Assessing Baldwin Insurance Group (BWIN) Valuation After Recent Rebrand And Share Price Weakness

Baldwin Insurance Group (BWIN) has drawn attention after rebranding from BRP Group in May 2024. This change is prompting investors to reassess the stock using its recent share performance and latest revenue and earnings figures.

See our latest analysis for Baldwin Insurance Group.

The rebrand comes against a mixed backdrop, with the latest share price at $24.93 and a 90 day share price return of a 13.89% decline. The 1 year total shareholder return of a 31.79% loss points to fading longer term momentum despite year to date gains.

If Baldwin’s shift has you rethinking your portfolio, it could be a good moment to broaden your search and check out healthcare stocks as another area of opportunity.

With the share price at $24.93 against an analyst price target of $33.88 and recent annual revenue and net income growth figures, should you view Baldwin as undervalued, or assume the market is already pricing in potential future growth?

Most Popular Narrative Narrative: 26.4% Undervalued

With a fair value estimate of $33.88 against the last close at $24.93, the most followed narrative sees Baldwin trading at a meaningful discount.

The analysts have a consensus price target of $41.375 for Baldwin Insurance Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $52.0, and the most bearish reporting a price target of just $31.0.

Curious what kind of revenue climb, margin shift, and future earnings multiple could justify that gap between today’s price and fair value? The full narrative lays out an aggressive earnings ramp, a step change in profitability, and a valuation multiple more often associated with faster growing sectors, all tied together under a single discounted cash flow view.

Result: Fair Value of $33.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on mortgage and Medicare channels holding up, and on elevated leverage not becoming a drag if credit conditions or sector pricing tighten.

Find out about the key risks to this Baldwin Insurance Group narrative.

Another View: Market Ratio Sends a Different Signal

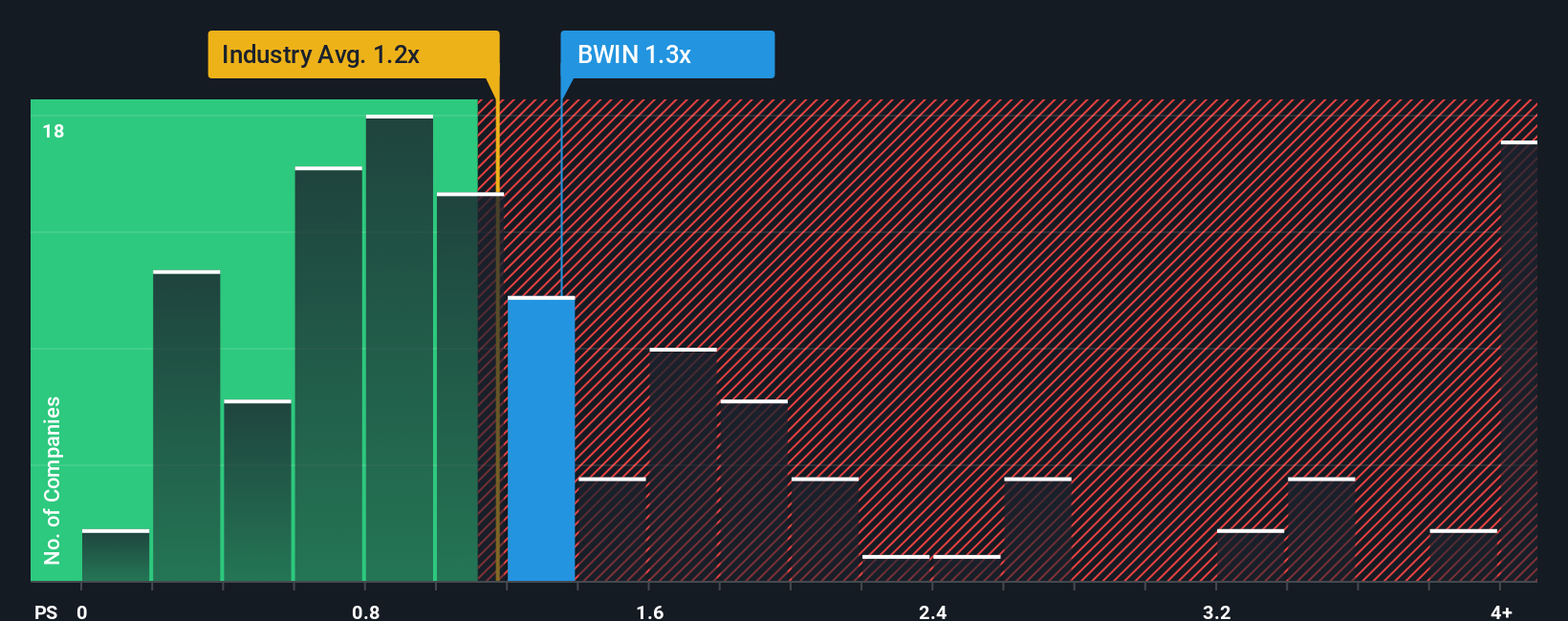

The fair value narrative leans on long term earnings forecasts, but the current P/S ratio tells a tougher story. Baldwin trades at 1.2x P/S, slightly above the US insurance industry at 1.1x and above its own fair ratio of 1.1x. This suggests less room for error if growth or margins fall short. Is this a temporary premium, or a sign expectations already run hot?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Baldwin Insurance Group Narrative

If you see the story differently, or just prefer running the numbers yourself, you can shape your own Baldwin view in minutes, starting with Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Baldwin Insurance Group.

Looking for more investment ideas?

If Baldwin is only one piece of your watchlist, this is the moment to widen your scope and line up a few more candidates worth your attention.

- Spot potential value setups by scanning these 877 undervalued stocks based on cash flows and see which businesses the model flags as priced below their cash flow potential.

- Capture income-focused opportunities by checking out these 11 dividend stocks with yields > 3% that may suit investors who want yields above 3% alongside equity exposure.

- Add growth and disruption themes to your list by reviewing these 79 cryptocurrency and blockchain stocks linked to digital assets and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal