Lennar (LEN) Valuation Check After Bank Of America Flags Shares As Only Underperform Short Idea

Bank of America recently flagged Lennar (LEN) as its only Underperform rated name on a first quarter short ideas list, highlighting concerns about interest rates, cooling housing demand, and ongoing supply chain pressures.

See our latest analysis for Lennar.

At a share price of $106.36, Lennar has seen short term momentum soften, with a 30-day share price return of 14.16% and a 90-day share price return of 11.46%. Its 5-year total shareholder return of 61.52% points to a stronger long run record.

If homebuilder sentiment has you reassessing your options, it could be a good time to check out auto manufacturers as another way to look for opportunities tied to consumer demand and big-ticket spending.

With Lennar sitting at $106.36, trading at a discount to the average analyst price target but facing an Underperform call and weaker recent returns, should you see potential value here or is the market already pricing in whatever growth lies ahead?

Most Popular Narrative: 16.3% Undervalued

With Lennar last closing at $106.36 against a narrative fair value of about $127.13, the current pricing sits below that implied estimate, setting up a clear tension between recent share performance and longer term expectations.

The analysts have a consensus price target of $124.0 for Lennar based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $159.0, and the most bearish reporting a price target of just $95.0.

Curious what earnings path and margin reset underpin that fair value? The narrative leans on moderate growth, slimmer profitability, and a richer future earnings multiple. Want to see how those pieces fit together?

Result: Fair Value of $127.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher mortgage rates and thinner margins could still undercut that underpriced story if affordability weakens further or incentives eat deeper into earnings.

Find out about the key risks to this Lennar narrative.

Another View: Market Pricing Sends A Different Signal

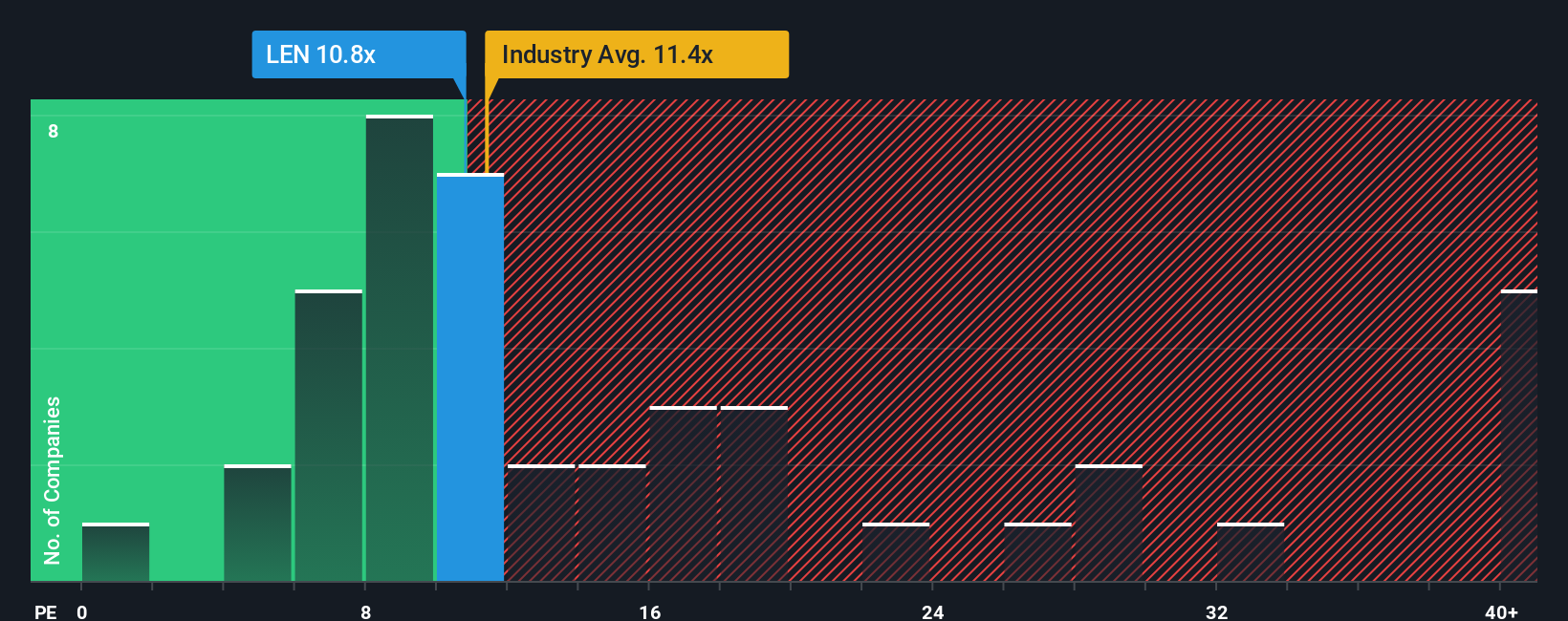

That 16.3% narrative undervaluation sits awkwardly against how the market is actually pricing Lennar today. On a P/E of 12.6x, the shares trade richer than the US Consumer Durables industry at 10.4x and above the peer average of 11.2x, yet below a fair ratio of 18x.

In plain terms, the stock is not cheap compared with its direct comparables. However, the fair ratio suggests the market could still move higher over time if earnings and sentiment line up. For you, the real question is whether that gap looks like room for upside or a margin of risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lennar Narrative

If parts of this story do not sit right with you, or you simply want to test your own view against the numbers, you can build a custom Lennar thesis in just a few minutes with Do it your way.

A great starting point for your Lennar research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready to hunt for your next idea?

If Lennar has you thinking harder about where to put fresh capital, do not stop here. Broaden your watchlist with focused stock ideas built from hard numbers.

- Target potential mispricings by checking out these 875 undervalued stocks based on cash flows that line up current prices with underlying cash flow strength.

- Ride powerful tech shifts by reviewing these 25 AI penny stocks tapping into real use cases for machine learning and automation.

- Aim for income first, then growth, by screening these 11 dividend stocks with yields > 3% backed by higher yields and underlying business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal