Top TSX Dividend Stocks To Watch In January 2026

As we step into 2026, Canadian investors are encouraged to reassess their portfolios in light of recent economic surprises and shifting interest rates. With the Canadian market showing resilience and employment trends defying expectations, dividend stocks remain an attractive option for those seeking stable returns amidst evolving market conditions.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Wajax (TSX:WJX) | 4.95% | ★★★★★☆ |

| Transcontinental (TSX:TCL.A) | 3.93% | ★★★★★☆ |

| Toronto-Dominion Bank (TSX:TD) | 3.30% | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | 13.86% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 3.31% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.32% | ★★★★★☆ |

| Great-West Lifeco (TSX:GWO) | 3.58% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.56% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.40% | ★★★★★☆ |

| Bank of Montreal (TSX:BMO) | 3.64% | ★★★★★☆ |

Click here to see the full list of 17 stocks from our Top TSX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

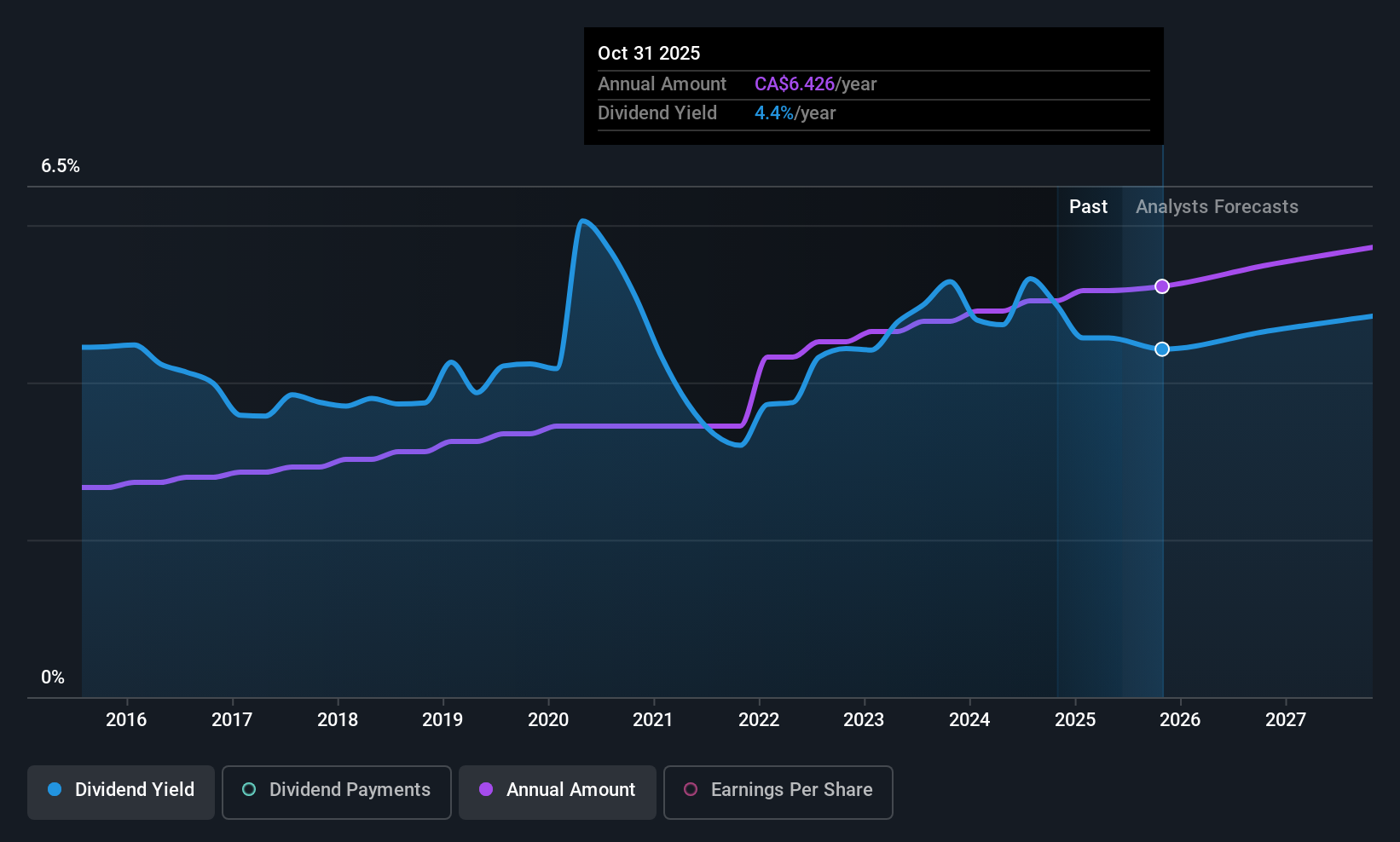

Bank of Montreal (TSX:BMO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Montreal provides diversified financial services primarily in North America and has a market cap of CA$131.50 billion.

Operations: Bank of Montreal's revenue is primarily derived from its Capital Markets segment (CA$7.25 billion), Wealth Management (CA$5.29 billion), U.S. Personal and Commercial Banking (U.S. P&C) (CA$10.44 billion), and Canadian Personal and Commercial Banking (Canadian P&C) (CA$9.90 billion).

Dividend Yield: 3.6%

Bank of Montreal offers a stable dividend track record, with dividends consistently covered by earnings and forecasted to remain sustainable. The payout ratio stands at 56.2%, indicating coverage by current earnings, with future projections showing further improvement to 44.3%. While the dividend yield is lower than top-tier Canadian payers, it remains reliable and has grown over the past decade. Recent fixed-income offerings suggest a focus on strengthening capital structure amidst consistent profit growth and strategic initiatives like partnerships with Walmart Canada for enhanced client value.

- Click here and access our complete dividend analysis report to understand the dynamics of Bank of Montreal.

- Insights from our recent valuation report point to the potential overvaluation of Bank of Montreal shares in the market.

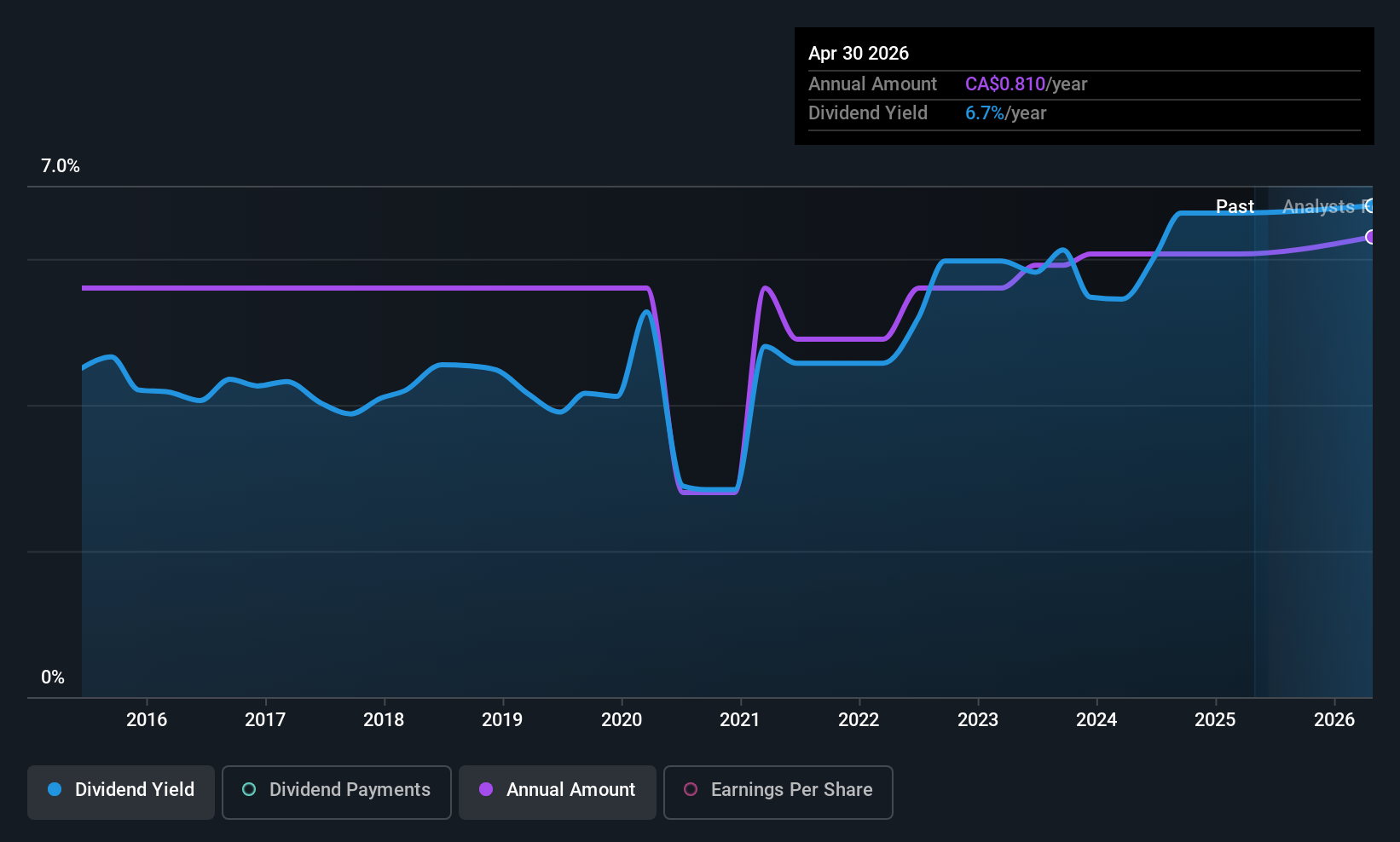

Evertz Technologies (TSX:ET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally with a market cap of CA$1.04 billion.

Operations: Evertz Technologies Limited generates revenue primarily from the Television Broadcast Equipment Market, amounting to CA$509.60 million.

Dividend Yield: 6%

Evertz Technologies' dividend yield is among the top 25% of Canadian payers, yet it lacks reliability due to past volatility and a high payout ratio of 94.8%, indicating dividends aren't well covered by earnings. However, with a cash payout ratio of 59.9%, dividends are supported by cash flows. Recent earnings growth and special dividend announcements highlight its commitment to shareholder returns despite historical inconsistencies in dividend stability.

- Click to explore a detailed breakdown of our findings in Evertz Technologies' dividend report.

- Our expertly prepared valuation report Evertz Technologies implies its share price may be lower than expected.

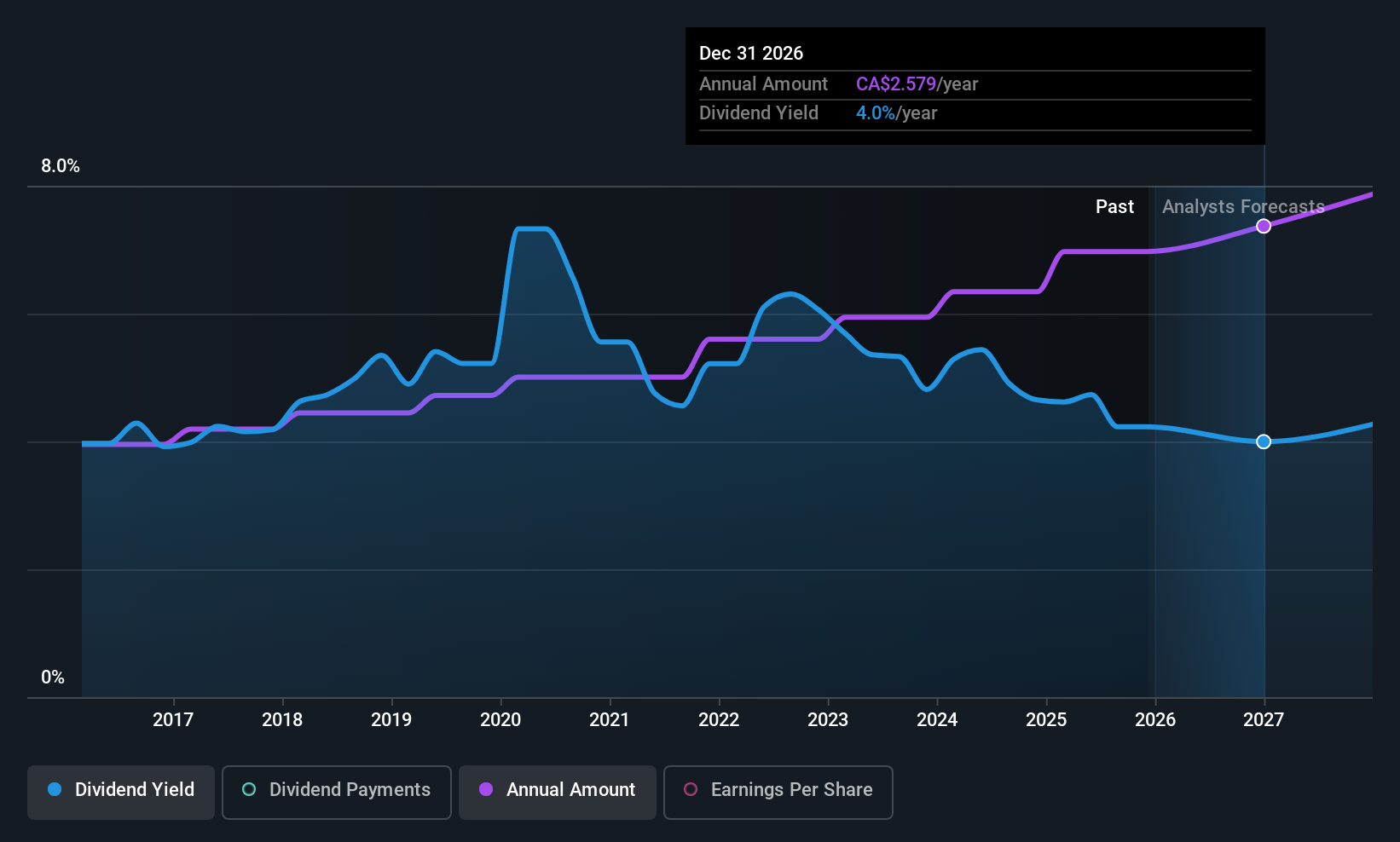

Great-West Lifeco (TSX:GWO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Great-West Lifeco Inc. operates in life and health insurance, retirement savings, wealth and asset management, and reinsurance across Canada, the United States, and Europe with a market cap of CA$61.13 billion.

Operations: Great-West Lifeco Inc.'s revenue is derived from its operations in Canada (CA$17.88 billion), Europe (CA$8.23 billion), the United States (CA$6.41 billion), and Capital and Risk Solutions (CA$5.31 billion).

Dividend Yield: 3.6%

Great-West Lifeco offers a stable and reliable dividend, with a payout ratio of 55% supported by earnings and cash flows. Despite its dividend yield of 3.58% being lower than the top Canadian payers, it has consistently grown over the past decade. Recent moves include a share repurchase program for up to 20 million shares, reflecting potential value enhancement for shareholders. The company's strong earnings growth further supports its dividend sustainability.

- Click here to discover the nuances of Great-West Lifeco with our detailed analytical dividend report.

- Our valuation report here indicates Great-West Lifeco may be undervalued.

Taking Advantage

- Reveal the 17 hidden gems among our Top TSX Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal