What Eni (BIT:ENI)'s Industrial Evolution Spin-Off and Zohr Expansion Plans Mean For Shareholders

- In recent months, Eni has created Eni Industrial Evolution S.p.A. to consolidate its European and Middle Eastern refining and logistics assets, while advancing talks with Egypt’s EGAS to add offshore processing and onshore water treatment capacity to the Zohr gas field. These moves, alongside ongoing LNG and decarbonisation initiatives, highlight how Eni is reshaping its operations around gas, efficiency and lower-carbon industrial activities.

- By examining how the Zohr expansion plans and Eni Industrial Evolution restructuring fit with its existing LNG growth and legacy-business risks, we can assess what they might mean for the company’s overall investment case.

- We’ll now assess how the creation of Eni Industrial Evolution refines Eni’s investment narrative around gas-led growth and industrial transformation.

Find companies with promising cash flow potential yet trading below their fair value.

Eni Investment Narrative Recap

To own Eni today, you need to believe in its shift toward gas, LNG and more efficient industrial assets while legacy businesses and energy transition projects still weigh on results. The Zohr discussions and creation of Eni Industrial Evolution appear directionally consistent with this gas-led, lower carbon focus, but they do not fundamentally change the near term balance between upstream growth as a key catalyst and ongoing losses in chemicals and other legacy activities as the main drag.

The formation of Eni Industrial Evolution, which groups European and Middle Eastern refining and logistics operations, is the clearest recent move that ties into this investment story. By ring fencing traditional refining while using existing downstream know how in new industrial supply chains, it gives investors a cleaner view on how Eni is trying to tilt the portfolio toward gas, LNG and potentially more resilient industrial earnings, even as Europe’s weaker chemical and refining backdrop remains a constraint.

Yet against this more focused industrial story, investors still need to weigh the risk that Versalis and other legacy units continue to...

Read the full narrative on Eni (it's free!)

Eni's narrative projects €88.8 billion revenue and €5.1 billion earnings by 2028.

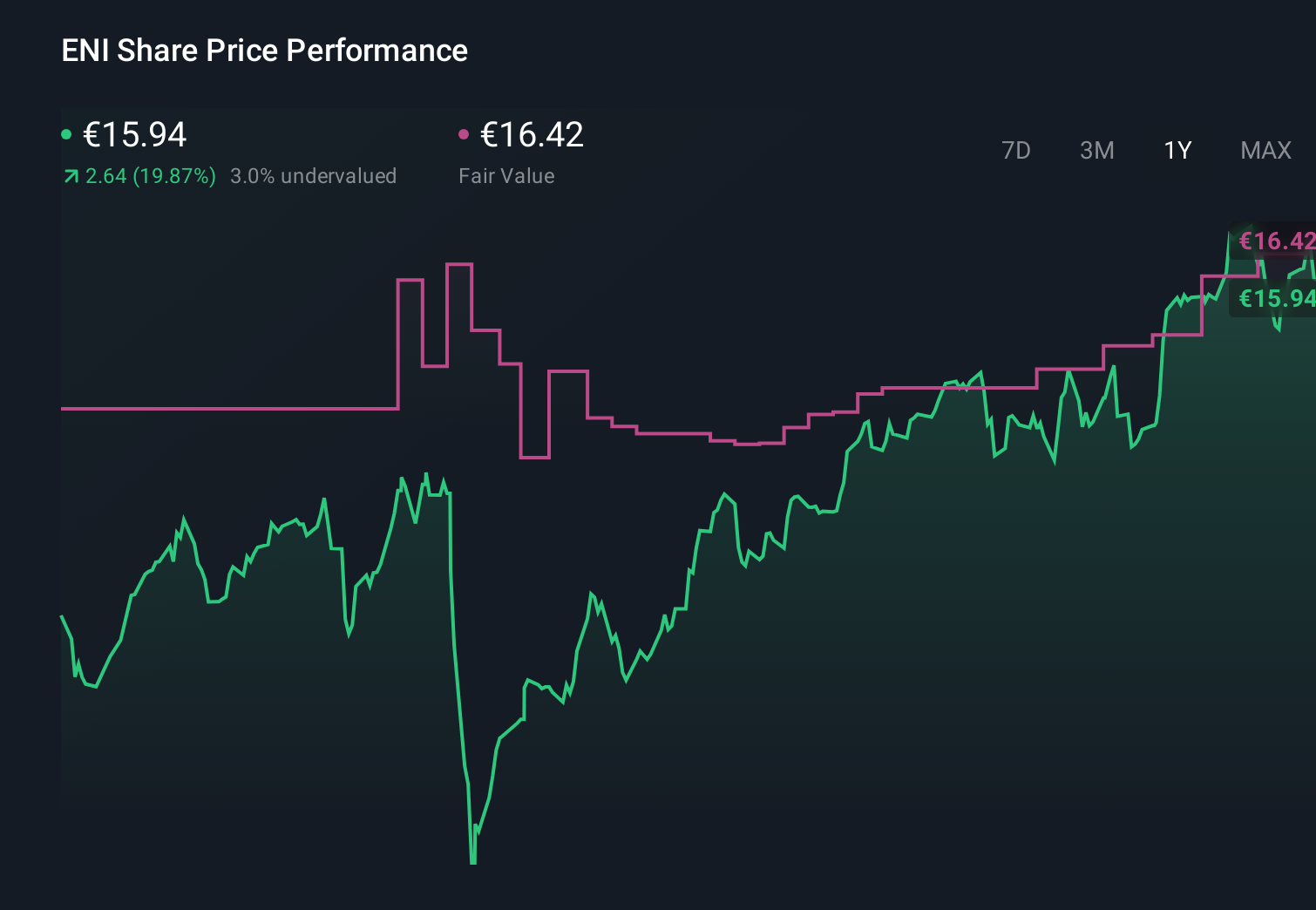

Uncover how Eni's forecasts yield a €16.54 fair value, in line with its current price.

Exploring Other Perspectives

Three Simply Wall St Community valuations for Eni span roughly €15.95 to €22.20, underlining how far apart individual views can sit. When you set these against Eni’s heavy reliance on new LNG and large gas projects for growth, it becomes even more important to compare several perspectives before deciding how comfortable you are with the company’s future earnings mix.

Explore 3 other fair value estimates on Eni - why the stock might be worth just €15.95!

Build Your Own Eni Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eni research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eni research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eni's overall financial health at a glance.

No Opportunity In Eni?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal