Discovering Opportunities: 3 Global Penny Stocks With Market Caps Under US$2B

As global markets navigate a landscape marked by fluctuating indices and geopolitical tensions, investors are exploring diverse avenues for potential growth. Penny stocks, despite their somewhat outdated label, continue to represent intriguing opportunities within the investment world. These smaller or newer companies can offer significant value when they possess strong financials and a clear growth path, making them appealing options for those looking to uncover hidden gems in the market.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.45 | HK$896.85M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.50 | THB1.05B | ✅ 3 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.43 | £508.75M | ✅ 5 ⚠️ 0 View Analysis > |

| IVE Group (ASX:IGL) | A$2.91 | A$453.39M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.56 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.56 | SGD14.01B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.70 | $406.93M | ✅ 4 ⚠️ 2 View Analysis > |

| RGB International Bhd (KLSE:RGB) | MYR0.215 | MYR331.28M | ✅ 4 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.165 | £187.48M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,553 stocks from our Global Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Huapont Life SciencesLtd (SZSE:002004)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Huapont Life Sciences Co., Ltd. operates in the fields of medicine, medical care, agrochemicals, new materials, and tourism both in China and internationally, with a market cap of CN¥9.65 billion.

Operations: Huapont Life Sciences Co., Ltd. does not report specific revenue segments, but it is involved in diverse sectors including medicine, medical care, agrochemicals, new materials, and tourism across China and international markets.

Market Cap: CN¥9.65B

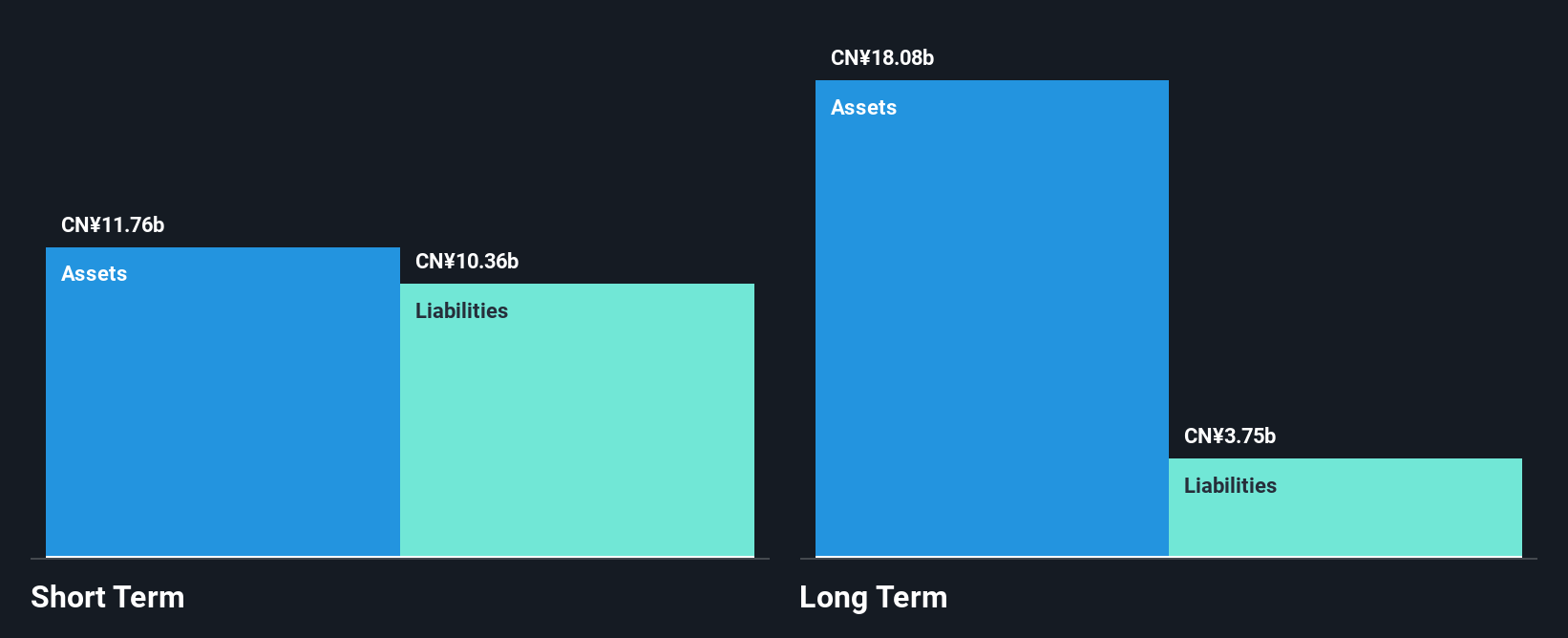

Huapont Life Sciences Co., Ltd. has shown resilience with sales reaching CN¥9.09 billion for the nine months ending September 2025, up from CN¥8.91 billion the previous year, despite being currently unprofitable and experiencing a 44.3% annual decline in earnings over five years. The company's financial health is supported by short-term assets exceeding both long- and short-term liabilities, and a satisfactory net debt to equity ratio of 27.7%. Although trading significantly below its estimated fair value, Huapont's dividend yield of 8.23% is not well covered by earnings, indicating potential risk for income-focused investors.

- Click to explore a detailed breakdown of our findings in Huapont Life SciencesLtd's financial health report.

- Understand Huapont Life SciencesLtd's track record by examining our performance history report.

Shandong Mining Machinery Group (SZSE:002526)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shandong Mining Machinery Group Co., Ltd. operates in the mining machinery industry, focusing on the manufacture and sale of equipment for coal mining and other related sectors, with a market cap of CN¥6.43 billion.

Operations: No specific revenue segments are reported for Shandong Mining Machinery Group Co., Ltd.

Market Cap: CN¥6.43B

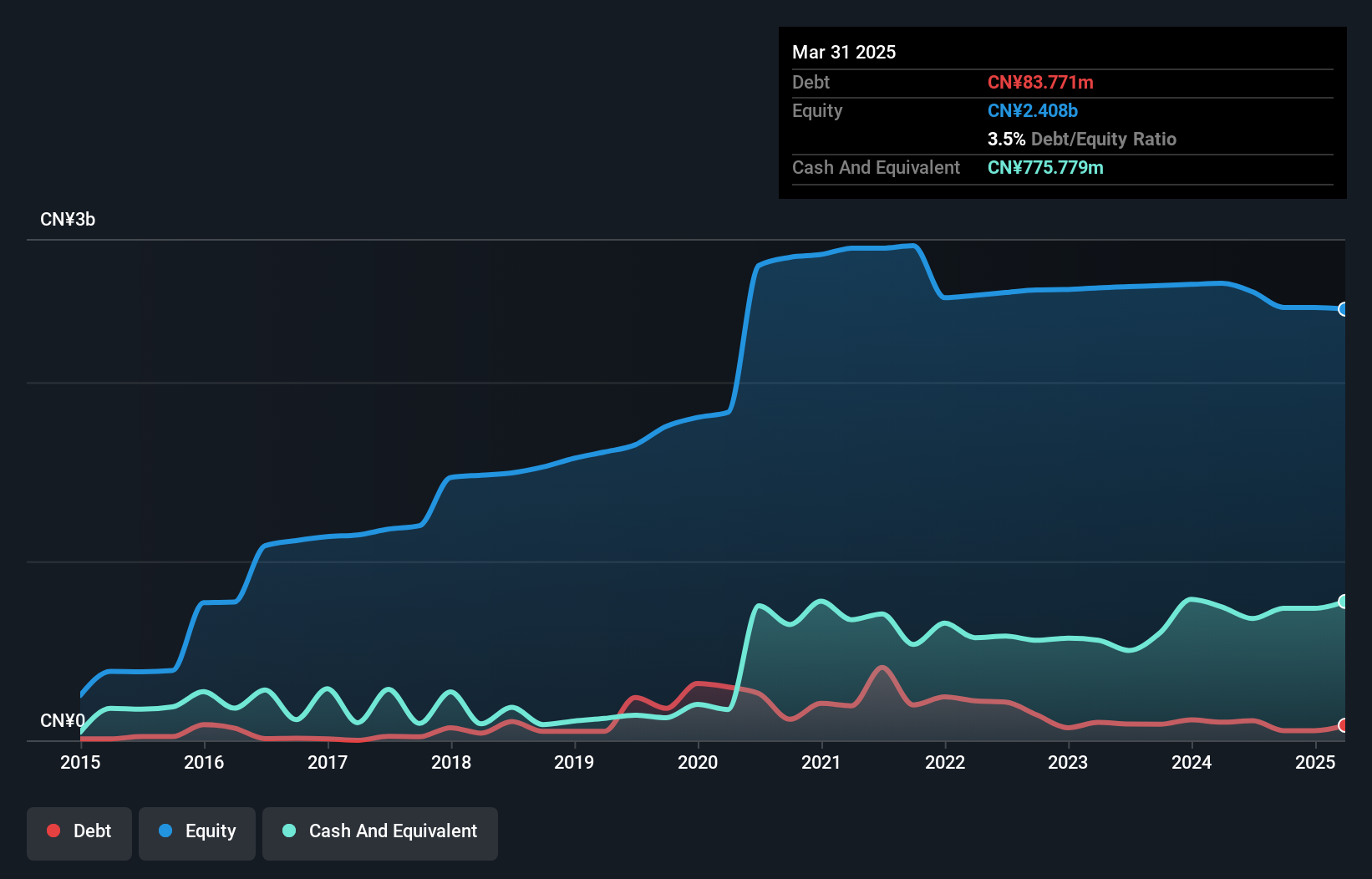

Shandong Mining Machinery Group Co., Ltd. has demonstrated robust earnings growth, with a 53.9% increase over the past year, significantly outpacing its five-year average of 6%. The company's net profit margins have improved to 5.2%, and it maintains strong financial health with cash exceeding total debt and operating cash flow covering debt well. However, its debt-to-equity ratio has risen from 1.6% to 9.5% over five years, indicating increased leverage risk. Recent corporate governance changes include amendments to the articles of association and considerations for changing the audit firm at upcoming shareholder meetings.

- Navigate through the intricacies of Shandong Mining Machinery Group with our comprehensive balance sheet health report here.

- Gain insights into Shandong Mining Machinery Group's historical outcomes by reviewing our past performance report.

Jiangsu Wuyang Automation Control Technology (SZSE:300420)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiangsu Wuyang Automation Control Technology Co., Ltd. (SZSE:300420) specializes in automation control solutions and has a market cap of CN¥4.42 billion.

Operations: The company's revenue is primarily generated from its operations in China, amounting to CN¥998.48 million.

Market Cap: CN¥4.42B

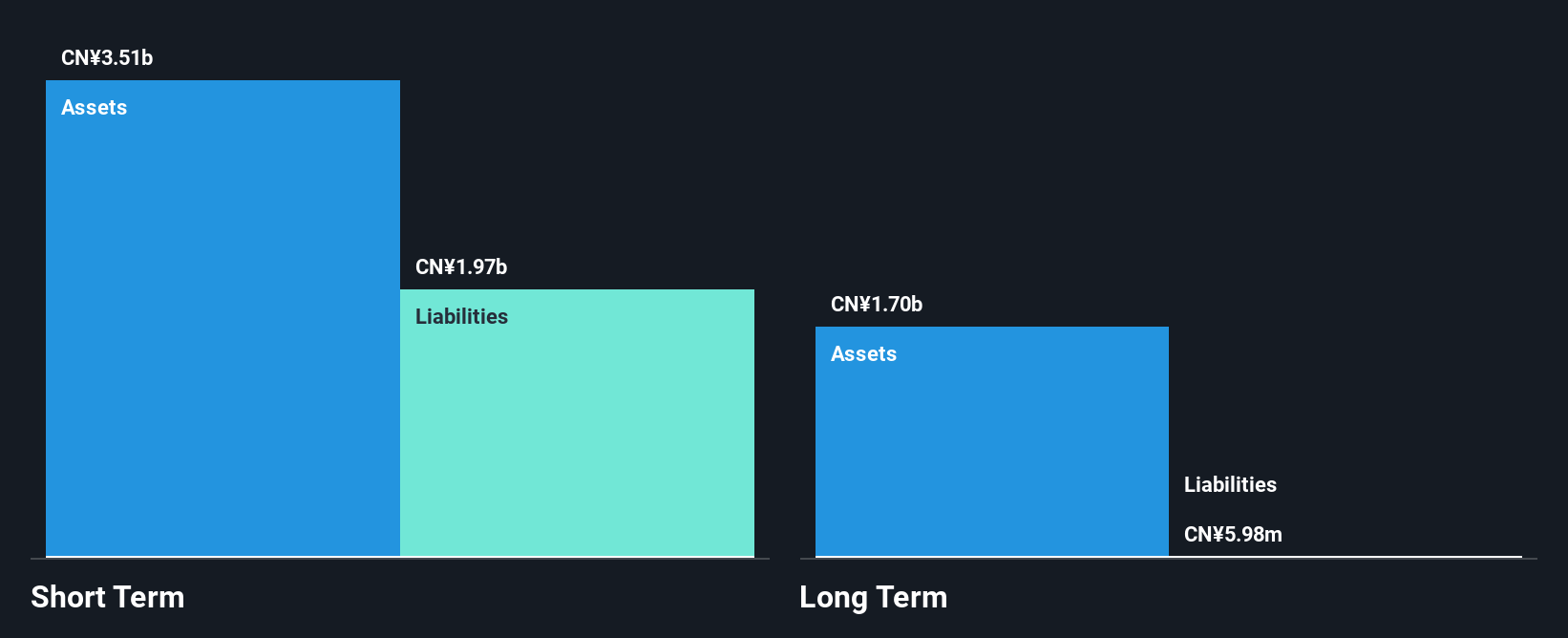

Jiangsu Wuyang Automation Control Technology has seen a shift in its financial performance, reporting net income of CN¥38.78 million for the first nine months of 2025, compared to a loss the previous year. Despite being unprofitable over five years with increasing losses, it has reduced its debt-to-equity ratio from 4.4% to 3% and maintains more cash than total debt. The company recently completed a significant M&A transaction, with Shenzhen Gaowu Excellence acquiring a 15% stake for CN¥670 million. Jiangsu Wuyang's short-term assets significantly exceed both short- and long-term liabilities, ensuring liquidity stability.

- Click here and access our complete financial health analysis report to understand the dynamics of Jiangsu Wuyang Automation Control Technology.

- Learn about Jiangsu Wuyang Automation Control Technology's historical performance here.

Seize The Opportunity

- Gain an insight into the universe of 3,553 Global Penny Stocks by clicking here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal