Societe Generale Securities: What is the contribution of the rise in various industries in 2025?

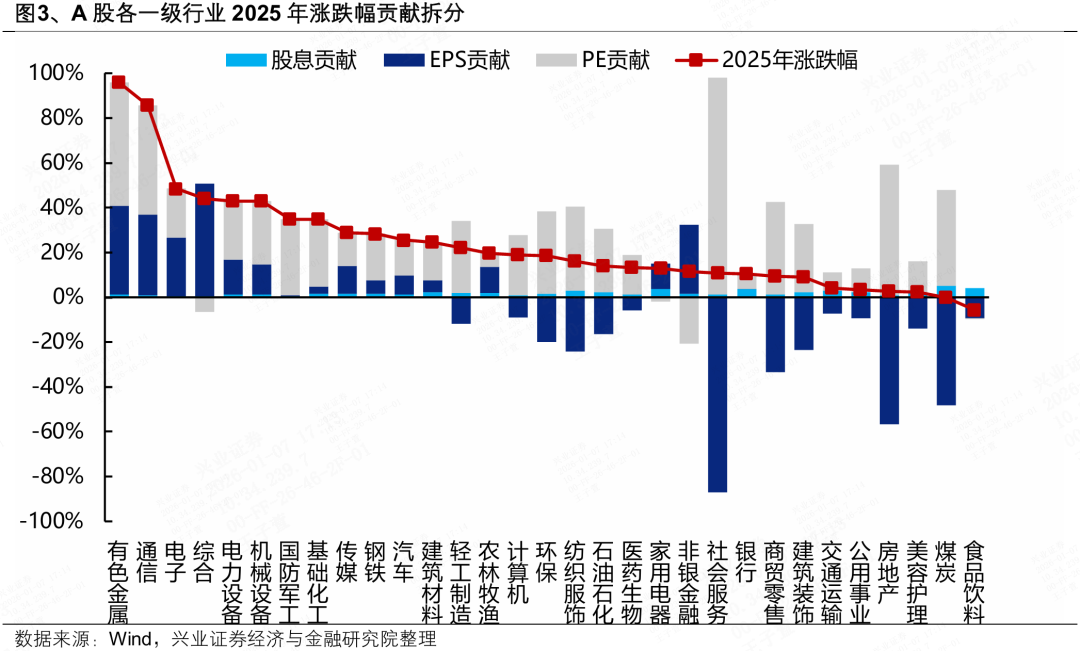

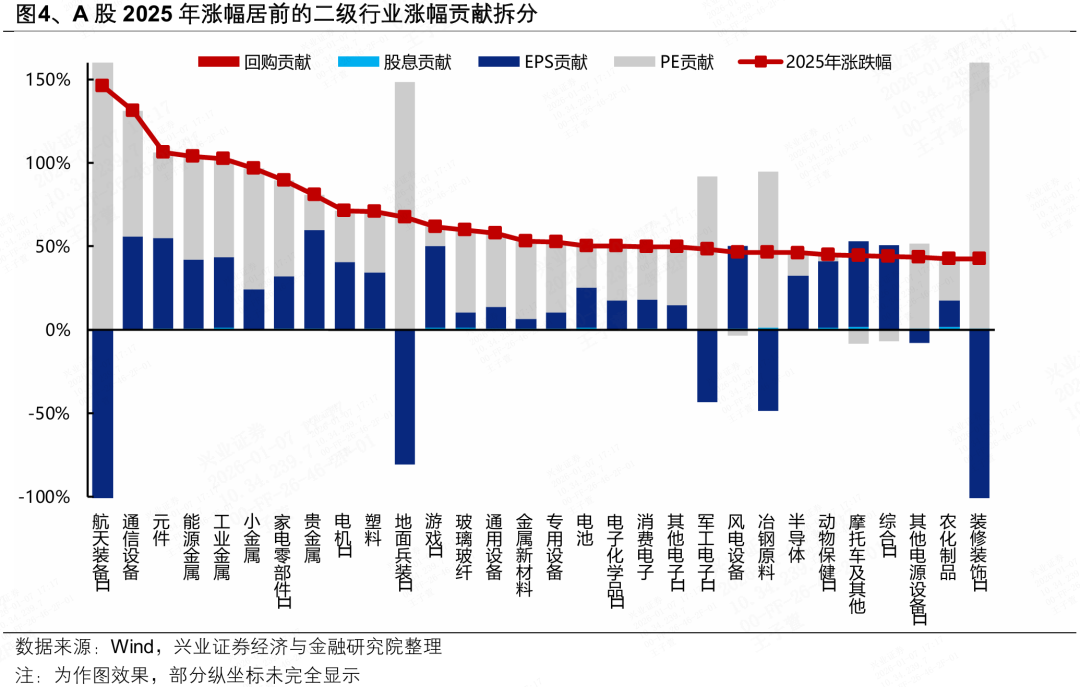

The Zhitong Finance App learned that Societe Generale Securities released a research report saying that out of 27.65% of the total A increase in 2025, profit contributed 5.29%, valuation contributed 20.44%, and dividends contributed 1.91%. Looking at the Tier 1 industry, profit will become a “watershed moment” that will determine the performance of various industries in 2025. Non-ferrous, AI hardware (communications, electronics), new energy, machinery, etc. all contributed a lot to profits, which had the highest increases. However, consumption, real estate chains, dividends, etc. that have seen lower increases are also basically being dragged down by profits. Looking at the secondary sector, the profit contributions of the second-tier industry, which had the highest increase, were mostly positive, while the profit contributions of the military industry (space equipment, ground weapons, military electronics), raw materials for steel smelting, and decoration were negative, mainly driven by valuation.

Societe Generale Securities's main views are as follows:

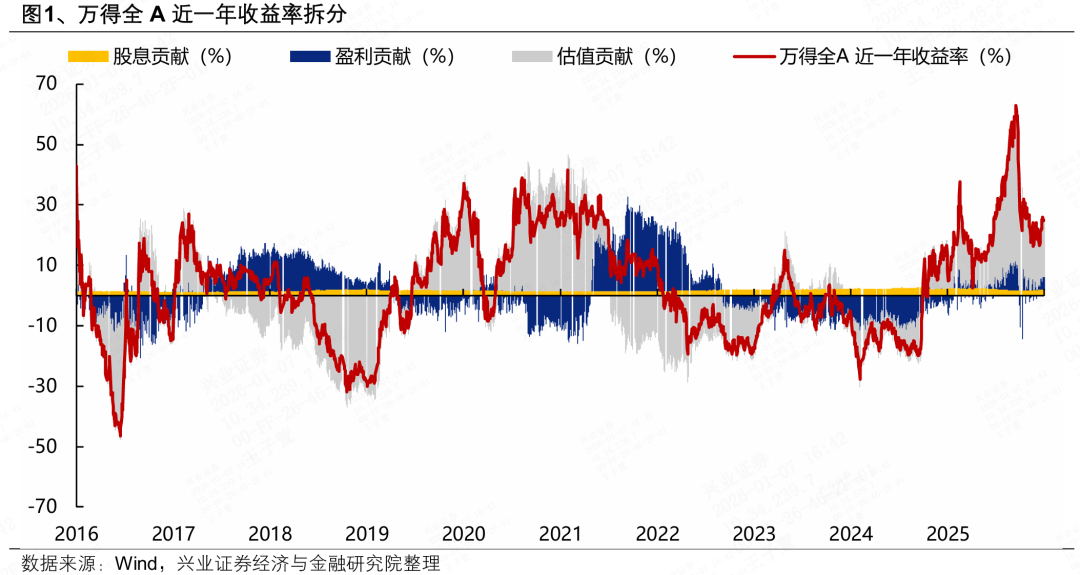

Of the 27.65% increase in full A in 2025, profit contributed 5.29%, valuation contributed 20.44%, and dividends contributed 1.91%.

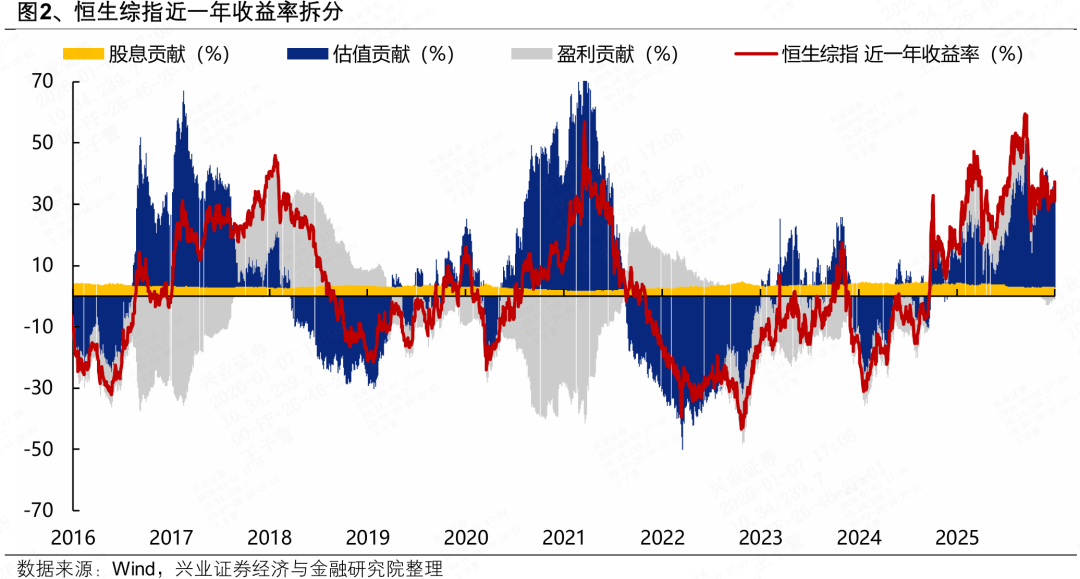

Of the 30.98% increase in the Hang Seng Composite Index in 2025, the profit contribution was -1.2%, the valuation contribution was 28.99%, and the dividend contribution was 3.2%.

Looking at the A-share tier 1 industry, profit became a “watershed moment” that will determine the performance of various industries in 2025. In 2025, most industries were “devalued” to varying degrees, and profit became a “watershed moment” that ultimately determines the performance of each industry. Non-ferrous, AI hardware (communications, electronics), new energy, machinery, etc. all contributed a lot to profits, which had the highest increases. However, consumption, real estate chains, dividends, etc. that have seen lower increases are also basically being dragged down by profits.

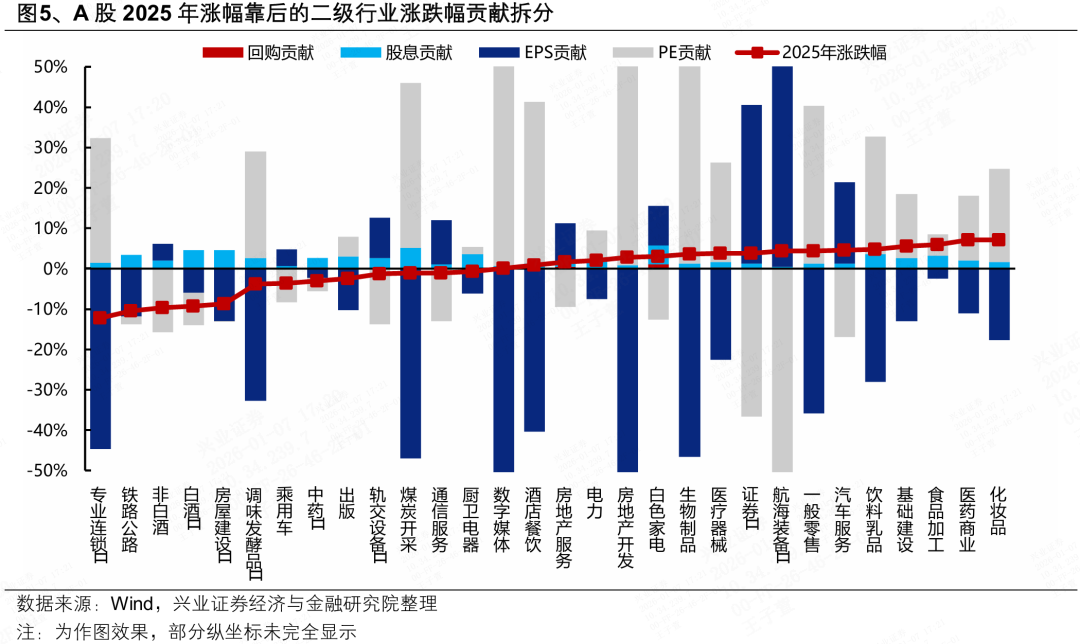

Looking at the A-share second-tier industry, most of the profit contributions of the second-tier industry, which had the highest increase, were positive, while the profit contributions of military industry (space equipment, ground weapons, military electronics), raw materials for steel smelting, and decoration were negative, mainly driven by valuation. The profit contributions of the secondary sector, which lagged behind in growth, were mostly negative. Instead of liquor, passenger cars, rail transit equipment, communication services, real estate services, white goods, and automobile services, the profit contributions were positive, mainly dragged down by valuations.

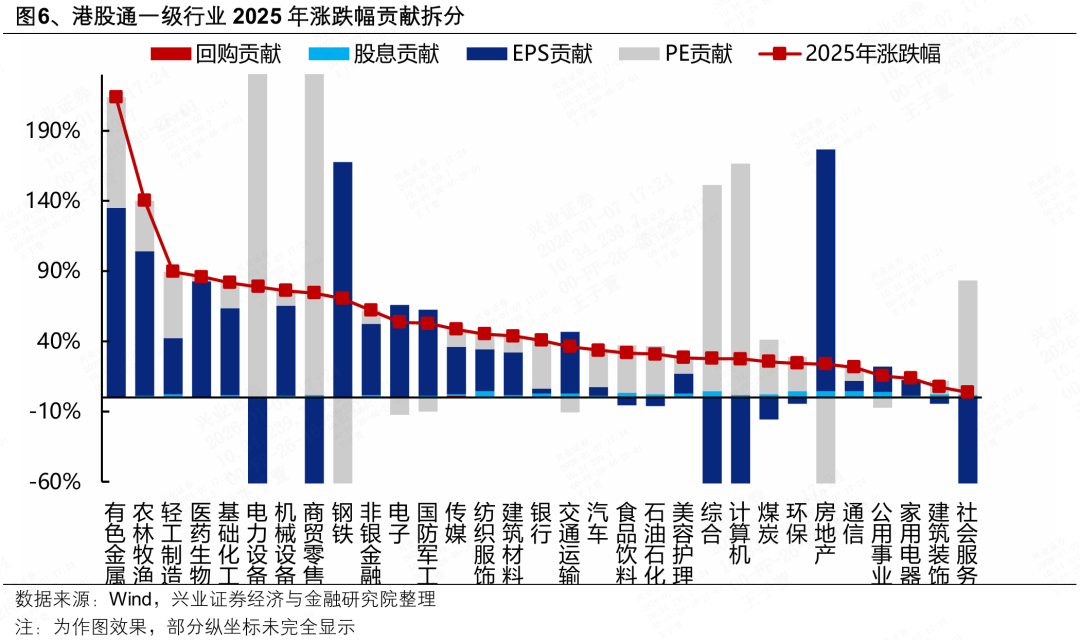

Looking at the Hong Kong Stock Connect Tier 1 sector, most of the industries with the highest gains contributed positively to profits. In particular, the leading companies in agriculture, agriculture and animal husbandry, pharmaceuticals, chemicals, and machinery all contributed more than half of the profits. In industries where growth has lagged behind, social services and construction were mainly dragged down by profits, while household appliances, utilities, and communications contributed positively to profits, mainly by valuation.

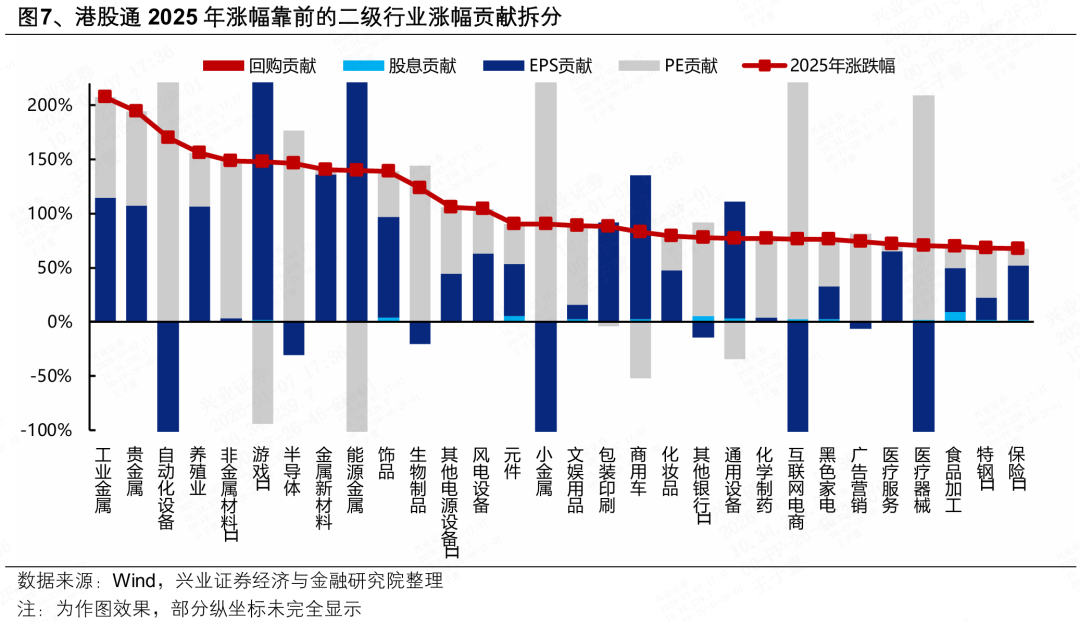

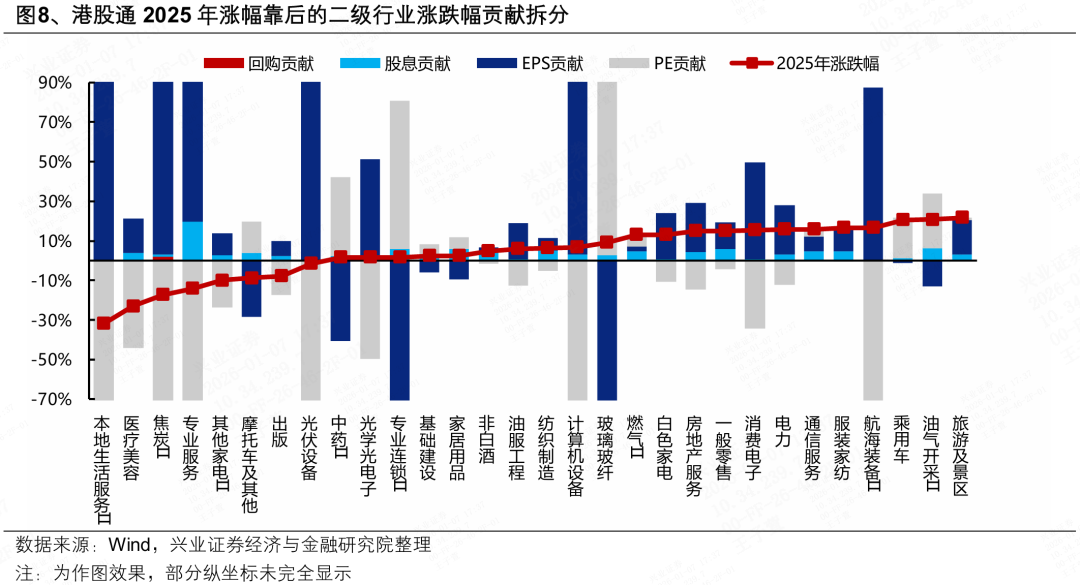

Looking at the Hong Kong Stock Connect secondary sector, most of the profit contributions of the secondary sector with the highest increase were positive, while the profit contributions of automation equipment, semiconductors, biological products, and small metals were negative, mainly driven by valuation. Among the second-tier industries, which have lagged behind in growth, industries such as motorcycles, traditional Chinese medicine, glass and glass fiber were mainly dragged down by profits, while local lifestyle services, medical and beauty, coke, photovoltaic equipment, computer equipment, consumer electronics and other industries contributed positively, mainly by valuation.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal