Exploring Global's Undervalued Small Caps With Insider Action January 2026

As global markets navigate the complexities of a new year, small-cap stocks have experienced mixed performance, with the Russell 2000 Index showing modest gains despite broader market declines. Amidst this backdrop, investors often look for opportunities in small-cap companies that demonstrate resilience and potential for growth, especially when insider activity suggests confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| A.G. BARR | 14.1x | 1.6x | 49.53% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 40.58% | ★★★★★☆ |

| Norcros | 14.8x | 0.8x | 36.77% | ★★★★☆☆ |

| Eurocell | 16.1x | 0.3x | 40.04% | ★★★★☆☆ |

| Chinasoft International | 21.7x | 0.7x | -1220.21% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 43.68% | ★★★★☆☆ |

| Ever Sunshine Services Group | 6.4x | 0.4x | -416.79% | ★★★☆☆☆ |

| SmartCraft | 41.3x | 7.4x | 34.01% | ★★★☆☆☆ |

| CVS Group | 48.2x | 1.4x | 22.85% | ★★★☆☆☆ |

| Senior | 27.7x | 0.9x | 18.64% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

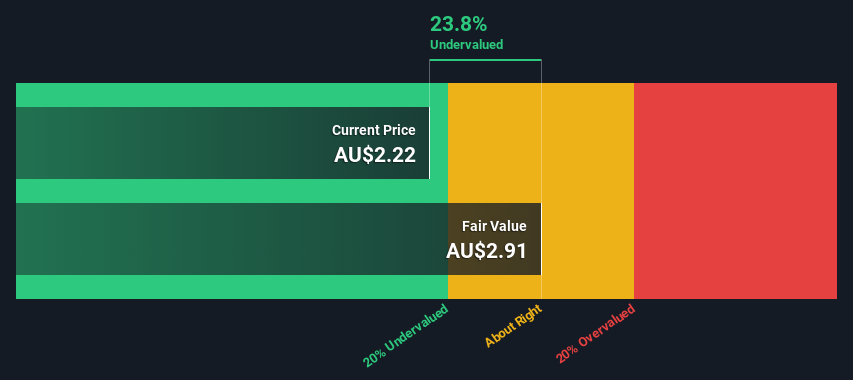

Region Group (ASX:RGN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Region Group operates in the real estate sector, focusing on convenience-based retail properties, with a market cap of A$3.47 billion.

Operations: Region Group generates revenue primarily from its convenience-based retail properties, with the latest reported revenue at A$384.8 million. The company's cost structure includes a significant portion attributed to the cost of goods sold (COGS), which was A$142.5 million in the most recent period, resulting in a gross profit margin of 62.97%. Operating expenses are another key component, recorded at A$25.3 million for the same period, and impact overall profitability alongside non-operating expenses.

PE: 12.7x

Region Group, a small-cap company, recently declared a dividend of A$0.069 per unit for the six months ending December 31, 2025. The company shows insider confidence with recent share purchases throughout 2025. Despite higher risk due to reliance on external borrowing, Region Group maintains high-quality earnings and projects a modest annual growth rate of 4.48%. These factors indicate potential value in the market despite some financial risks.

- Get an in-depth perspective on Region Group's performance by reading our valuation report here.

Assess Region Group's past performance with our detailed historical performance reports.

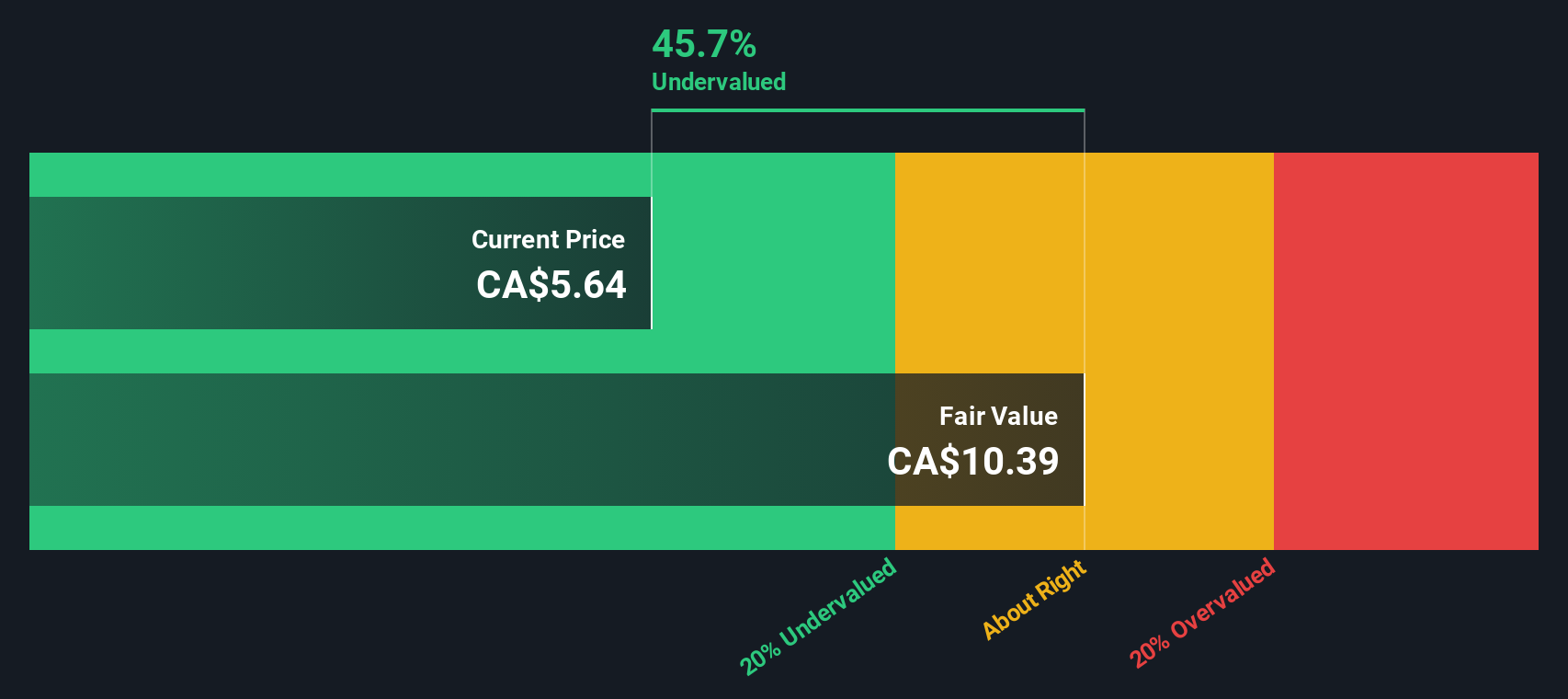

Rogers Sugar (TSX:RSI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Rogers Sugar operates in the production and distribution of sugar and maple products, with a market cap of CA$0.53 billion.

Operations: The company generates revenue primarily from its Sugar segment, contributing CA$1.05 billion, and its Maple Products segment, adding CA$263.14 million. Over recent periods, the gross profit margin has shown fluctuations, with a notable figure of 15.27% in mid-2025. Operating expenses have consistently included significant allocations for general and administrative costs alongside sales and marketing efforts.

PE: 11.8x

Rogers Sugar, a smaller company in the sugar industry, recently announced a CAD 50 million fixed-income offering with convertible debentures due in 2033. Despite having high debt levels and relying on external borrowing, their financials show growth with sales rising to CAD 1.31 billion and net income at CAD 64 million for the year ending September 2025. Insider confidence is evident as insiders have been purchasing shares over recent months, hinting at potential positive outlooks amidst their strategic moves.

- Click to explore a detailed breakdown of our findings in Rogers Sugar's valuation report.

Evaluate Rogers Sugar's historical performance by accessing our past performance report.

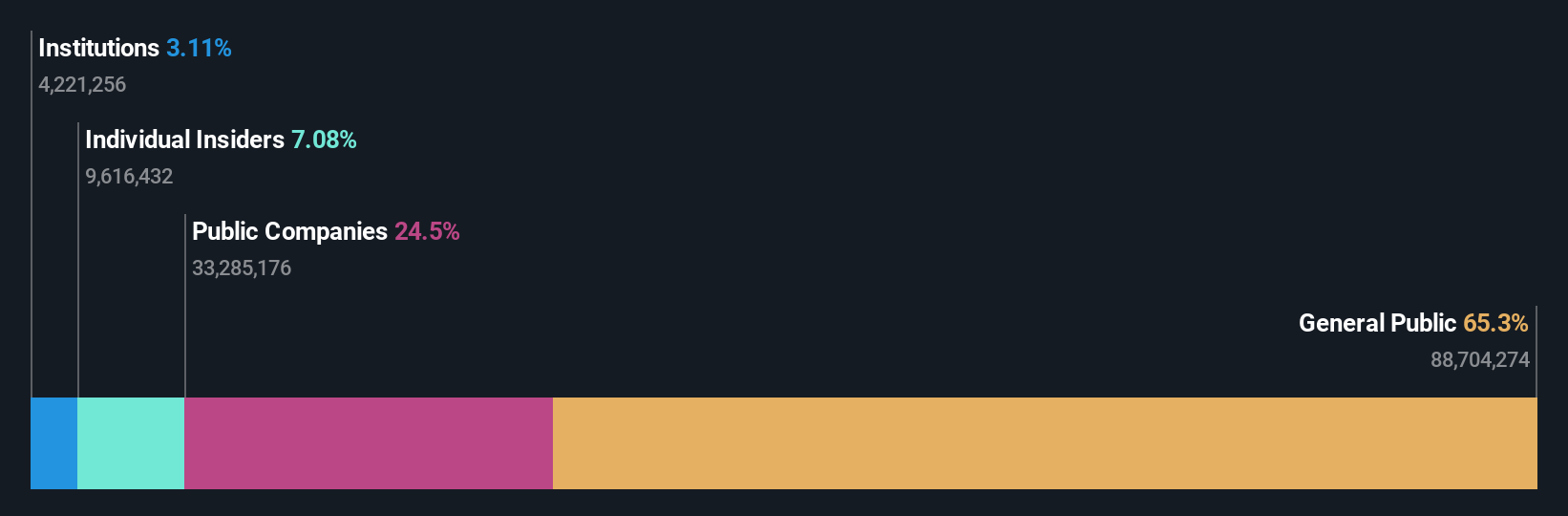

Sagicor Financial (TSX:SFC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sagicor Financial is a financial services company operating through segments like Sagicor Life, Sagicor Canada, and Sagicor Jamaica, with a market capitalization of approximately $1.87 billion.

Operations: Sagicor Financial's revenue is primarily derived from its segments in Canada, Jamaica, and Life Insurance operations. The company has experienced fluctuations in its net income margin, with a notable high of 34.77% and lows reaching negative figures during certain periods. Operating expenses have varied significantly, impacting overall profitability alongside non-operating expenses.

PE: 7.0x

Sagicor Financial, a company with a smaller market cap, recently reported strong earnings growth for Q3 2025, with net income rising to US$81.08 million from US$59.05 million the previous year. Basic earnings per share improved significantly as well. Demonstrating insider confidence, Non-Independent Director Gilbert Palter acquired 50,000 shares worth approximately US$399,560 in late 2025, indicating potential value recognition within the company despite lower profit margins compared to last year. Additionally, Sagicor completed a share buyback of 512,500 shares for US$2.9 million by September end 2025 and declared a quarterly dividend of US$0.0675 per share payable on December 16th.

Make It Happen

- Take a closer look at our Undervalued Global Small Caps With Insider Buying list of 141 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal