Assessing Intuit (INTU) Valuation As Shares Deliver Modest Returns And P/E Signals Mixed Expectations

Intuit (INTU) has drawn investor attention after recent trading left the shares with a return of about 3% year to date, while the 1 year total return sits near 6%. This has prompted fresh questions about valuation.

See our latest analysis for Intuit.

Intuit’s share price, now at $647.2, has a 7 day share price return of a 3.39% decline and a 30 day share price return of a 3.92% decline, while its 5 year total shareholder return of 82.34% points to momentum built over a longer horizon.

If Intuit’s track record has you thinking about what else is out there, it could be a good moment to size up high growth tech and AI stocks as your next stop.

With shares up only modestly this year despite revenue of $19.4b and net income of $4.1b, plus an indicated intrinsic discount of about 15%, an important question arises: Is Intuit a genuine opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 19.5% Undervalued

With Intuit last closing at $647.2 against a narrative fair value near $803.9, the widely followed view sees meaningful upside baked into its long term earnings path.

The accelerating adoption of Intuit's AI-driven all-in-one platform, including virtual teams of AI agents and human experts, positions the company to consolidate customers' tech stacks, drive automation of workflows, and unlock substantial ROI for customers. This is viewed as supporting higher average revenue per customer (ARPC) and net margin expansion over time.

Curious what kind of revenue climb, margin uplift, and future P/E this narrative leans on, and how they connect to that higher fair value? The full story ties product breadth, AI monetisation and long term earnings power into one valuation roadmap.

Result: Fair Value of $803.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on Intuit overcoming slower Mailchimp and international momentum, and on Credit Karma avoiding the kind of cyclicality that could quickly cool current optimism.

Find out about the key risks to this Intuit narrative.

Another View: Rich P/E, Mixed Signals

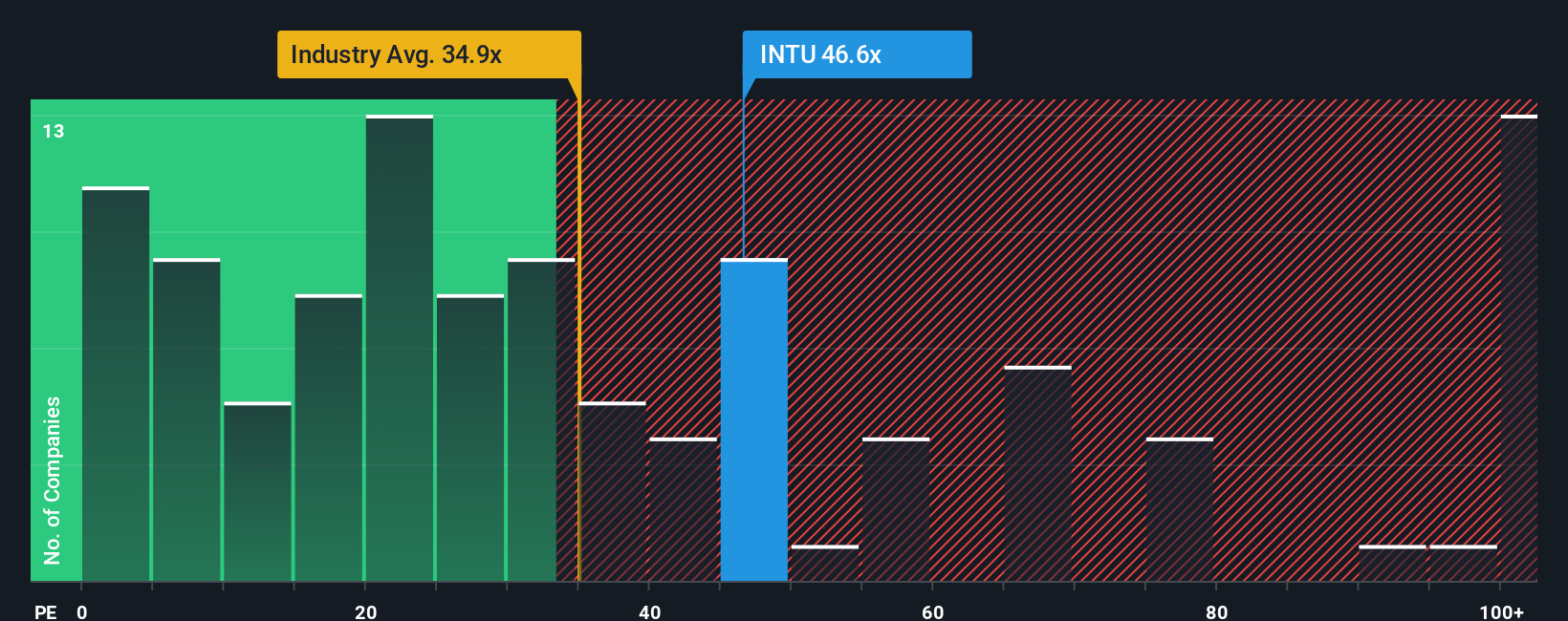

There is a twist when you look at Intuit through its P/E. The shares trade at 43.7x earnings, above the estimated fair ratio of 39.5x and well above the US Software industry on 32.7x, although still below the peer average of 49.6x.

In plain terms, you are paying more than the industry and more than what our fair ratio suggests the market could move toward, but less than some close peers. That mix can imply less downside cushion if expectations slip. The key question is whether Intuit’s earnings story justifies staying at this premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intuit Narrative

If you see the numbers differently or prefer to weigh the assumptions yourself, you can build a custom view in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Intuit.

Looking for more investment ideas?

If Intuit has sharpened your thinking, do not stop here. Broaden your watchlist with a few targeted stock ideas that fit what you care about most.

- Zero in on potential mispricing by scanning these 877 undervalued stocks based on cash flows that align with your views on earnings quality and cash flows.

- Explore the AI theme more deliberately by checking out these 25 AI penny stocks that connect real revenue and products to the hype.

- Balance growth with income by reviewing these 11 dividend stocks with yields > 3% that aim to combine regular payouts with business resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal