Assessing Infratil (NZSE:IFT) Valuation After CDC Uplift And Renewables And Digital Growth Momentum

Infratil (NZSE:IFT) is back in focus after reporting a AU$349 million uplift in the valuation of its CDC data center investment over the past 3 months, alongside supportive commentary around its renewables and digital infrastructure exposure.

See our latest analysis for Infratil.

At a share price of NZ$11.61, Infratil has a 7 day share price return of 4.78% but a 90 day share price return of a 6.30% decline. Its 5 year total shareholder return of 78.34% points to solid longer term momentum despite recent volatility around CDC and renewables news.

If Infratil’s mix of renewables and digital assets has your attention, it could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With the CDC uplift, mixed recent returns and analysts still broadly constructive, the key question now is simple: is Infratil’s current share price leaving investors with upside on future growth, or has the market already priced it in?

Most Popular Narrative: 17.2% Undervalued

With Infratil last closing at NZ$11.61 against a narrative fair value of NZ$14.02, the current price sits below what this widely followed view implies.

Significant demand growth at CDC, particularly with advancing customer negotiations and ongoing investment in new projects and power capacity, is expected to drive future revenue growth. The continuous progress of One NZ on strategic priorities, including growth in mobile and wholesale revenue and IT transformations for cost efficiency, indicates potential for improved net margins and earnings.

Curious how data center demand, margin rebuild and a premium future P/E multiple all fit together? The narrative leans on specific revenue paths, margin shifts and a rich earnings multiple to arrive at that higher fair value. The finer details sit in a tight set of assumptions that connect future earnings, required returns and valuation in a way the share price does not currently reflect.

Result: Fair Value of $14.02 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still pressure points, including delayed approvals for the Manawa and Contact merger and possible policy shifts affecting Longroad’s US projects, that could challenge this upside story.

Find out about the key risks to this Infratil narrative.

Another Angle: Earnings Multiple Sends A Different Signal

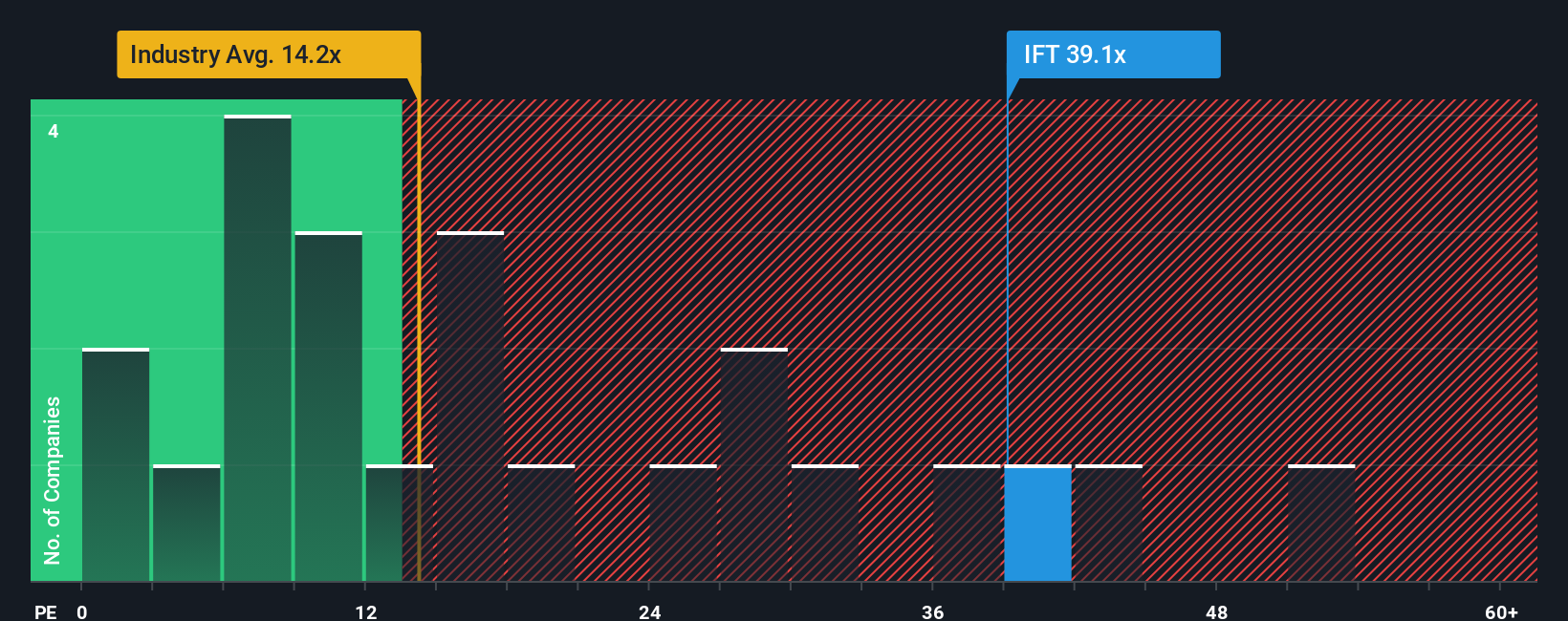

While the popular narrative points to a fair value of NZ$14.02, the current P/E of 41x tells a tougher story. That is well above the New Zealand peer average of 17.2x, the global industry average of 14.2x, and even the 34.7x fair ratio the market could move toward, which points to valuation risk rather than clear upside. The question is whether Infratil’s mix of renewables and digital assets really justifies paying this kind of premium today.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Infratil Narrative

If you see the numbers differently or prefer to weigh the CDC, renewables and earnings mix in your own way, you can build a custom view in just a few minutes with Do it your way.

A great starting point for your Infratil research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Infratil has sharpened your interest in infrastructure and growth, do not stop here. Broaden your opportunity set with targeted stock ideas that fit clear themes.

- Target potential value opportunities by scanning these 877 undervalued stocks based on cash flows built around discounted cash flow assessments.

- Ride the digital transformation trend by zeroing in on these 25 AI penny stocks that focus on artificial intelligence applications.

- Tap into higher income potential by reviewing these 11 dividend stocks with yields > 3% that combine share price exposure with meaningful cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal