Why Axon Enterprise (AXON) Is Up 9.5% After Strong Q3 Growth And New Market Expansion

- In the past quarter, Alpha Wealth Insiders Fund highlighted Axon Enterprise after it reported 31% year-over-year revenue growth to US$711 million in Q3 2025 and forecast full-year revenue between US$2.55 billion and US$2.65 billion.

- The investor letter also underscored Axon’s push into retail, healthcare, and smart-city surveillance, building on its recurring-revenue ecosystem of devices, sensors, and AI software.

- We’ll now explore how this strong Q3 revenue performance and expansion into new verticals may influence Axon’s existing investment narrative.

Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

Axon Enterprise Investment Narrative Recap

To own Axon, you generally need to believe its ecosystem of conducted-energy devices, body cameras, and cloud software can keep deepening its role in public safety and adjacent markets. The latest Q3 2025 revenue jump to US$711 million and raised full year guidance reinforce the demand side of that thesis, but do not materially change the near term focus on sustaining high growth while managing profit margin pressure as the key catalyst and risk right now.

The most relevant recent announcement is Axon’s updated 2025 guidance to about US$2.74 billion in revenue, which aligns with the strong Q3 result highlighted by Alpha Wealth Insiders Fund. For investors, that guidance sits alongside Axon’s product driven catalysts, such as faster adoption of newer offerings like TASER 10, Axon Body 4, and AI tools, which are central to the story of higher average deal sizes and deeper recurring revenue across law enforcement and newer verticals.

But while growth is front and center, the growing scrutiny and regulatory risk around surveillance and AI driven public safety tools is something investors should be aware of...

Read the full narrative on Axon Enterprise (it's free!)

Axon Enterprise's narrative projects $4.6 billion revenue and $476.0 million earnings by 2028. This requires 24.3% yearly revenue growth and about a $149.7 million earnings increase from $326.3 million today.

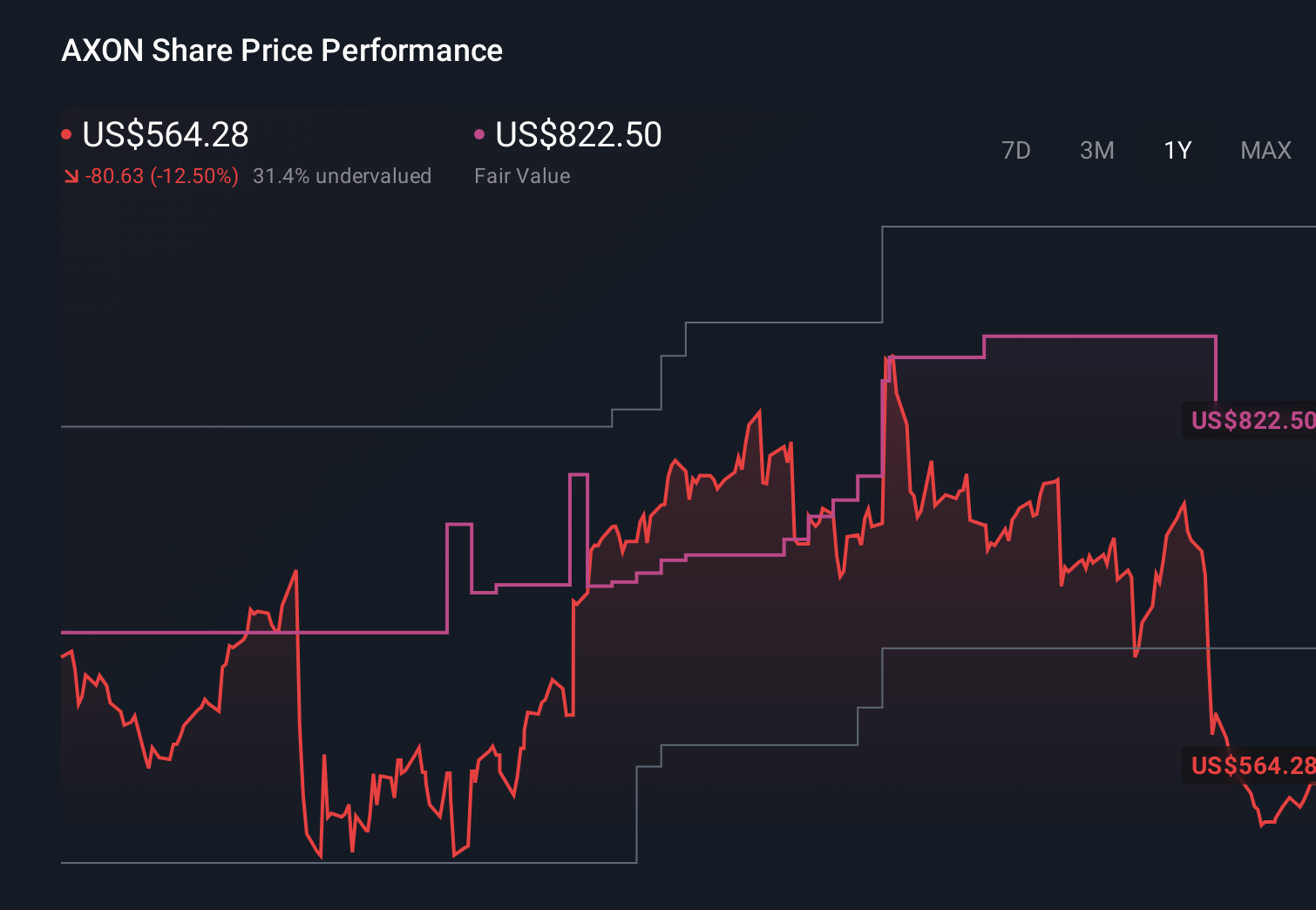

Uncover how Axon Enterprise's forecasts yield a $822.50 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Nine members of the Simply Wall St Community currently see Axon’s fair value between about US$394 and US$835 per share, underscoring how far views can spread. Against that backdrop, concerns about regulatory and privacy pushback on surveillance and AI tools could be a key factor shaping how the company’s growth potential actually plays out, so it is worth weighing several of these perspectives side by side.

Explore 9 other fair value estimates on Axon Enterprise - why the stock might be worth as much as 33% more than the current price!

Build Your Own Axon Enterprise Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Axon Enterprise research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Axon Enterprise research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Axon Enterprise's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal