Assessing Kadant (KAI) Valuation After Recent Share Price Moves And Mixed Return Profile

Kadant (KAI) has drawn investor attention after recent share price moves, with the stock closing at $305.11. With mixed return figures across different periods, many investors are reassessing how this industrial supplier fits their portfolios.

See our latest analysis for Kadant.

The recent 1-day share price return of 2.88% and 30-day share price return of 5.93% sit alongside a 1-year total shareholder return decline of 11.73%. The 3 and 5-year total shareholder returns of 62.23% and 111.29% point to longer term strength, suggesting momentum has picked up again in the short term as investors reassess the risk and growth profile around US$305.

If Kadant has you looking more broadly at industrial and capital goods exposure, it can also be useful to see what else is moving and compare it with fast growing stocks with high insider ownership.

With shares around US$305 and a recent 1 year total shareholder return decline alongside solid 3 and 5 year figures, is Kadant quietly offering value today, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 11.1% Undervalued

With Kadant last closing at US$305.11 and the widely followed fair value estimate at US$343.33, the narrative is built around steady compounding rather than dramatic swings.

Global infrastructure and engineered wood project cycle is rebounding, especially in North America and emerging markets, driven by sustained urbanization and broader adoption of engineered materials. This is expanding Kadant's capital equipment order pipeline and offering forward visibility for sequential revenue growth.

Strategic acquisitions (Dynamic Sealing Technologies, Babbini, GPS) are broadening Kadant's addressable markets and technology capabilities in upcycling, fluid rotary unions, and dewatering. This enhances diversification and positions Kadant to tap into growing sustainability and circular economy-focused customer requirements, potentially accelerating revenue and market share.

Curious how moderate revenue growth, higher margins, and a premium P/E multiple all fit together? The fair value call leans on a tight earnings roadmap, firm margin assumptions, and only a small change in valuation multiples. The full narrative shows exactly how those pillars support the target.

Result: Fair Value of $343.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still pressure points, such as tariff uncertainty and rising SG&A costs, that could cap margins and challenge the earnings path behind this fair value story.

Find out about the key risks to this Kadant narrative.

Another View on Valuation

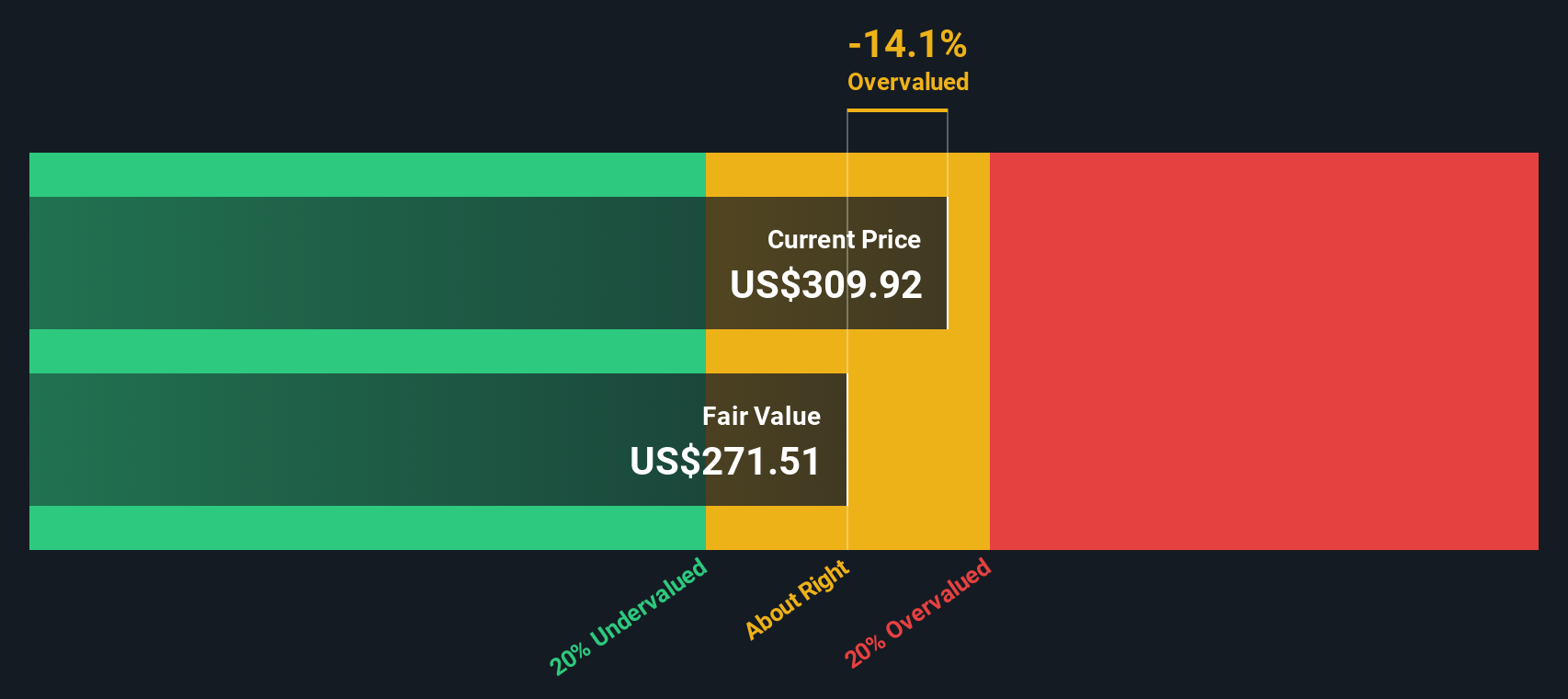

While the narrative points to an 11.1% discount to fair value at US$343.33, our DCF model paints a more cautious picture. On those cash flow assumptions, Kadant's fair value sits at US$270.82, which makes the current US$305.11 price look expensive rather than cheap. Which story do you find more convincing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kadant Narrative

If you look at the numbers and reach a different conclusion, or simply want to stress test the assumptions yourself, you can build a personalized thesis in just a few minutes with Do it your way.

A great starting point for your Kadant research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Kadant has sharpened your thinking, do not stop here. A few minutes with the right screeners can surface opportunities you might otherwise miss.

- Spot potential value plays early by checking out these 875 undervalued stocks based on cash flows that line up attractive prices with underlying cash flow strength.

- Ride the AI wave more thoughtfully by scanning these 25 AI penny stocks that connect real business models with artificial intelligence themes.

- Target income-focused opportunities by reviewing these 11 dividend stocks with yields > 3% that combine higher yields with equity exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal