Assessing Astronics (ATRO) Valuation After Strong Multi Year Share Price Momentum

Astronics stock reaction and recent performance snapshot

Astronics (ATRO) has drawn fresh attention after recent trading, with the stock last closing at US$59.48. Investors are weighing this move against the company’s multi year total returns and current fundamentals.

Over the past week and month, Astronics has recorded gains of 9.24% and 16.31% respectively, while the past 3 months show a 25.38% return. On a 1 year basis, the total return is 176.22%, with a 3 year total return of about 4.8x and a 5 year total return of roughly 3.4x.

See our latest analysis for Astronics.

The recent 1 day share price return of 2.32% and 90 day share price return of 25.38% sit alongside a very large 1 year total shareholder return and a roughly 5x 3 year total shareholder return. Together, these figures suggest momentum has been building rather than fading.

If Astronics has you looking closer at aerospace opportunities, this could be a handy time to scan other aerospace and defense names using aerospace and defense stocks.

With Astronics trading near its recent high, carrying a value score of 2, an intrinsic value estimate that sits at a premium, and a small discount to analyst targets, you have to ask: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 3% Undervalued

With Astronics last closing at US$59.48 against a narrative fair value of about US$61.18, the current setup depends on how future margins and growth unfold.

Cost and cash discipline evidenced by major cost savings initiatives, active tariff mitigation plans, and a healthy, flexible balance sheet provide headroom for further margin expansion, potential share repurchases, and opportunistic acquisitions to diversify and stabilize earnings.

Curious what kind of revenue trajectory and margin rebuild would need to hold for that slight upside to make sense? The narrative leans on sharply higher profitability, faster top line compound growth than today, and a future earnings multiple that assumes investors continue to pay a premium for that in-seat power niche. Want to see exactly how those moving parts fit together in the model?

Result: Fair Value of $61.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story collides with real pressure points, including higher tariff related costs and ongoing execution issues in the Test segment that could curb earnings power.

Find out about the key risks to this Astronics narrative.

Another Angle on Value

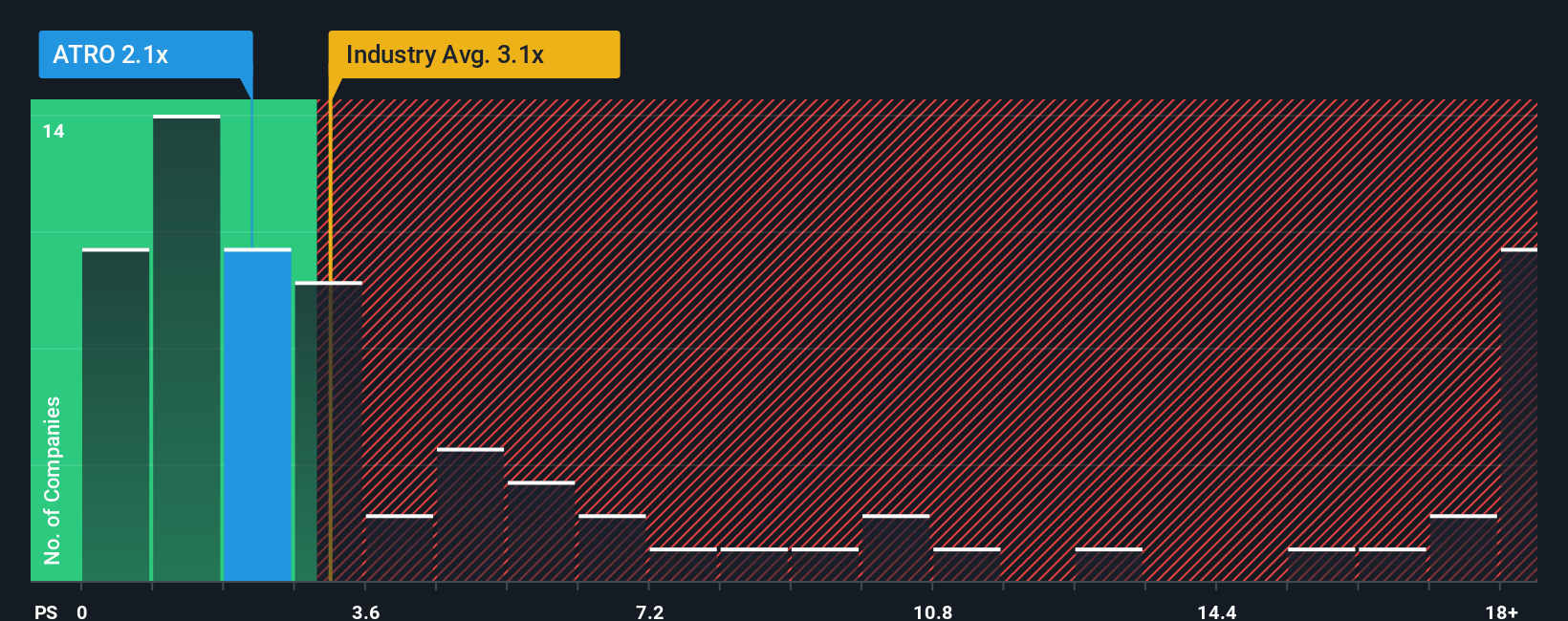

Those narrative fair value numbers suggest a small upside, but the market is sending a different signal when you look at sales-based pricing. Astronics trades on a P/S of 2.6x while our fair ratio sits closer to 1.2x, which points to a richer price tag and less margin for error if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Astronics Narrative

If you see the numbers differently, or simply want to test your own assumptions, you can review the same inputs, build a custom view in minutes, and then Do it your way.

A great starting point for your Astronics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Astronics has sparked your interest, do not stop here. Use the screener to spot other clear setups that match your style before the crowd catches on.

- Hunt for possible mispriced opportunities by scanning these 876 undervalued stocks based on cash flows that might offer more upside if their fundamentals stay on track.

- Target future focused themes with these 25 AI penny stocks that sit at the intersection of automation, data, and long term spending trends.

- Boost your income watchlist by checking out these 11 dividend stocks with yields > 3% that combine yield with established business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal