The Bull Case For argenx (ENXTBR:ARGX) Could Change Following CEO-Chair Leadership Reshuffle - Learn Why

- argenx SE recently announced a leadership overhaul in which Chief Operating Officer Karen Massey became Chief Executive Officer and Executive Director, while long-time CEO Tim Van Hauwermeiren shifted to non-Executive Director and Chairman, succeeding retiring board member Peter Verhaeghe.

- This reshaping of the top team, especially the move of an operationally focused COO into the CEO role while the outgoing CEO remains as chair, highlights argenx’s emphasis on continuity as it executes its long-term Vision 2030 plan.

- We’ll now examine how Karen Massey’s appointment as CEO, with Tim Van Hauwermeiren shifting to chairman, could influence argenx’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

argenx Investment Narrative Recap

To own argenx, you need to believe in the long term value of VYVGART and its pipeline, while accepting product concentration and competition as central risks. The COO to CEO handover, with the former CEO staying on as chair, looks designed to preserve execution focus and does not materially change the near term catalyst of further VYVGART uptake or the key risk around intensifying competitive pressure and pricing.

In that context, the recent US FDA approval of a self injection option for VYVGART Hytrulo using a prefilled syringe is especially relevant, because it directly supports the commercial roll out that Karen Massey previously helped build as COO. It ties the leadership transition to a concrete, near term product initiative that could influence how argenx manages competition and product dependence in the months ahead.

Yet, while the leadership shift underpins continuity, investors still need to be aware of how rising gross to net adjustments could...

Read the full narrative on argenx (it's free!)

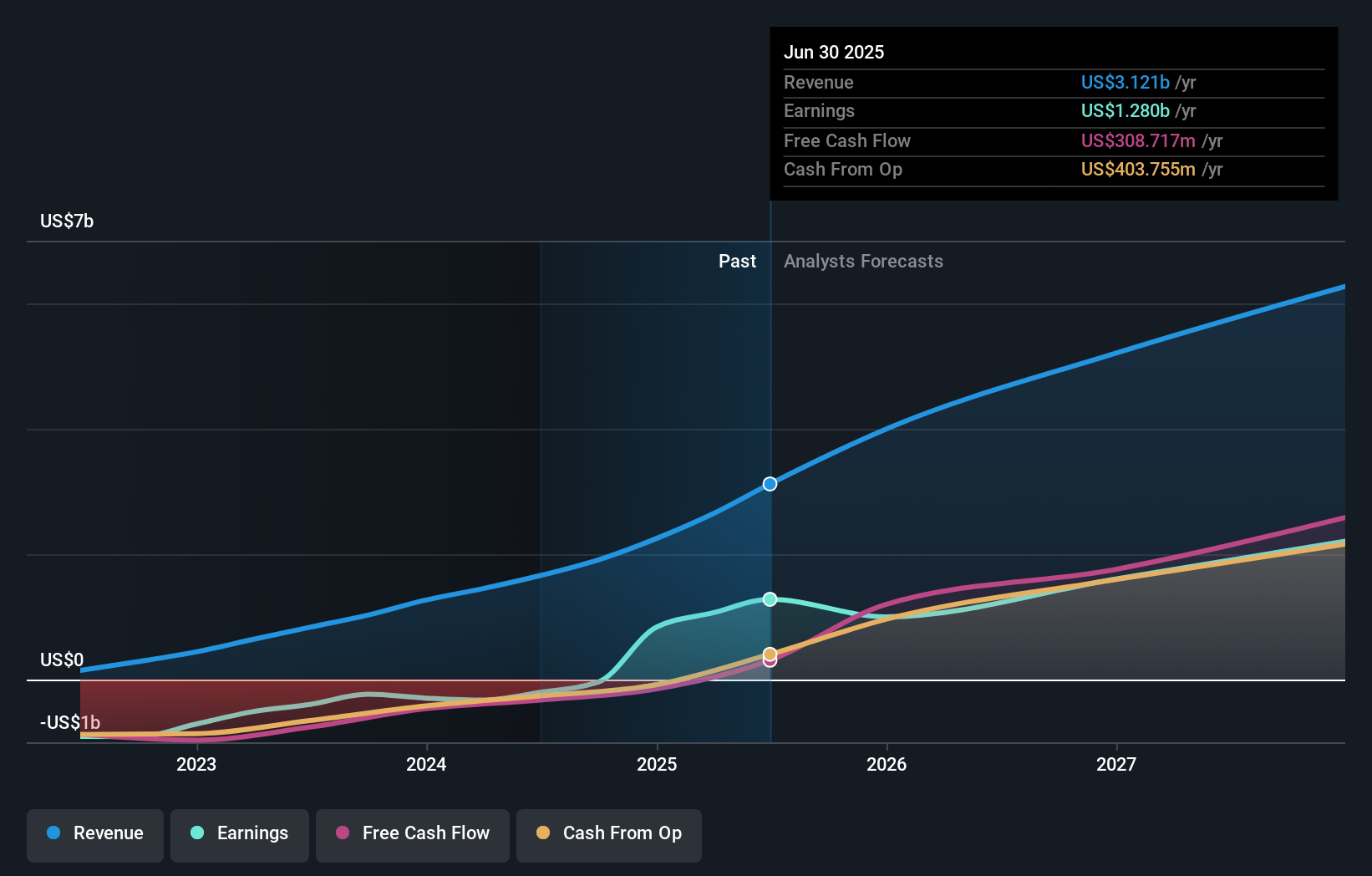

argenx's narrative projects $6.9 billion revenue and $2.6 billion earnings by 2028.

Uncover how argenx's forecasts yield a €820.09 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community currently estimate fair value for argenx in a very wide band between €528 and €2,088. As you weigh those views against the competitive and pricing risks around VYVGART, it is worth comparing how different investors think those factors could shape the company’s future performance.

Explore 7 other fair value estimates on argenx - why the stock might be worth 23% less than the current price!

Build Your Own argenx Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your argenx research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free argenx research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate argenx's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal