Assessing Redwire (RDW) Valuation After New European Space Contracts Expand Growth Prospects

Redwire (RDW) is back in focus after a series of European contract wins, including docking systems for The Exploration Company's Nyx spacecraft and completion of payload integrations for ESA's Syndeo-3 mission.

See our latest analysis for Redwire.

The recent European contract wins appear to have coincided with sharp share price momentum, with a 7 day share price return of 34.01% and a 30 day share price return of 66.51%, building on a 3 year total shareholder return above 4x despite a 1 year total shareholder return decline of 36.70%.

If Redwire’s recent contracts have caught your attention, it could be a useful moment to also scan other aerospace names through aerospace and defense stocks.

With Redwire trading at US$10.64 and sitting at roughly a 13% discount to an average analyst price target of US$12, the key question is whether that gap signals opportunity or whether the market is already accounting for future growth.

Most Popular Narrative Narrative: 19.5% Undervalued

Redwire’s most followed narrative places fair value at about US$13.22 per share versus the last close of US$10.64. This frames a material upside gap that hinges on aggressive growth and margin assumptions.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $887.3 million, earnings will come to $73.2 million, and it would be trading on a PE ratio of 54.7x, assuming you use a discount rate of 8.0%.

Curious what kind of revenue ramp, margin shift, and valuation multiple need to come together to support that fair value line? The core assumptions stretch across growth, profitability, and how highly the market might price those future earnings.

Result: Fair Value of $13.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could easily crack if large fixed price contracts run into cost overruns, or if government funding delays keep revenue and margins choppy for longer.

Find out about the key risks to this Redwire narrative.

Another View: Multiples Point the Other Way

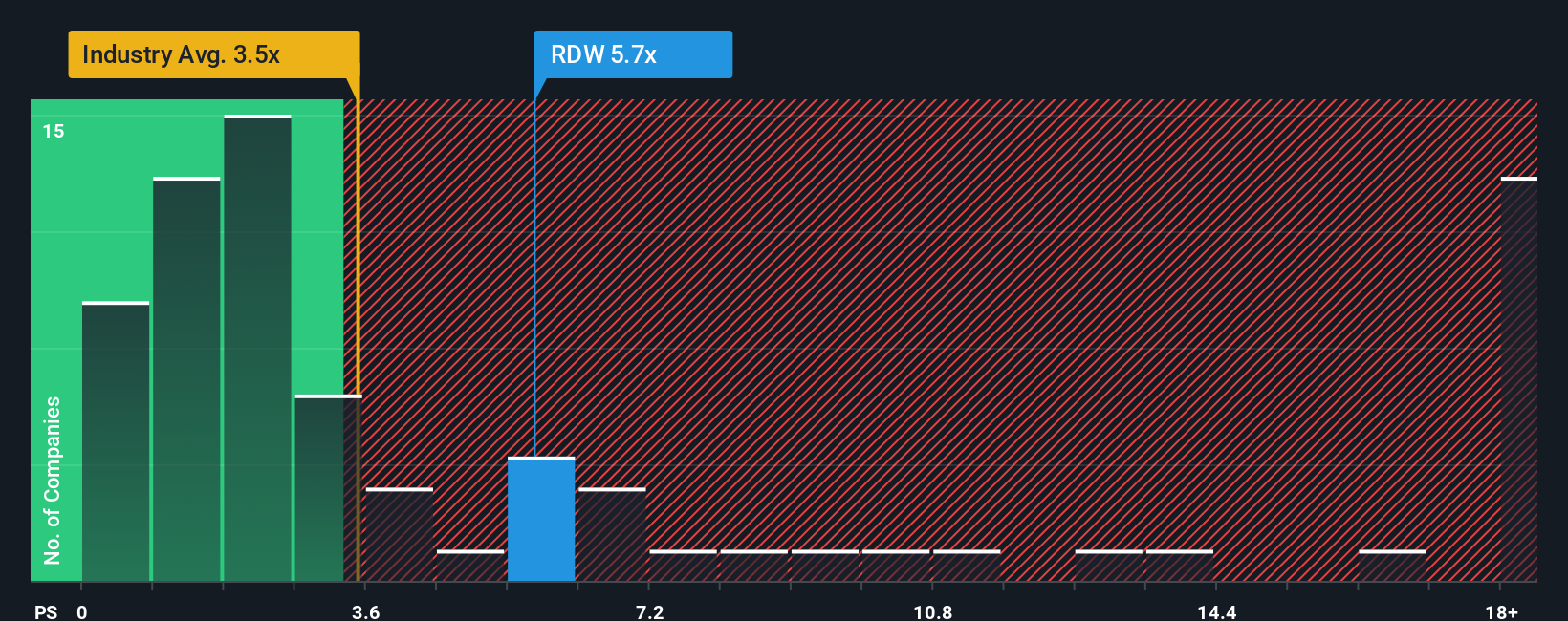

That 19.5% “undervalued” fair value sits awkwardly next to how the market is pricing Redwire’s current sales. At a P/S of 5.9x versus 3.7x for the US Aerospace & Defense group and 1.9x for peers, while our fair ratio sits at 2.2x, today’s price embeds a lot of optimism for an unprofitable company.

Put simply, the gap between 5.9x and a fair ratio of 2.2x suggests limited room for error if growth or margins fall short. As you weigh the upside case, are you comfortable paying a premium multiple before profits are in sight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Redwire Narrative

If parts of this story do not quite line up with your view, you can always stress test the numbers yourself and shape a version that fits your assumptions in just a few minutes, then Do it your way.

A great starting point for your Redwire research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready to hunt for your next idea?

If Redwire has you thinking about where to look next, use the Simply Wall St Screener to spot other focused ideas that match your style.

- Target potential value opportunities by scanning these 876 undervalued stocks based on cash flows that may be priced below what their cash flows suggest.

- Spot growth themes at the frontier of computing by checking out these 29 quantum computing stocks shaping future hardware and software breakthroughs.

- Build an income focused watchlist with these 11 dividend stocks with yields > 3% that already offer yields above 3% on current prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal