Idexx Laboratories (IDXX) Valuation Check As Earnings Optimism Builds On Diagnostics Growth

Investor attention is turning to IDEXX Laboratories (IDXX) as the company heads into its fiscal fourth quarter earnings release, with expectations for continued double digit earnings growth and renewed focus on its Companion Animal Group Diagnostics business.

See our latest analysis for IDEXX Laboratories.

The recent 3.6% 1 day and 12.2% 90 day share price returns, alongside a 65.4% 1 year total shareholder return, suggest momentum has been building as the market reassesses IDEXX Laboratories ahead of its earnings update.

If IDEXX’s run has you rethinking your watchlist, this could be a good moment to scan other healthcare names using our healthcare stocks.

With IDEXX now trading around $706.83 and sitting roughly 8% below its average analyst price target of $766, investors have to ask: is there still value on the table, or is the market already pricing in future growth?

Most Popular Narrative: 6.4% Undervalued

Using a fair value of about $754.83 against the last close at $706.83, the most followed narrative sees upside still on the table.

High customer retention and growing installed base of premium instruments provide IDEXX with stable, high-margin recurring revenue streams, positioning the company to compound earnings growth over time as industry consolidation and elevated care standards continue.

Curious what earnings path and margin profile support that valuation gap, and why the assumed future P/E stays well above the sector norm? The full narrative describes the revenue build, profitability assumptions, and required multiple in detail, so you can assess whether those expectations align with your own.

Result: Fair Value of $754.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still watchpoints, including softer U.S. clinical visit trends and the risk that slower instrument placements could cool consumables growth over time.

Find out about the key risks to this IDEXX Laboratories narrative.

Another View: Rich Multiples Versus Fair Value

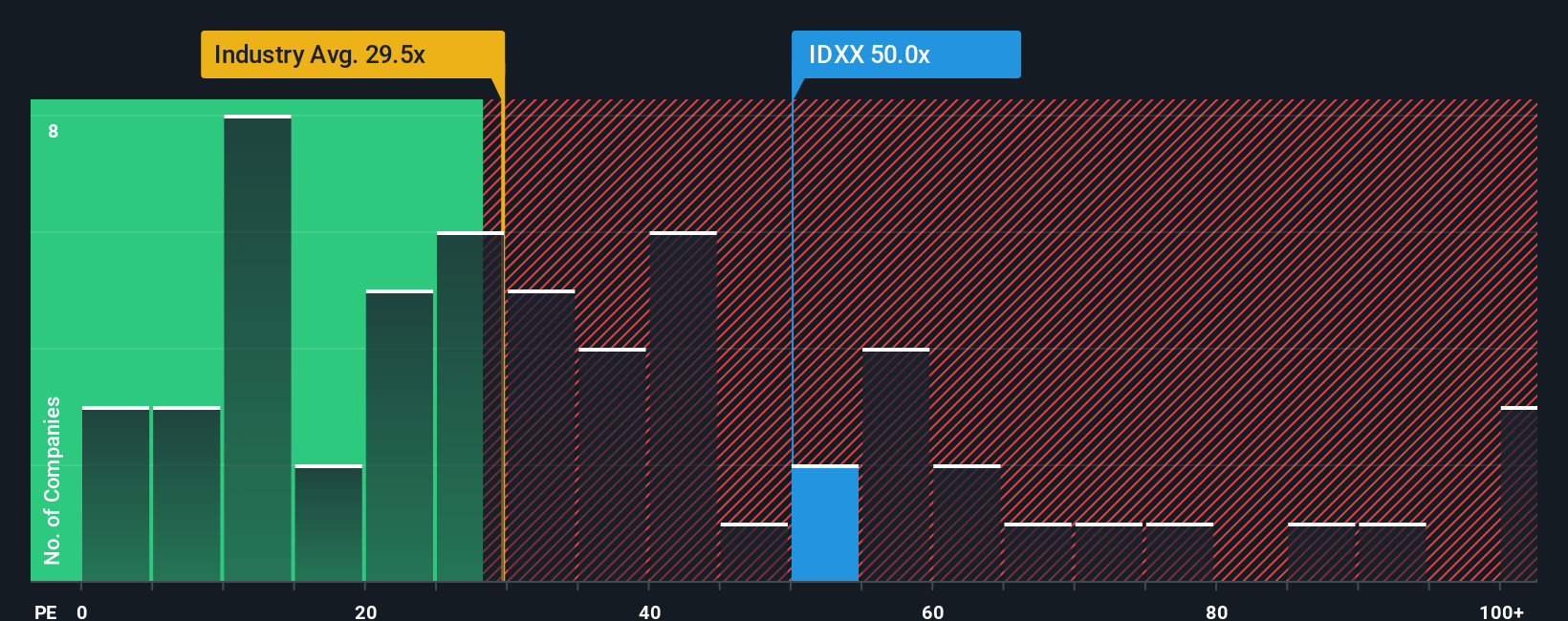

That 6.4% upside to the narrative fair value sits alongside a very different signal from the current P/E. At 54.9x earnings, IDEXX trades well above both peers at 28.8x and the US Medical Equipment industry at 29.9x, and also above a fair ratio of 30.2x.

This gap suggests investors are paying a steep premium for quality and growth, which could limit future return potential if sentiment cools or earnings progress slows. The question for you is whether IDEXX’s business strength justifies keeping that premium in place for years to come.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IDEXX Laboratories Narrative

If you see the story differently or want to weigh the numbers yourself, it takes just a few minutes to build a tailored view, starting with Do it your way.

A great starting point for your IDEXX Laboratories research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If IDEXX is already on your radar, do not stop there. A wider watchlist can help you spot opportunities that match your style before others react.

- Spot potential bargains early by checking out these 877 undervalued stocks based on cash flows that line up with your preferred price and quality thresholds.

- Ride structural trends in automation and data by scanning these 25 AI penny stocks shaping real world applications of artificial intelligence.

- Aim for growing income streams by reviewing these 11 dividend stocks with yields > 3% that could complement growth names already in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal