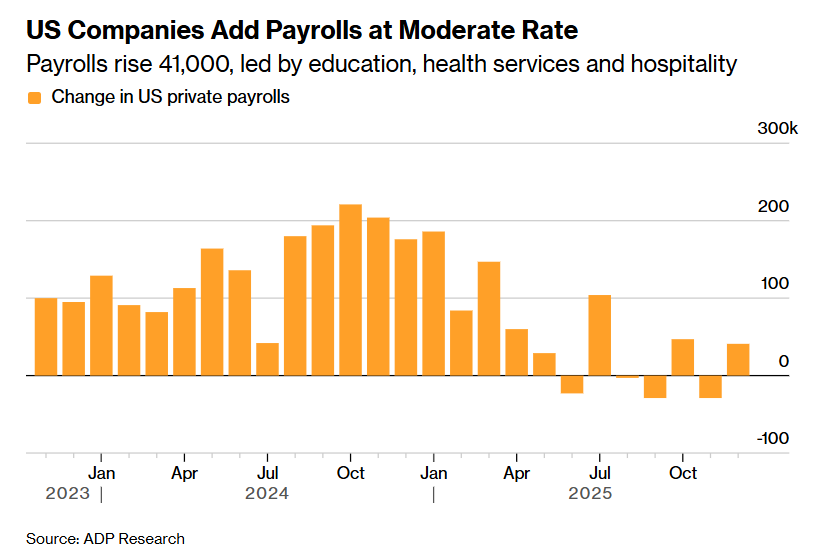

According to the US private sector employment data released by ADP Research on Wednesday local time (this data is known as “small non-farmers”), the overall number of people employed in the US private sector increased by 41,000 in December, and there was a significant decline in the previous month. In contrast, “small farmers” fell short of the more optimistic market consensus expectations in December. According to a survey of economists, economists generally expected an increase of about 50,000 people.

The report further confirms that the labor market is showing a slight cooling, but is not rapidly deteriorating or continuing to weaken. Recently, the pace of recruitment in the US labor market has been weakening, and the unemployment rate has also risen. This has not only dragged down some economists' predictions of the US GDP growth rate for the 2026 New Year, but also affected Americans' views on their own employment prospects.

Overall, this small peasant is just right. It is also the small peasant that the market wants to see the most. Not only can it be reported that the US economy is still resilient, and the expectation of a “soft landing” for the US economy can be described as having no negative disturbance, and at the same time, it does not cause changes in the market's interest rate expectations of the Fed's interest rate cuts — the interest rate futures market is still priced. The Fed is expected to cut interest rates three times in 2026, which is higher than the median expectation that interest rates will be cut only once, as shown in the FOMC bitmap.

ADP added 41,000 new private sector accounts for December, a marked recovery from November (revised -29,000), but it did show a delicate balance of “cooling recruitment but not completely stalled” — neither strong enough to cause the market to worry that “demand is overheating, to the point where expectations of interest rate cuts are greatly cooling due to the return of the monster of inflation”, nor weak enough to instantly break the “soft landing” of the US economy as a sign of a major recession.

The education, healthcare, and leisure and hospitality industries are leading employment growth

According to ADP employment data, the growth trend of private employment in the US in December was mainly driven by the education and health services industry, as well as the leisure and hospitality industry. The number of people employed in professional services and a wide range of manufacturing types declined. After months of layoffs, small businesses are also returning to a relatively positive pace of recruitment.

“Even though large employers reduced the scale of employment, small and medium-sized private institutions achieved an overall upward trend in the private employment sector through active recruitment at the end of the year after a wave of temporary unemployment in November.” ADP's chief economist and well-known financial writer Nela Richardson said in a statement.

The weakening labor market has always been the focus of attention of Federal Reserve officials, who announced their decision to cut interest rates three times in a row at the end of 2025. Federal Reserve officials are trying to balance this with stubborn inflation figures above 2% as they weigh further potential interest rate cuts in the new year.

Additional data released this week will help inform their decisions later this month. The most critical of these is the monthly non-farm payroll report to be released by the US government on Friday. It is expected to show moderate recruitment in December, while the unemployment rate is likely to drop slightly.

According to the US ADP employment report released in collaboration with the Stanford Digital Economy Lab, the overall wage growth rate in the private sector accelerated after American workers who changed jobs recorded the smallest annual increase since 2021 the previous month. In December, the wages of workers who changed jobs increased 6.6% year over year, while the wages of workers who stayed in their original jobs increased by 4.4%.

ADP's monthly employment statistics findings are based on salary data covering more than 26 million US private sector employees. In addition to monthly reports, ADP also publishes a narrower range of payroll statistics separately each week. In the last three recent readings, ADP statistics showed positive growth in private sector wage employment.

The impact of “small farmers” is limited. Friday's non-farm payrolls data may have a significant impact on the Federal Reserve's January monetary decision

As far as the Fed's interest rate cut expectations and the big story of the US economy's “soft landing” are concerned, the impact of ADP's “small non-farm farmers” employment data is often very limited, so the non-farm payrolls report released this Friday is bound to be a key variable in determining the Fed's short-term policy path. According to the latest report released on Monday by a team of analysts led by Andrew Hollenhorst, a senior analyst at Citigroup Research, if the US unemployment rate rises to 4.7% as expected in December, the Federal Reserve will most likely continue to cut policy interest rates by 25 basis points this month.

Despite recent signals from Federal Reserve officials that they are “not in a hurry” to cut interest rates further, continued weakness in the labor market is changing this expectation. Citi believes that further loosening of the labor market will force policymakers to re-evaluate their positions after the November data showed fatigue. If the unemployment rate continues to rise, supporting the economy by cutting interest rates will be an inevitable choice.

A team of analysts from Citi believes that under the risk balance of a weakening US labor market combined with continued slight cooling of inflation, the agency's benchmark forecast for the actual interest rate cut by the Federal Reserve this year is 75 basis points, and the possibility of the Fed's decision to cut interest rates by more than 100 basis points in 2026 is not ruled out.

Citibank analysts said that based on the trading experience of the past two years, once the labor market clearly weakens further, the Federal Reserve will resume the process of cutting interest rates. Although the conference-by-meeting decision-making model makes the exact path of interest rate cuts highly dependent on data and difficult to predict, the overall trend points to easing. Looking beyond the fluctuations in monthly data, the unemployment rate has shown an upward trend in the past two years. In line with the cooling trend of inflation in the service sector (especially in the housing sector), it has provided a macro basis for interest rate cuts.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal