Undervalued Small Caps With Insider Activity To Explore In January 2026

As the Dow and S&P 500 reach new all-time highs, small-cap stocks in the United States are also garnering attention amid a robust market environment. With economic indicators showing resilience and broader market sentiment buoyant, exploring opportunities within small caps can be compelling, especially when there is notable insider activity. Identifying promising stocks involves examining factors such as financial health, growth potential, and insider transactions that may signal confidence in future performance.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| MVB Financial | 10.2x | 1.9x | 23.85% | ★★★★★★ |

| Wolverine World Wide | 17.7x | 0.8x | 36.24% | ★★★★★☆ |

| First United | 9.8x | 2.9x | 45.43% | ★★★★★☆ |

| Merchants Bancorp | 8.1x | 2.7x | 49.46% | ★★★★★☆ |

| Union Bankshares | 9.6x | 2.1x | 22.35% | ★★★★☆☆ |

| S&T Bancorp | 11.4x | 3.9x | 36.93% | ★★★★☆☆ |

| Angel Oak Mortgage REIT | 12.3x | 6.2x | 39.26% | ★★★★☆☆ |

| Stock Yards Bancorp | 14.6x | 5.2x | 34.16% | ★★★☆☆☆ |

| Farmland Partners | 6.6x | 8.1x | -95.03% | ★★★☆☆☆ |

| Vestis | NA | 0.3x | -16.02% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

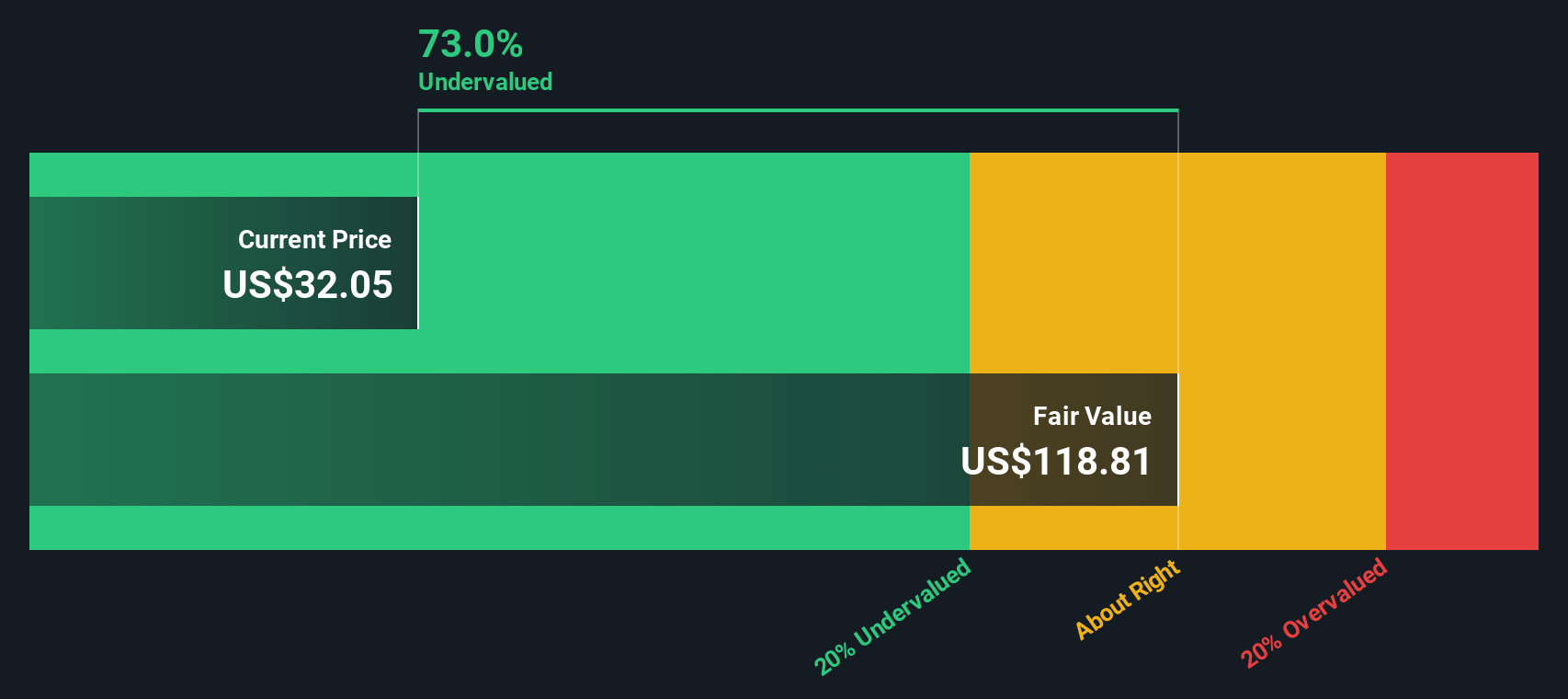

Merchants Bancorp (MBIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Merchants Bancorp is a financial services company focused on banking, mortgage warehousing, and multi-family mortgage banking operations, with a market capitalization of approximately $1.16 billion.

Operations: The company generates revenue primarily from its Banking, Mortgage Warehousing, and Multi-Family Mortgage Banking segments. The net income margin has shown variability, reaching as high as 50.99% in early 2021 but decreasing to 33.43% by late 2025. Operating expenses have increased over time, impacting net income margins despite consistent gross profit margins of 100%.

PE: 8.1x

Merchants Bancorp, a smaller U.S. financial entity, recently announced dividends for both common and preferred shares, signaling steady shareholder returns. However, the company faces challenges with high charge-offs in its multi-family loan portfolio totaling US$29.5 million in Q3 2025. Despite this, insider confidence is evident with recent share purchases from October 2025 to December 2025. Earnings per share dropped to US$0.97 from US$1.17 year-over-year for Q3 2025; yet future earnings are projected to grow annually by over 15%.

- Unlock comprehensive insights into our analysis of Merchants Bancorp stock in this valuation report.

Assess Merchants Bancorp's past performance with our detailed historical performance reports.

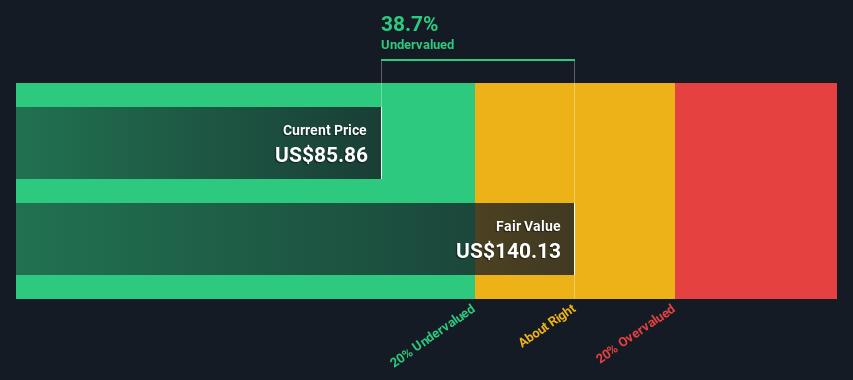

ICF International (ICFI)

Simply Wall St Value Rating: ★★★★★☆

Overview: ICF International provides professional services to a diverse range of clients, with a market capitalization of approximately $2.39 billion.

Operations: ICFI generates revenue primarily from professional services, with a recent figure of $1.93 billion. The company's cost structure includes significant expenses in COGS and operating expenses, with the latter reaching $560 million recently. The gross profit margin has shown variability, most recently recorded at 37.23%.

PE: 16.5x

ICF International, a company with a focus on technology and consulting services, recently secured a $300 million digital experience contract from Maryland, enhancing its portfolio in government services. Despite facing revenue declines due to reduced federal business and the impact of government shutdowns, ICF maintains its earnings guidance for 2025. The firm has not engaged in recent share buybacks but shows insider confidence through leadership transitions aimed at strategic growth. With earnings projected to grow annually by 8.26%, ICF is positioned for future opportunities amidst market challenges.

- Get an in-depth perspective on ICF International's performance by reading our valuation report here.

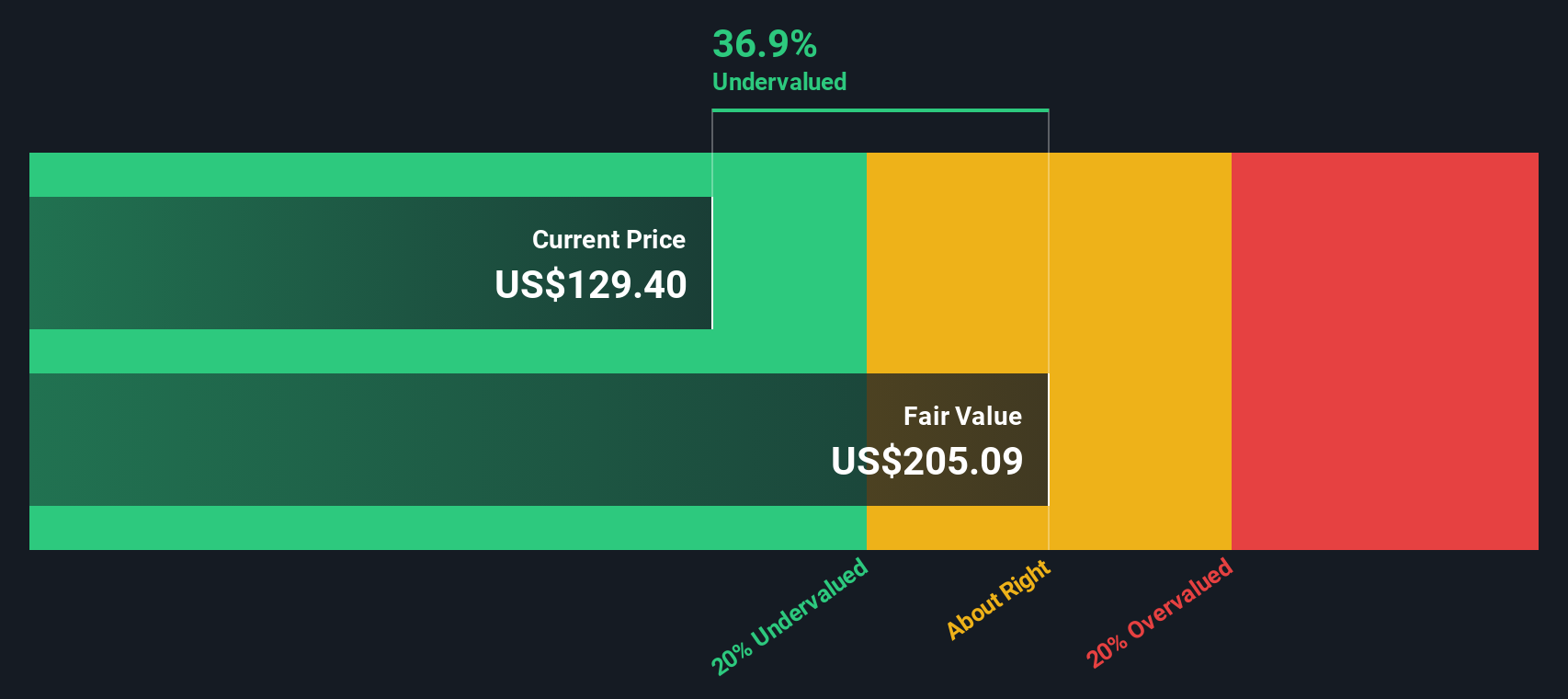

Nicolet Bankshares (NIC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nicolet Bankshares operates as a financial services company providing consumer and commercial banking services, with a market capitalization of approximately $1.02 billion.

Operations: Nicolet Bankshares generates revenue primarily from consumer and commercial banking services, with recent figures indicating $375.96 million in revenue. The company consistently achieves a gross profit margin of 100%, as cost of goods sold (COGS) is not applicable. Operating expenses are a significant part of the cost structure, with general and administrative expenses being the largest component, followed by sales and marketing costs. The net income margin has shown variability over time, reaching 38.53% in the latest period reported.

PE: 12.8x

Nicolet Bankshares presents a compelling case with its earnings forecast to grow 35% annually. Insider confidence is evident as an independent director recently purchased 3,000 shares for US$347,200 in November 2025. The company announced a quarterly dividend of US$0.32 per share and reported strong financials with third-quarter net income rising to US$41.74 million from US$32.52 million the previous year. Additionally, Nicolet completed significant share repurchases and plans to acquire MidWestOne Bank, indicating strategic growth initiatives in the banking sector.

- Navigate through the intricacies of Nicolet Bankshares with our comprehensive valuation report here.

Understand Nicolet Bankshares' track record by examining our Past report.

Make It Happen

- Delve into our full catalog of 81 Undervalued US Small Caps With Insider Buying here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal