Assessing AbbVie (ABBV) Valuation After Recent Share Price Gain And Mixed Return Profile

Why AbbVie stock is back on investors’ radar

AbbVie (ABBV) has drawn fresh attention after its recent share move, with the stock closing at $223.93 and mixed returns across different time frames prompting investors to reassess the biopharma giant.

See our latest analysis for AbbVie.

That 1 day share price gain of 1.70% comes after a softer patch, with the year to date share price return of 2.35% decline contrasting with a 1 year total shareholder return of 29.09%. This suggests longer term momentum has been stronger than recent trading implies.

If AbbVie has you rethinking your pharma exposure, it could be a moment to scan other pharma stocks with solid dividends that combine income potential with large cap resilience.

With AbbVie trading at $223.93, a reported intrinsic discount of about 41% and a value score of 4, the key question is whether this is genuine undervaluation or if the market is already pricing in future growth.

Most Popular Narrative: 8.5% Undervalued

With AbbVie last closing at $223.93 versus a narrative fair value of $244.68, the valuation debate centers on how durable its growth engines can be.

Continued robust growth in immunology from Skyrizi and Rinvoq, buoyed by expanded prescribing across multiple high-need indications like IBD and dermatology, and further supported by ongoing launches and indication expansions, is likely to drive sustained top-line revenue growth and mitigate the impact of Humira's LOE.

Curious what kind of earnings step up would justify paying more for AbbVie today, and how rich a future P/E this narrative leans on? The full story connects expected revenue growth, margin expansion and a premium earnings multiple into one valuation roadmap.

Result: Fair Value of $244.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh the risk that pricing pressure, policy changes, or setbacks in the concentrated immunology and neuroscience portfolio could challenge this upbeat narrative.

Find out about the key risks to this AbbVie narrative.

Another View: What AbbVie’s Sales Multiple Is Telling You

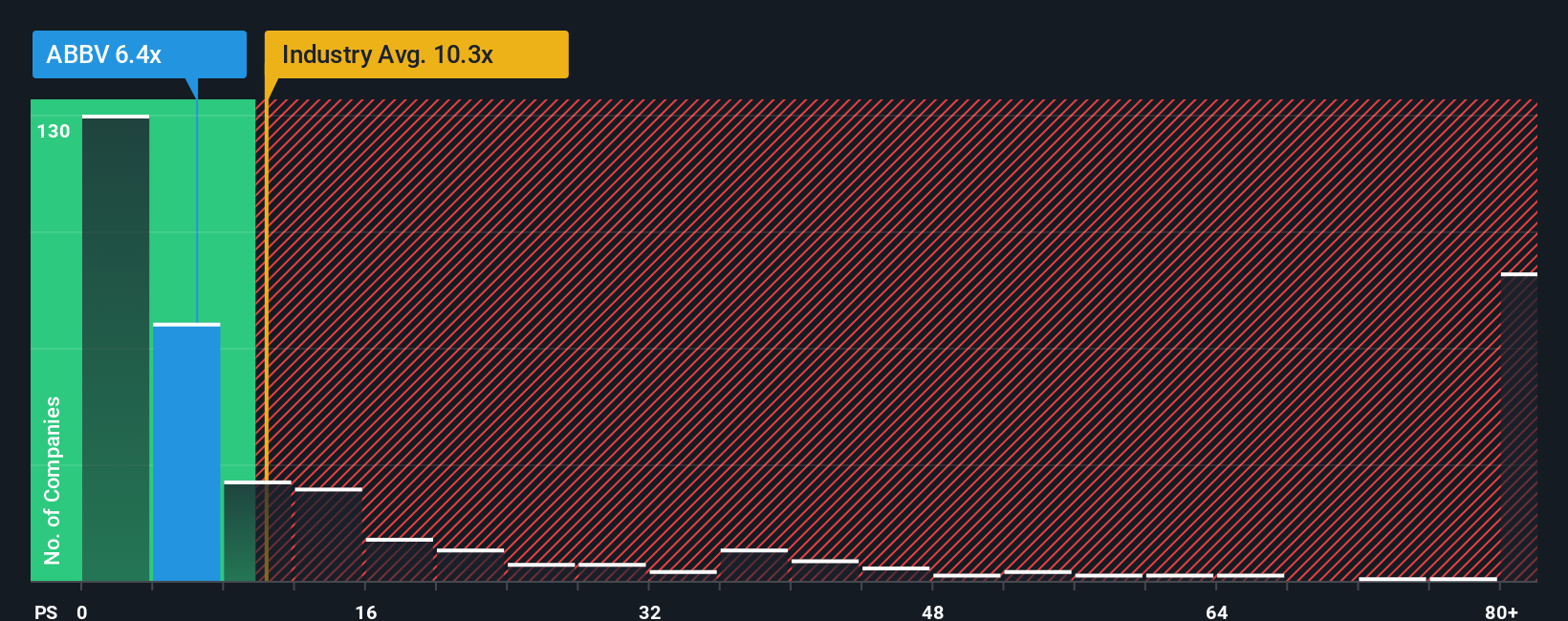

Our SWS model, which uses a sales based valuation, paints a different picture. AbbVie trades on a P/S of 6.6x, which is slightly higher than close peers at 6.5x, yet far below the US Biotechs industry at 11.7x and our fair ratio of 11.8x. Is that a cautious discount or a potential opening?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AbbVie Narrative

If you look at the numbers and reach a different conclusion, or just prefer to stress test the assumptions yourself, you can build a fresh story for AbbVie in a couple of minutes, starting with Do it your way.

A great starting point for your AbbVie research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Ready to hunt for more investment ideas?

If AbbVie sparked your interest, do not stop there, use Simply Wall Street’s screener to quickly spot other opportunities that fit the way you like to invest.

- Jump on potential high income opportunities by scanning these 11 dividend stocks with yields > 3% that could complement a long term dividend portfolio.

- Target mispriced names by filtering for these 875 undervalued stocks based on cash flows that might suit a value driven approach.

- Tap into growth themes at an early stage with these 25 AI penny stocks that focus on artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal