Assessing Acushnet Holdings (GOLF) Valuation After Recent Share Price Momentum

Why Acushnet Holdings is on investor watchlists today

Acushnet Holdings (GOLF) has drawn attention after recent share price gains, with the stock up over the past week, month, and past 3 months, prompting fresh interest in how the business is currently valued.

See our latest analysis for Acushnet Holdings.

The recent 1-day share price return of 2.70% and 7-day share price return of 5.97% sit alongside a 1-year total shareholder return of 22.97% and 5-year total shareholder return of 119.80%. Together, these figures point to share price momentum that has been building over both shorter and longer periods.

If the strength in Acushnet Holdings has you thinking about what else is performing well, it could be a good time to broaden your search with fast growing stocks with high insider ownership.

With Acushnet trading at $86.78, above the average analyst price target of $79.86 yet still showing an estimated 40% intrinsic discount, you have to ask: is this a buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 8.7% Overvalued

With Acushnet shares at $86.78 against an estimated fair value of about $79.86, the most followed narrative suggests the price sits ahead of its fundamentals.

The analysts have a consensus price target of $75.857 for Acushnet Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $65.0.

Curious how modest revenue growth, easing margins, and a richer future earnings multiple can still support that valuation anchor? The full narrative spells out the trade off between slower profit growth, steady buybacks, and the required P/E uplift that ties it all together.

Result: Fair Value of $79.86 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if golf participation keeps rising faster than expected, or if premium product launches support firmer margins, those factors could challenge the current overvaluation story.

Find out about the key risks to this Acushnet Holdings narrative.

Another View: Earnings Multiple Sends A Mixed Signal

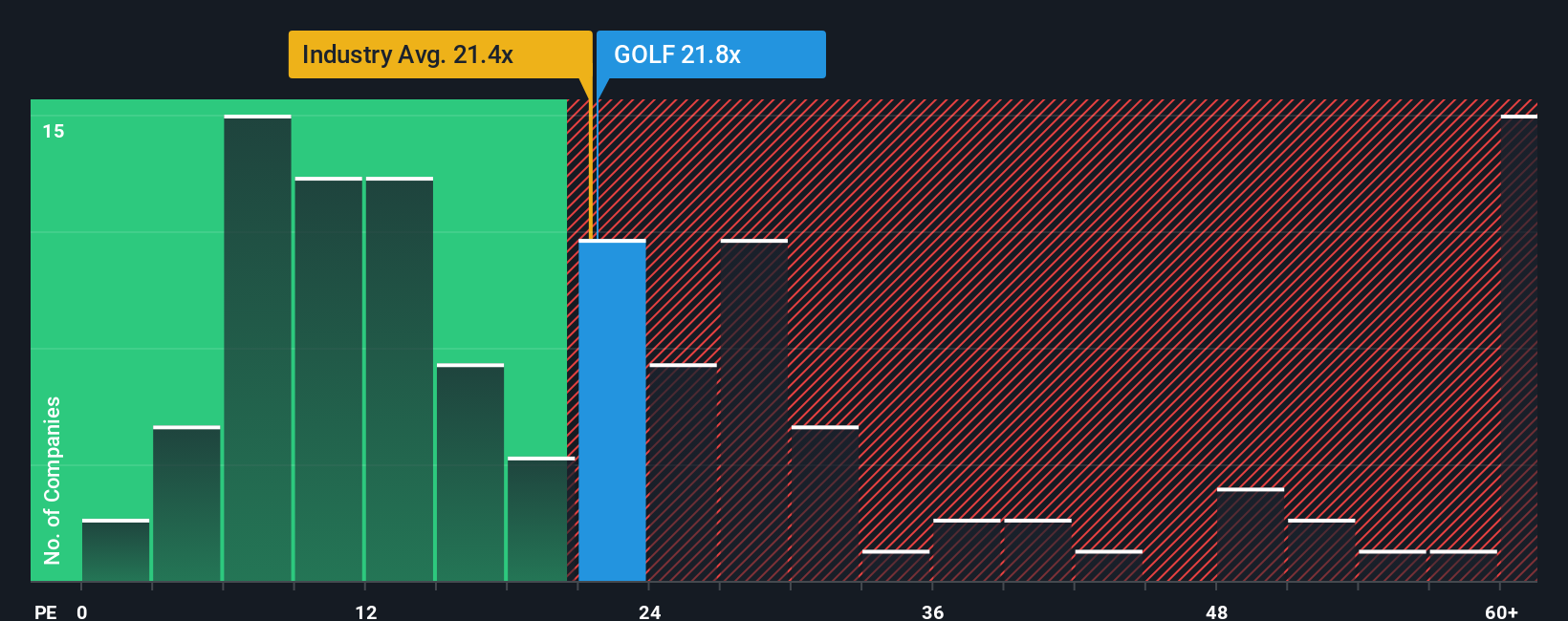

While the most followed narrative sees Acushnet as about 8.7% overvalued relative to an estimated fair value of $79.86, the market is sending a different message when you look at the P/E.

At 22.9x earnings, GOLF trades below its peer average of 29.6x but above the Global Leisure average of 22.3x, and well above an estimated fair ratio of 14x. That mix suggests investors are paying up versus what our fair ratio implies, even though the stock looks cheaper than direct peers.

Put simply, if sentiment cools, the share price could drift toward that lower fair ratio. However, if peer enthusiasm holds or grows, the current valuation may not look stretched. Which outcome do you think the market is leaning toward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Acushnet Holdings Narrative

If you look at this and come to a different conclusion, or simply prefer to test your own view using the same data, you can build a full narrative yourself in just a few minutes with Do it your way.

A great starting point for your Acushnet Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Acushnet has caught your eye, do not stop there. The next strong idea on your watchlist could come from a completely different corner of the market.

- Spot potential value by scanning these 877 undervalued stocks based on cash flows that currently trade at prices below what their cash flows suggest.

- Target future growth by checking out these 25 AI penny stocks shaping how artificial intelligence filters into everyday products and services.

- Add income potential by reviewing these 11 dividend stocks with yields > 3% that offer yields above 3% alongside regular cash distributions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal