A Look At Hormel Foods (HRL) Valuation After Recent Share Price Weakness

Hormel Foods (HRL) is back on many investors’ watchlists after recent share weakness. The stock is down over the past month and the past 3 months, prompting fresh questions about valuation and long term expectations.

See our latest analysis for Hormel Foods.

That recent weakness sits within a tougher spell for shareholders overall. The share price is $22.85, with a year-to-date share price return of a 2.31% decline, alongside a 1-year total shareholder return of a 20.99% decline that points to fading momentum rather than a short-term wobble.

If Hormel’s pullback has you reassessing your watchlist, this could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With Hormel trading at $22.85 and flagged with an intrinsic discount of about 52%, plus a value score of 2 and a gap to analyst targets, you have to ask: is this a buying opportunity, or is future growth already priced in?

Most Popular Narrative: 16.1% Undervalued

The most followed narrative puts Hormel’s fair value at US$27.25 per share versus the last close of US$22.85, framing a clear valuation gap for investors to assess.

Major supply chain automation, manufacturing footprint improvements, and the ongoing Transform and Modernize (T&M) initiatives are on track, expected to drive significant operational efficiencies and cost reductions, supporting long-run margin expansion and ultimately higher future earnings.

Curious what sits behind that efficiency story? The narrative leans heavily on steadier revenue, thicker margins, and a future earnings multiple that is far from conservative. The full breakdown shows how those moving parts combine into today’s fair value estimate.

Result: Fair Value of $27.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story can unravel if commodity costs stay volatile or if slower pricing pass through keeps margins under pressure for longer than analysts currently assume.

Find out about the key risks to this Hormel Foods narrative.

Another View: Multiples Flash A Very Different Signal

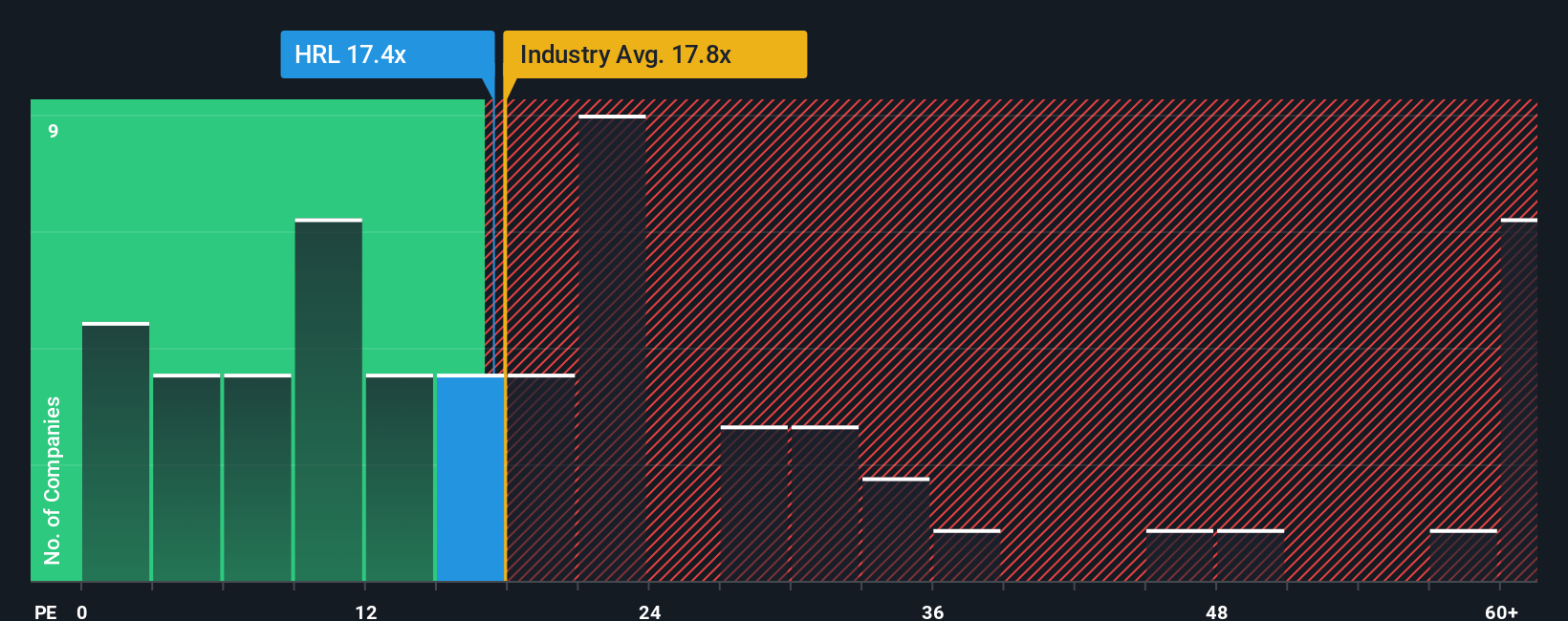

There is a catch. While the narrative and fair value model point to Hormel as undervalued, the market is currently paying a P/E of 26.3x. That is well above the US Food industry at 19.8x, the peer average at 11.8x, and even our fair ratio of 19.6x.

In plain terms, the share price already reflects a richer earnings tag than peers and what the fair ratio suggests the market could move toward over time. If sentiment cools, that gap can close from the multiple side instead of the price catching up. Which outcome do you think is more realistic here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hormel Foods Narrative

If you look at these numbers and reach a different conclusion, or just prefer to test your own assumptions, you can build a complete view in a few minutes with Do it your way.

A great starting point for your Hormel Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Hormel has sharpened your focus, do not stop here. Widen your net with a few targeted stock ideas that could sharpen your overall watchlist.

- Spot potential bargains early by checking out these 875 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Tap into the AI trend and scan these 25 AI penny stocks where machine learning and automation sit at the core of the business model.

- Boost your income focus by reviewing these 11 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal