US High Growth Tech Stocks to Watch in January 2026

As the U.S. stock market reaches new heights with the Dow and S&P 500 setting all-time records, investors are keenly observing sectors leading this rally, particularly data storage stocks that have been pivotal in the AI surge. In such a dynamic environment, identifying high-growth tech stocks involves looking for companies that are well-positioned to capitalize on technological advancements and market trends, which can offer potential opportunities despite broader economic fluctuations.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Marker Therapeutics | 62.86% | 62.39% | ★★★★★★ |

| Palantir Technologies | 26.11% | 30.13% | ★★★★★★ |

| Workday | 11.14% | 32.11% | ★★★★★☆ |

| Kiniksa Pharmaceuticals International | 15.10% | 31.60% | ★★★★★☆ |

| RenovoRx | 59.12% | 64.21% | ★★★★★☆ |

| Viridian Therapeutics | 46.25% | 52.26% | ★★★★★☆ |

| Zscaler | 15.85% | 45.93% | ★★★★★☆ |

| Circle Internet Group | 20.63% | 83.64% | ★★★★★☆ |

| Procore Technologies | 11.70% | 116.48% | ★★★★★☆ |

| Duos Technologies Group | 53.76% | 155.11% | ★★★★★☆ |

Click here to see the full list of 71 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

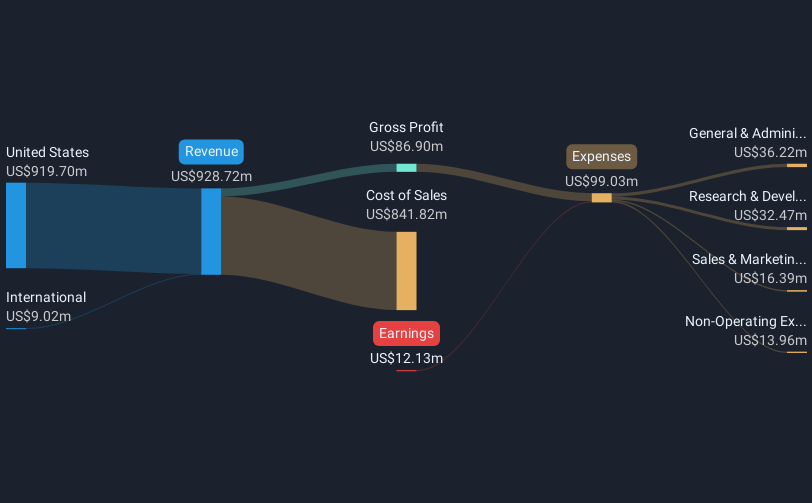

QuinStreet (QNST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: QuinStreet, Inc. is an online performance marketing company that offers customer acquisition services for clients both in the United States and internationally, with a market capitalization of $826.87 million.

Operations: The company generates revenue primarily through its Direct Marketing segment, which accounted for $1.10 billion.

QuinStreet's strategic maneuvers, including a new $150 million revolving credit facility to fund acquisitions and working capital, underscore its aggressive expansion efforts. This financial agility complements its recent performance with a notable turnaround to profitability in Q1 2026, posting net income of $4.54 million from a net loss the previous year and projecting revenue growth of at least 10% annually. Additionally, the company's commitment to shareholder returns is evident from its recent authorization to repurchase up to $40 million in shares, enhancing investor confidence amidst growing earnings forecasted at an impressive rate of 49.6% per year. These developments not only reflect QuinStreet's robust operational strategy but also highlight its potential resilience and growth trajectory in the competitive tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of QuinStreet.

Understand QuinStreet's track record by examining our Past report.

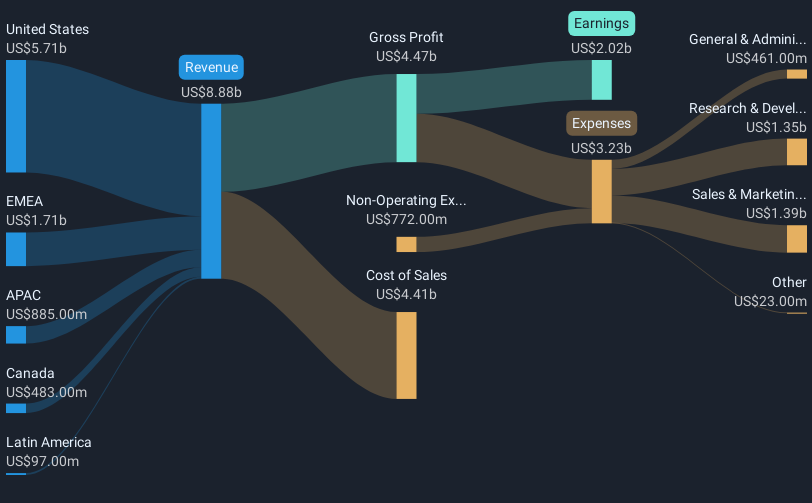

Shopify (SHOP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shopify Inc. is a commerce technology company that offers tools for starting, scaling, marketing, and running businesses globally across multiple regions, with a market cap of $216.38 billion.

Operations: Shopify generates revenue primarily from its Internet Software & Services segment, totaling $10.70 billion. The company operates across various regions, providing technology solutions to businesses of all sizes.

Shopify's strategic focus on integrating advanced AI technologies, as evidenced by its partnership with Liquid AI, underscores its commitment to enhancing platform capabilities and user experience. This collaboration has already yielded a sub-20ms text model for improved search functionalities, demonstrating Shopify's proactive approach in adopting cutting-edge technologies to stay competitive. Furthermore, the company's recent financial performance reveals robust growth with third-quarter revenue reaching $2.84 billion, a significant increase from the previous year. These initiatives not only solidify Shopify’s position in e-commerce but also highlight its potential to redefine retail operations through technological innovation and strategic partnerships.

- Get an in-depth perspective on Shopify's performance by reading our health report here.

Evaluate Shopify's historical performance by accessing our past performance report.

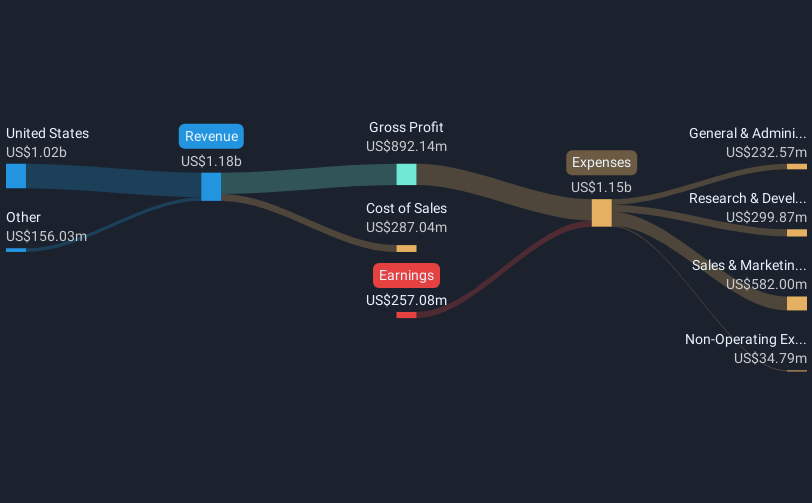

Samsara (IOT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Samsara Inc. offers solutions that integrate physical operations data with its connected operations platform, serving both U.S. and international markets, with a market cap of $19.78 billion.

Operations: The company's primary revenue stream is from its Software & Programming segment, which generated $1.52 billion. This indicates a strong focus on leveraging technology to connect physical operations data through its platform.

Samsara's recent earnings report reflects a notable turnaround, with Q3 sales surging to $416 million from $322 million the previous year, and net income hitting $7.77 million, a significant recovery from last year's loss of $37.81 million. This performance underscores Samsara's robust growth trajectory in the connected operations sector, where its innovative use of AI and data analytics is driving efficiency and safety improvements across fleet management industries. Moreover, the company projects continued revenue growth with estimates reaching up to $1.597 billion for the fiscal year 2026, highlighting its strong market position and potential for further expansion in high-tech operational solutions.

- Navigate through the intricacies of Samsara with our comprehensive health report here.

Examine Samsara's past performance report to understand how it has performed in the past.

Where To Now?

- Gain an insight into the universe of 71 US High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal