A Look At Veeva Systems (VEEV) Valuation After Announcing A US$2b Share Repurchase Program

Veeva Systems (VEEV) is back in focus after its Board of Directors authorized a share repurchase program of up to US$2b over two years, giving investors fresh information on capital allocation priorities.

See our latest analysis for Veeva Systems.

The buyback news comes after a sharp 7.48% 1 day share price return, lifting Veeva Systems to US$237.87. However, the 90 day share price return shows a 21.18% decline, which contrasts with a 3 year total shareholder return of 47.56%.

If this kind of capital return story interests you, it could be a good moment to see what is happening across healthcare stocks as well.

With a US$2b buyback now in play, a recent 21.18% 90 day share price decline, and revenue and net income running at US$3.08b and US$860.33m, it is fair to ask: is there a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 23.8% Undervalued

The most followed narrative puts Veeva Systems’ fair value at about US$312 per share versus the last close at US$237.87, framing the new buyback against a higher implied long term earnings outlook.

The resolution of the long-standing dispute with IQVIA removes critical data interoperability barriers, enabling Veeva to fully integrate industry-leading datasets into its Commercial Cloud, which should materially expand its addressable market, improve product adoption across multiple commercial applications, and accelerate top-line revenue growth over the next several years.

Want to see what sits behind that premium view? The narrative leans on steady revenue compounding, rising margins, and a rich future earnings multiple. Curious which assumptions really drive that valuation gap?

Using an 8.20% discount rate, the narrative values Veeva Systems’ future cash flows at roughly US$312 per share, which implies a sizeable margin over the current price. That outcome rests on revenue and earnings compounding at double digit rates, margin expansion over time, and the shares still trading on a relatively high P/E in the later forecast years.

Result: Fair Value of $312.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside view still hinges on smooth CRM migrations and broad AI adoption, and both customer resistance and heavyweight tech competitors could easily challenge those assumptions.

Find out about the key risks to this Veeva Systems narrative.

Another View: What The Market Multiple Is Saying

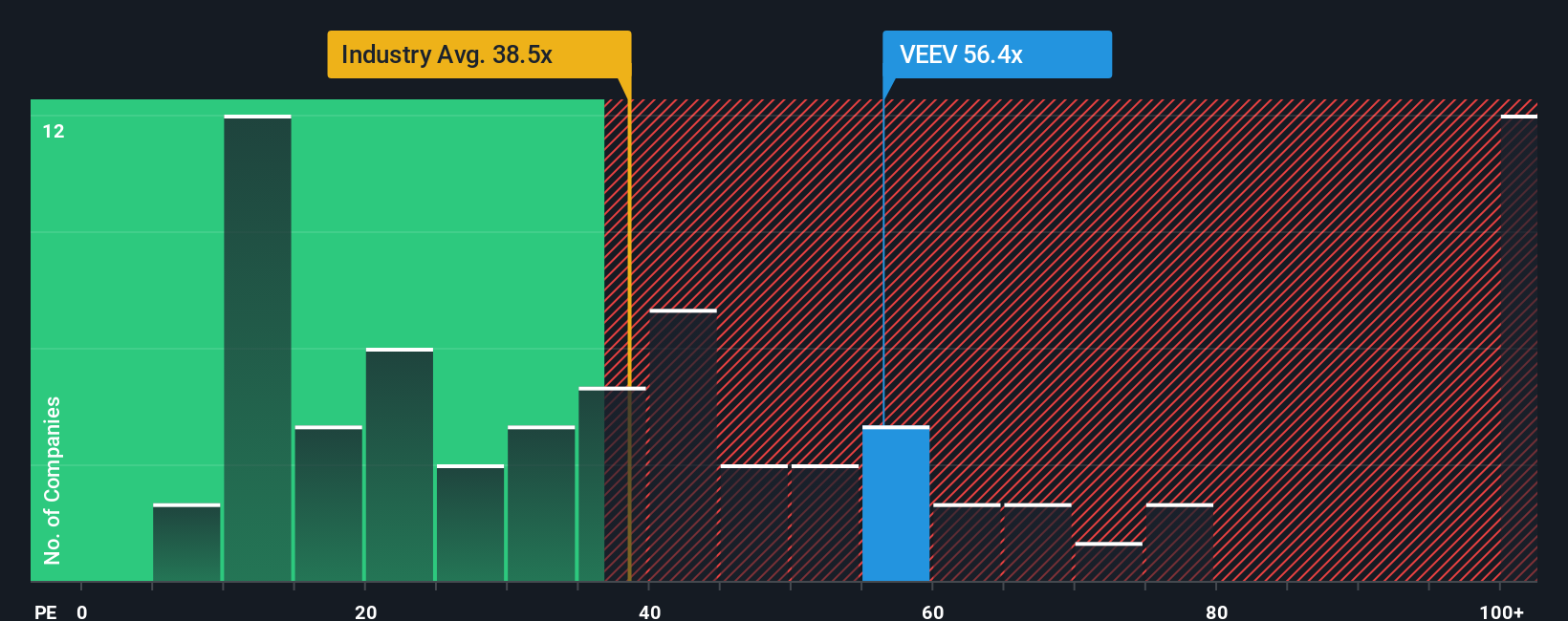

The narrative prices Veeva Systems at about US$312 per share, but the current P/E of 45.4x tells a more cautious story. It sits above the global Healthcare Services industry at 32.8x and above a fair ratio of 32.1x, even though it is below peers at 65.3x.

In practice, that means the market already asks investors to pay a premium for Veeva Systems’ earnings. The fair ratio suggests that premium could narrow over time. The question is whether the growth and quality on display justify maintaining that higher bar.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veeva Systems Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a full Veeva Systems view for yourself in just a few minutes, starting with Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Veeva Systems.

Ready to hunt for more ideas?

If Veeva Systems has your attention, now is a great time to widen your watchlist and see what other kinds of opportunities might fit your style.

- Spot potential value candidates early by scanning these 877 undervalued stocks based on cash flows that may offer more appealing cash flow based pricing.

- Zero in on income potential by checking these 11 dividend stocks with yields > 3% that already meet a 3% yield threshold.

- Lean into long term tech themes by reviewing these 29 quantum computing stocks that are working on quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal