Global Growth Companies With High Insider Ownership In January 2026

As global markets navigate the start of 2026, recent developments such as rising U.S. home sales and mixed performances across major indices highlight the complex economic landscape investors face. Amid these conditions, growth companies with high insider ownership can offer intriguing opportunities, as insider confidence often signals potential resilience and alignment with shareholder interests in fluctuating markets.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Modetour Network (KOSDAQ:A080160) | 12.7% | 41.8% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 35% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Underneath we present a selection of stocks filtered out by our screen.

Joinn Laboratories(China)Co.Ltd (SHSE:603127)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Joinn Laboratories(China)Co.,Ltd. offers preclinical and non-clinical services across the United States, the People’s Republic of China, and other international markets, with a market cap of CN¥26.25 billion.

Operations: Joinn Laboratories generates revenue through its provision of preclinical and non-clinical services across various international markets, including the United States and China.

Insider Ownership: 39.5%

Earnings Growth Forecast: 33.5% p.a.

Joinn Laboratories (China) Co. Ltd., recently added to the Shanghai Stock Exchange Health Care Sector Index, is experiencing significant earnings growth, forecasted at 33.5% annually, outpacing the CN market. Despite high insider ownership and recent strategic agreements like those with Staidson and BioAI for 2026, revenue growth remains modest at 14.4% per year. The company has seen substantial insider selling in the past three months but maintains profitability after reporting a net income of CNY 80.71 million for Q3 2025 compared to a loss last year.

- Navigate through the intricacies of Joinn Laboratories(China)Co.Ltd with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Joinn Laboratories(China)Co.Ltd shares in the market.

Suzhou Novosense Microelectronics (SHSE:688052)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Novosense Microelectronics Co., Ltd. operates in the semiconductor industry, focusing on designing and manufacturing microelectronic components, with a market cap of CN¥25.49 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 22.1%

Earnings Growth Forecast: 118.1% p.a.

Suzhou Novosense Microelectronics is forecasted to achieve significant growth, with revenue expected to increase by 23.5% annually, surpassing the CN market's average. The company is set to become profitable within three years, despite a low return on equity forecast of 5.5%. Recent strategic moves include a CNY 400 million share buyback program and a HKD 2.21 billion follow-on equity offering. Additionally, its partnership with UAES and Innoscience aims to advance GaN technology for automotive applications.

- Click to explore a detailed breakdown of our findings in Suzhou Novosense Microelectronics' earnings growth report.

- Our expertly prepared valuation report Suzhou Novosense Microelectronics implies its share price may be too high.

Silergy (TWSE:6415)

Simply Wall St Growth Rating: ★★★★☆☆

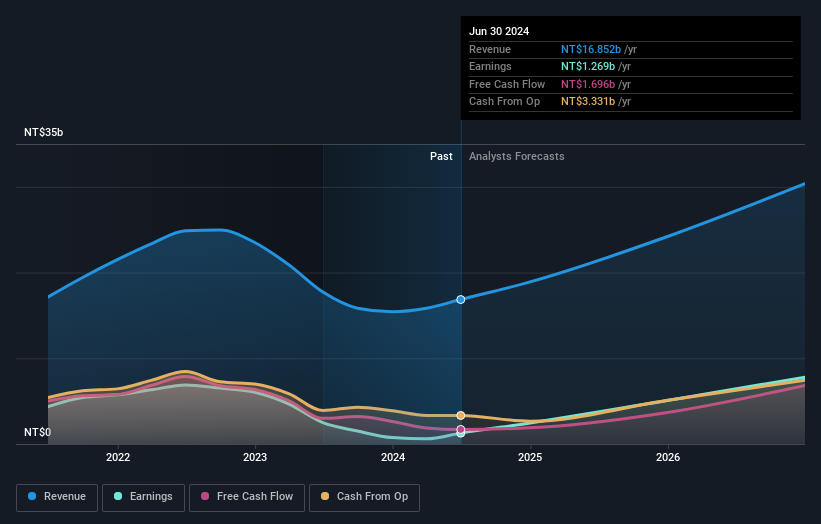

Overview: Silergy Corp. designs, manufactures, and sells integrated circuit products and provides related technical services in China and internationally, with a market cap of NT$80.09 billion.

Operations: The company's revenue primarily comes from its semiconductor segment, amounting to NT$18.53 billion.

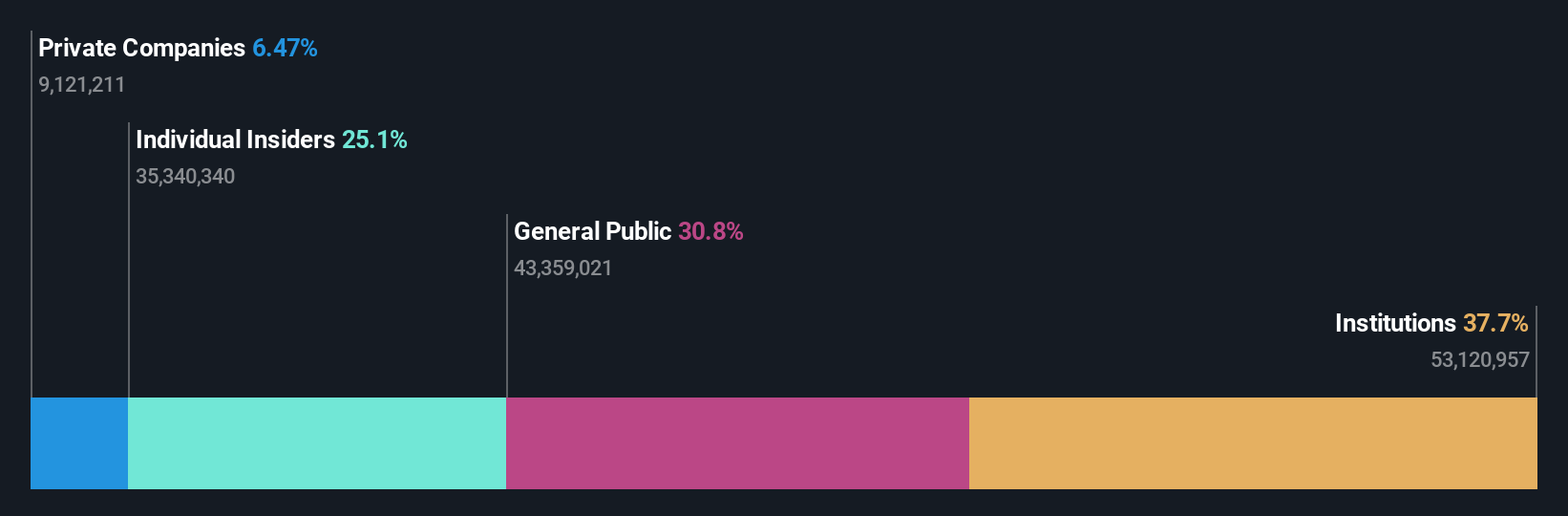

Insider Ownership: 14.2%

Earnings Growth Forecast: 33.7% p.a.

Silergy is experiencing significant earnings growth, projected at 33.7% annually over the next three years, outpacing the TW market. Despite trading 34% below its estimated fair value and a volatile share price, its revenue is expected to grow faster than the market average at 15.5% per year. Recent earnings showed mixed results with Q3 sales slightly down year-on-year but improved net income for nine months ending September 2025.

- Delve into the full analysis future growth report here for a deeper understanding of Silergy.

- In light of our recent valuation report, it seems possible that Silergy is trading behind its estimated value.

Where To Now?

- Access the full spectrum of 847 Fast Growing Global Companies With High Insider Ownership by clicking on this link.

- Want To Explore Some Alternatives? We've found 11 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal