Even Wall Street is tired of watching AI! US stock capital is quietly flowing to the remaining 493 S&P 500 companies

The Zhitong Finance App learned that in the past three years, artificial intelligence (AI) concept stocks have dominated the US stock market, driving related sectors to a cumulative increase of 78%. However, now more and more investors believe that this round of upward market led by the “Big Seven” is coming to an end.

Market concerns about whether AI can actually disrupt the US economy and generate lucrative profits have gradually cooled down and turned into anxiety among investors. At the same time, capital began to pour into the stocks of the “remaining” 493 companies in the S&P 500 index, especially those that are expected to benefit the most from the expected economic recovery.

“I call this phenomenon 'AI aesthetic fatigue',” said Ed Yardeni, president and chief investment strategist at Yardeni Research. “I'm tired of it, and I suspect many people are wary of this topic.”

If the market trend reverses, it will mark the end of a strong market cycle dominated by such a small number of stocks, which is rare in history. Since ChatGPT's amazing investor under OpenAI in 2022, the market capitalization of Nvidia (NVDA.US), Microsoft (MSFT.US), and Apple (AAPL.US) has grown by trillions of dollars. Google (GOOGL.US) and Meta (META.US) have also performed well, and second-tier companies in the AI industry chain, such as Broadcom (AVGO.US) and Oracle (ORCL.US), have also been involved in this boom.

However, this shift in market style has quietly begun — after the S&P 500 index hit a record high at the end of October last year, November ushered in a wave of sell-offs. By Monday's close, a tracking “Big Seven” index had fallen 2% since October 29, while the remaining 493 S&P 500 constituent stocks had risen 1.8%.

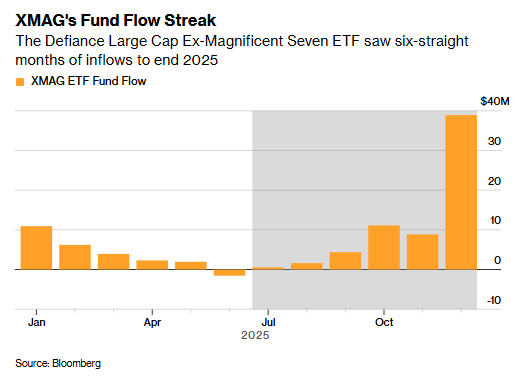

Obviously, market capital is shifting from popular growth stocks to sectors that are more defensive and have more reasonable valuations. The Defiance Large Cap Ex Magnificent Seven ETF (XMAG.US), which was listed at the end of 2024, achieved net capital inflows for six consecutive months until the end of 2025. Among them, the capital inflow in December tripled from November. The fund's growth for the full year of last year reached 15%, and most of the increase was concentrated in the second half of the year.

According to Yardeni, the performance of the remaining 493 constituent stocks of the S&P 500 in 2025 was “impressive.” The strategist pointed out that despite the establishment of the US Government's Department of Efficiency, the implementation of the Trump administration's tariff policy, and signs of weakness in the labor market, the profit margins of these companies remain high and have not been “squeezed.”

If the economic situation improves, the prospects for cyclical and growth-oriented sectors will also improve, bringing plenty of opportunities for investors who want to leave the era dominated by tech giants. Lenders such as J.P. Morgan Chase (JPM.US) and Bank of America (BAC.US) are expected to increase their performance; and as consumer confidence picks up, people will also be more willing to buy NKE.US (NKE.US) sneakers or book vacation trips through Booking Holdings (BKNG.US), and the non-essential consumer goods sector will benefit.

However, judging from historical experience, once the dominant position of the “Big Seven” comes to an end, the US stock market is likely to fluctuate.

“For a bull market, the ideal outcome is a smooth transition of market dominance to a broad camp of 493 remaining constituent stocks in the S&P 500 index,” said Doug Peta, chief US investment strategist at BCA Research. “Historically, however, those bull markets where a few stocks were strongly dominated by a small number of individual stocks often did not evolve this way.”

Using the end of the “Pretty 50” market in 1973 and the bursting of the internet bubble in early 2000 as an example, Peta reminded investors to be wary. In these two historical events, when leading stocks that have been leading the market for a long time fell into trouble, the overall market declined.

Despite market concerns that current capital expenditure is unsustainable and that some individual stocks are overvalued, Peta believes that the AI-related investment boom is not over. At the same time, investors in the AI sector have also become more cautious. Previously, the stock prices of any company involved with AI would rise in response. This “one-size-fits-all” investment boom has now diverged, and once popular AI stocks such as Oracle have experienced a severe setback.

“In my opinion, the dominance of the Big Seven hasn't come to an end yet — I'd be surprised if they hadn't ushered in a final wave of upward movements. However, once the era of dominance comes to an end, US stocks will likely need to experience a round of deep bear market before a new dominant force is born,” Peta said.

Yardeni's attitude towards the AI investment boom is even more pessimistic. He believes that this “aesthetic fatigue” began at the end of October last year — fund manager Michael Burry, famous for his “big shorts,” issued an obscure warning at the time, then revealed his bearish bet on Nvidia and Palantir (PLTR.US).

Other agencies have warned that the dominant position of tech giants may soon come to an end. When Wall Street strategists released their 2026 market outlook, one of the core ideas was that the heyday of the “Big Seven” was coming to an end. The Goldman Sachs strategist team said last month that it is expected that the “Big Seven” will contribute 46% to the profit growth rate of the S&P 500 index in 2026, down from 50% in 2025; at the same time, the profit growth rate of the remaining 493 S&P 500 constituent stocks is expected to increase from 7% in 2025 to 9% in 2026.

The remaining 493 constituent stocks of the S&P 500 are also attractive to value investors. A team of Goldman Sachs strategists led by Ben Snider pointed out that current market valuations are markedly divided, compounded by good macroeconomic prospects, all supporting value stocks.

“Looking at the sector, the valuation of the healthcare sector is low compared to historical levels and its own profitability, which further strengthens our recommendation to increase our holdings in this sector. In addition to this, we also recommend increasing our holdings in the raw materials, non-essential consumer goods, and software and services sectors,” Snider wrote in a research report published on January 6.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal