Intel (INTC) Valuation Check After Recent Share Price Momentum And Mixed Long Term Returns

Intel (INTC) is back in focus after recent share price moves, with the stock now around US$40.04. For investors, the key question is how this current level compares with Intel’s fundamentals.

See our latest analysis for Intel.

Recent trading has been mixed, with a 1 day share price return of 1.70% and a 7 day share price return of 8.51%, while the year to date share price return is 1.68%. Over longer horizons, the 1 year total shareholder return of 101.41% contrasts with a 5 year total shareholder return of a 22.23% decline, which points to strong recent momentum following weaker earlier years.

If Intel’s moves have you looking beyond a single chipmaker, this is a good moment to size up other US tech names through high growth tech and AI stocks as potential ideas for your watchlist.

With Intel shares around US$40.04 and trading at a small premium to the average analyst price target of US$38.31, the key question is whether the recent rebound leaves additional upside potential or if the market is already fully pricing in future growth.

Most Popular Narrative Narrative: 5% Overvalued

The most followed narrative sets Intel’s fair value near US$38.14, which sits slightly below the recent US$40.04 share price and frames a modest premium.

The analysts have a consensus price target of $22.061 for Intel based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $28.0, and the most bearish reporting a price target of just $14.0.

Want to see what kind of revenue path, margin rebuild, and profit multiple are baked into that fair value? The core assumptions are surprisingly punchy. Curious which levers matter most to this model and how they interact over time? The full narrative lays out the playbook in detail.

Result: Fair Value of $38.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative still leans heavily on cleaner execution in the foundry build out and faster AI adoption, both areas where delays or stumbles could quickly challenge those assumptions.

Find out about the key risks to this Intel narrative.

Another View: Multiples Point the Other Way

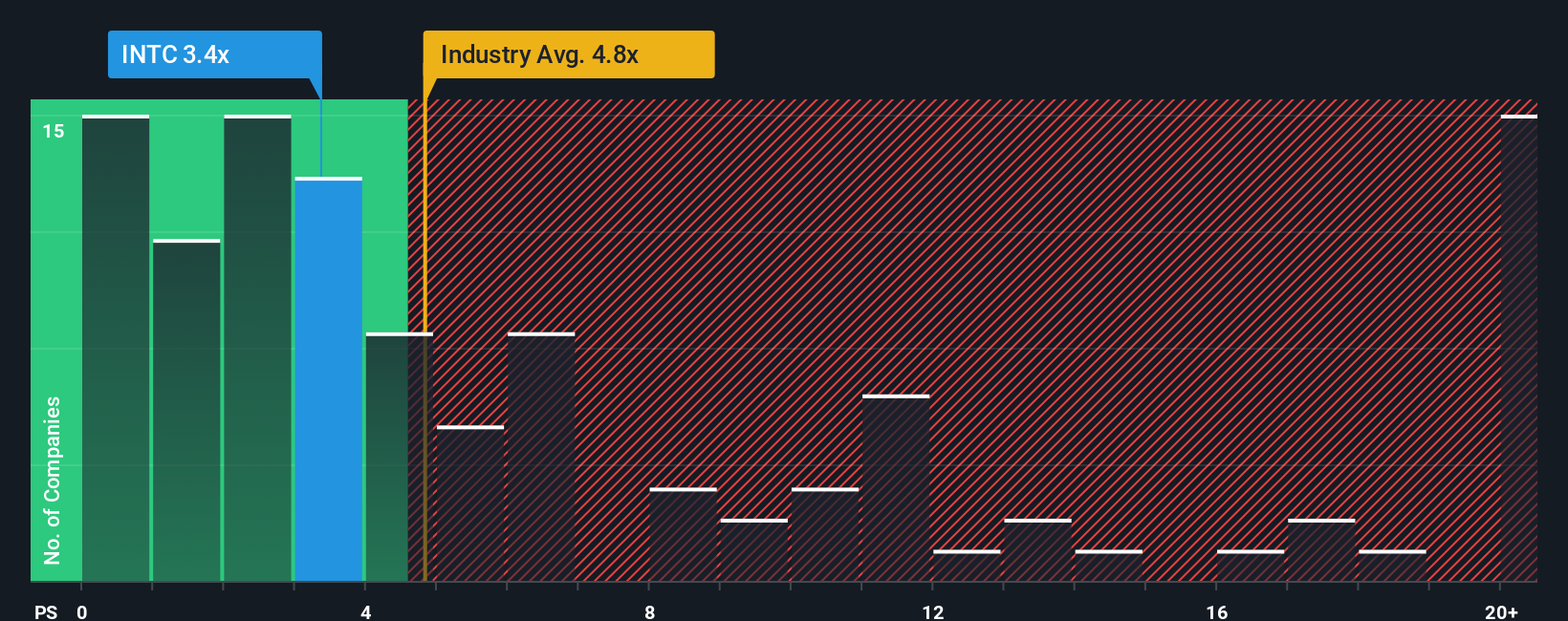

While the narrative model sees Intel about 5% overvalued at roughly US$38.14 per share, the market is telling a different story when you look at P/S. At about 3.7x, Intel sits below the US Semiconductor industry at 5.7x, well under peer averages of 13.8x, and even below a 5.6x fair ratio our work suggests the market could move toward. Is the crowd leaning too hard into execution risk, or is the discount exactly what that risk deserves?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intel Narrative

If you see the numbers differently, or prefer to stress test every assumption yourself, you can build a custom Intel story in minutes with Do it your way.

A great starting point for your Intel research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Intel has your attention, do not stop there. Widening your research now could put you ahead of trends that others only notice much later.

- Target potential mispricing by scanning these 875 undervalued stocks based on cash flows that might offer more attractive entry points based on their cash flow profiles.

- Ride key technology shifts by reviewing these 25 AI penny stocks that are shaping how artificial intelligence is applied across real businesses.

- Add a different source of growth by checking out these 79 cryptocurrency and blockchain stocks linked to blockchain, digital assets, and new payment rails.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal