Halliburton (HAL) Valuation Check After Venezuela Regime Change Lifts Oilfield Services Expectations

The U.S. military capture of Venezuelan President Nicolás Maduro and the resulting regime change have pushed Halliburton (HAL) into focus as investors weigh potential re entry of U.S. oilfield service providers into Venezuela.

See our latest analysis for Halliburton.

The Venezuela headlines come on top of a strong recent run, with Halliburton’s share price at $30.83 after a 28.89% 3 month share price return. The 1 year total shareholder return of 14.40% contrasts with a weaker 3 year total shareholder return of 19.38% and points to momentum building more recently.

If this move in Halliburton has you watching oilfield services more closely, it could be a good time to widen your search across aerospace and defense stocks for other idea starters.

With Halliburton trading at US$30.83, sitting close to an average analyst target of US$31.50 and flagged with a high intrinsic discount score, the key question is whether today’s price still leaves room for upside or if the market is already baking in future growth.

Most Popular Narrative: 1.5% Overvalued

With Halliburton last closing at US$30.83 versus a narrative fair value of about US$30.38, the valuation gap is tight and puts the focus squarely on the assumptions behind future cash flows, margins, and data center exposure.

Exposure to onsite and data center related power generation, including the stake in VoltaGrid, is viewed as an underappreciated growth vector that could provide incremental upside to both earnings and the stock’s valuation framework.

Curious how modest revenue expectations, slightly higher margins, and a richer future earnings multiple combine into that fair value? The narrative stitches together slow top line change, rising profitability, and a re rating of the P/E over time. Want to see which earnings path and share count assumptions sit underneath that price tag and how they connect to power generation and data center demand?

Result: Fair Value of $30.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear swing factors here, including faster global decarbonization efforts and weaker upstream spending, which could challenge those margin and earnings assumptions.

Find out about the key risks to this Halliburton narrative.

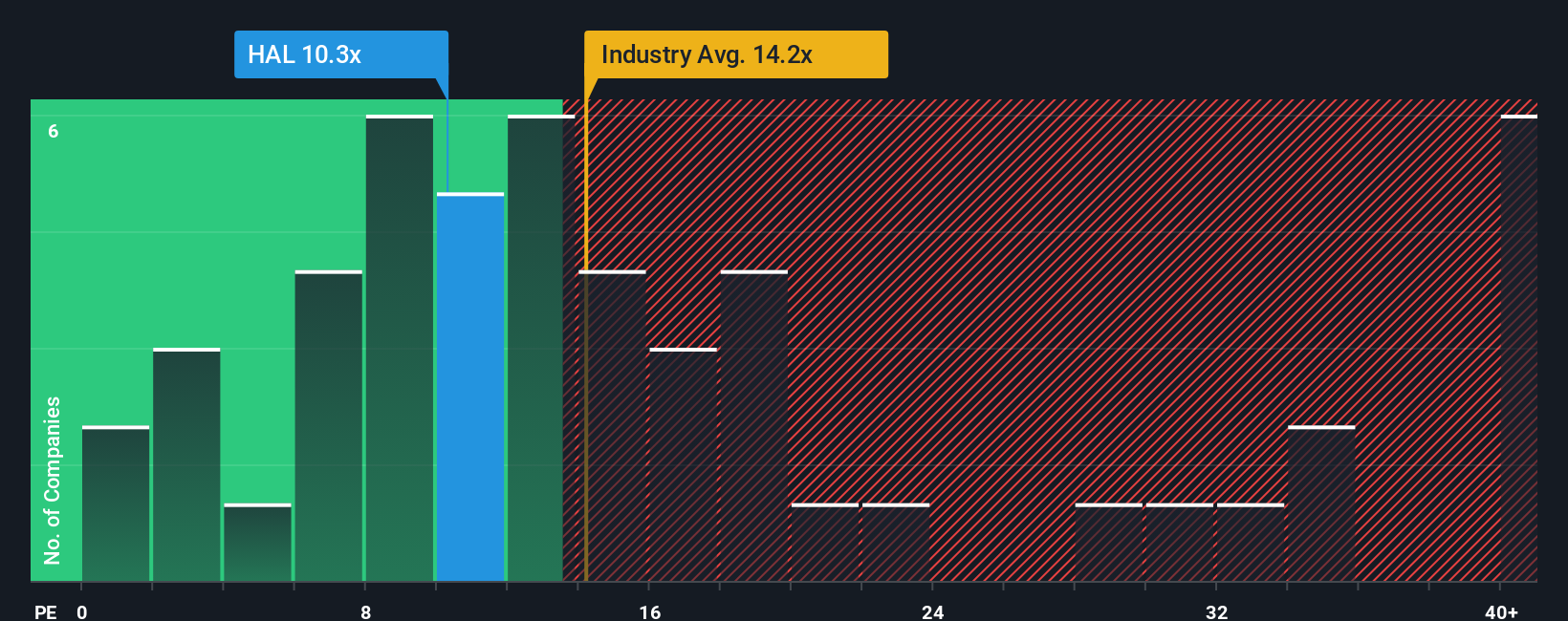

Another View: Market Ratios Point A Different Way

While the narrative fair value of about US$30.38 suggests Halliburton is slightly overvalued, the market’s own P/E signals a different story. At 19.8x earnings, the stock sits almost exactly in line with the US Energy Services industry at 19.9x and below its 21x fair ratio, yet trades above peers on 17.7x. That mix of in line, below fair, and above peers asks a simple question for you as an investor: which reference point matters most for the risk you are willing to take?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Halliburton Narrative

If you see the numbers differently or just want to stress test your own assumptions, you can create a personalized Halliburton story in minutes, starting with Do it your way.

A great starting point for your Halliburton research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Halliburton is on your radar, do not stop there. Use the screener to uncover other stocks that fit your style before the next move passes you by.

- Target potential value opportunities by scanning these 877 undervalued stocks based on cash flows and see which companies align with the kind of pricing you are looking for.

- Spot growth themes early by checking out these 25 AI penny stocks and see which businesses are building around artificial intelligence trends.

- Strengthen your income focus by reviewing these 11 dividend stocks with yields > 3% and see which companies currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal