Global Market's Top 3 Dividend Stocks To Consider

As global markets navigate a landscape of mixed performances, with U.S. stocks experiencing a slight decline and European indices reaching new highs, investors are increasingly turning their attention to dividend stocks for potential stability and income. In such an environment, a good dividend stock is typically characterized by consistent payouts and resilience in the face of market fluctuations, offering investors a measure of reliability amidst economic uncertainties.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.19% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.60% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.35% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.21% | ★★★★★★ |

| NCD (TSE:4783) | 3.64% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.86% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.33% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.75% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.47% | ★★★★★★ |

Click here to see the full list of 1251 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

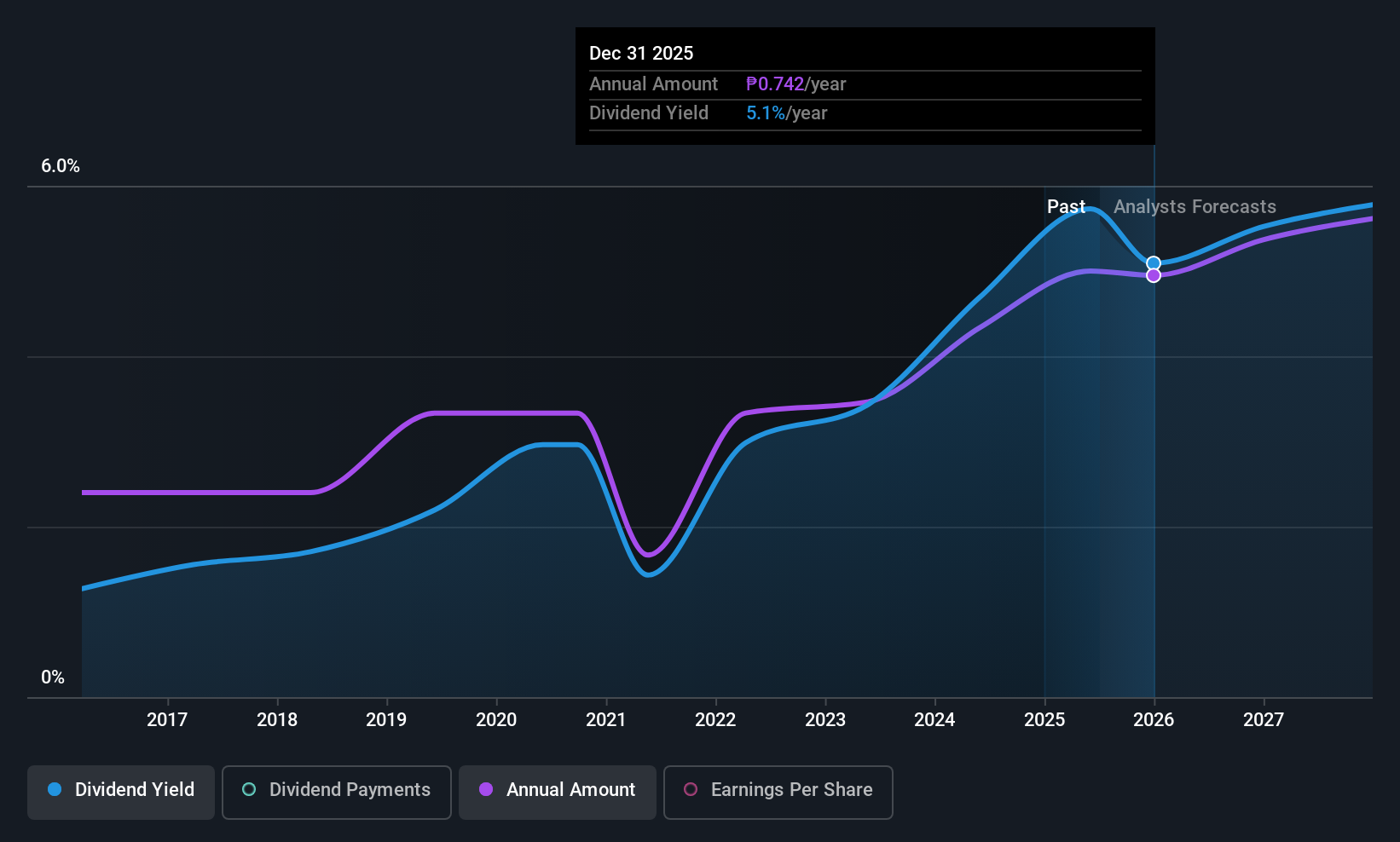

Robinsons Land (PSE:RLC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Robinsons Land Corporation, with a market cap of ₱79.67 billion, engages in acquiring, developing, operating, leasing, disposing of, and selling real estate properties in the Philippines through its subsidiaries.

Operations: Robinsons Land Corporation generates revenue from several segments, including Robinsons Malls (₱19.63 billion), Robinsons Offices (₱8.88 billion), Robinsons Hotels and Resorts (₱6.42 billion), Residential Division (₱11.08 billion), Chengdu Xin Yao (₱20.36 million), Robinsons Destination Estates (₱1.07 billion), and Robinsons Logistics and Industrial Facilities (₱927.84 million).

Dividend Yield: 4.3%

Robinsons Land's dividend sustainability is supported by a low cash payout ratio of 16.4% and a payout ratio of 27%, indicating dividends are well covered by both earnings and cash flows. However, its dividend history has been unreliable with volatility over the past decade. Despite this, dividends have grown over ten years, though the yield at 4.29% lags behind top Philippine payers. Recent earnings show improved revenue and net income growth, reinforcing financial stability for future payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Robinsons Land.

- The analysis detailed in our Robinsons Land valuation report hints at an inflated share price compared to its estimated value.

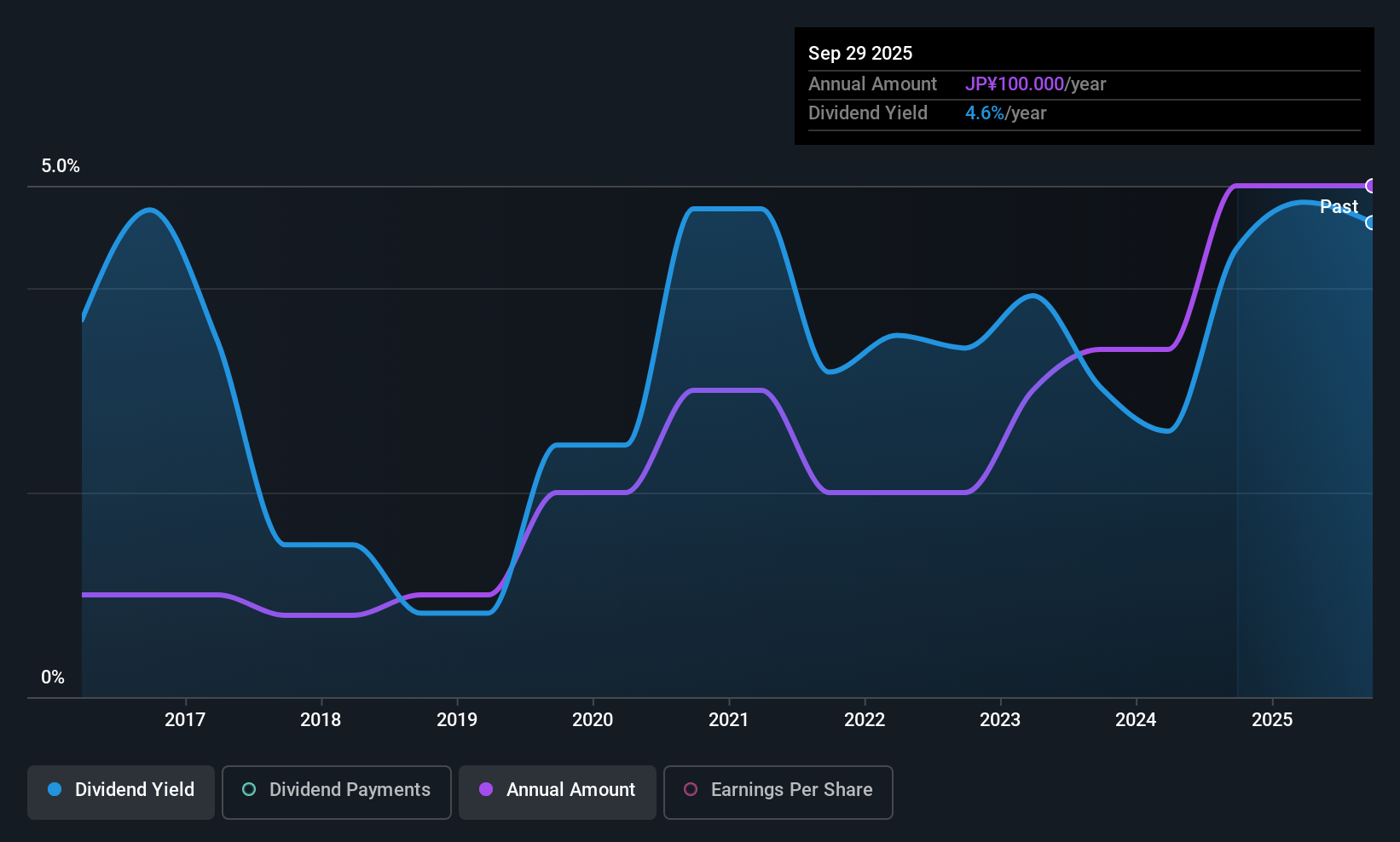

Sec CarbonLimited (TSE:5304)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sec Carbon Limited manufactures and sells graphite electrodes for steelmaking, with a market cap of ¥47.53 billion.

Operations: Sec Carbon Limited generates revenue of ¥25.09 billion from its manufacture and sale of carbon products segment.

Dividend Yield: 3.7%

Sec Carbon Limited's dividend yield of 3.73% places it among the top 25% of Japanese dividend payers, but sustainability is questionable as dividends aren't covered by free cash flows. Although the payout ratio is reasonable at 52.4%, past payments have been volatile and unreliable, with significant drops over the last decade. Despite this volatility, dividends have grown over ten years. The stock's price-to-earnings ratio of 14.1x suggests it offers good value compared to the market average.

- Click here to discover the nuances of Sec CarbonLimited with our detailed analytical dividend report.

- Our expertly prepared valuation report Sec CarbonLimited implies its share price may be too high.

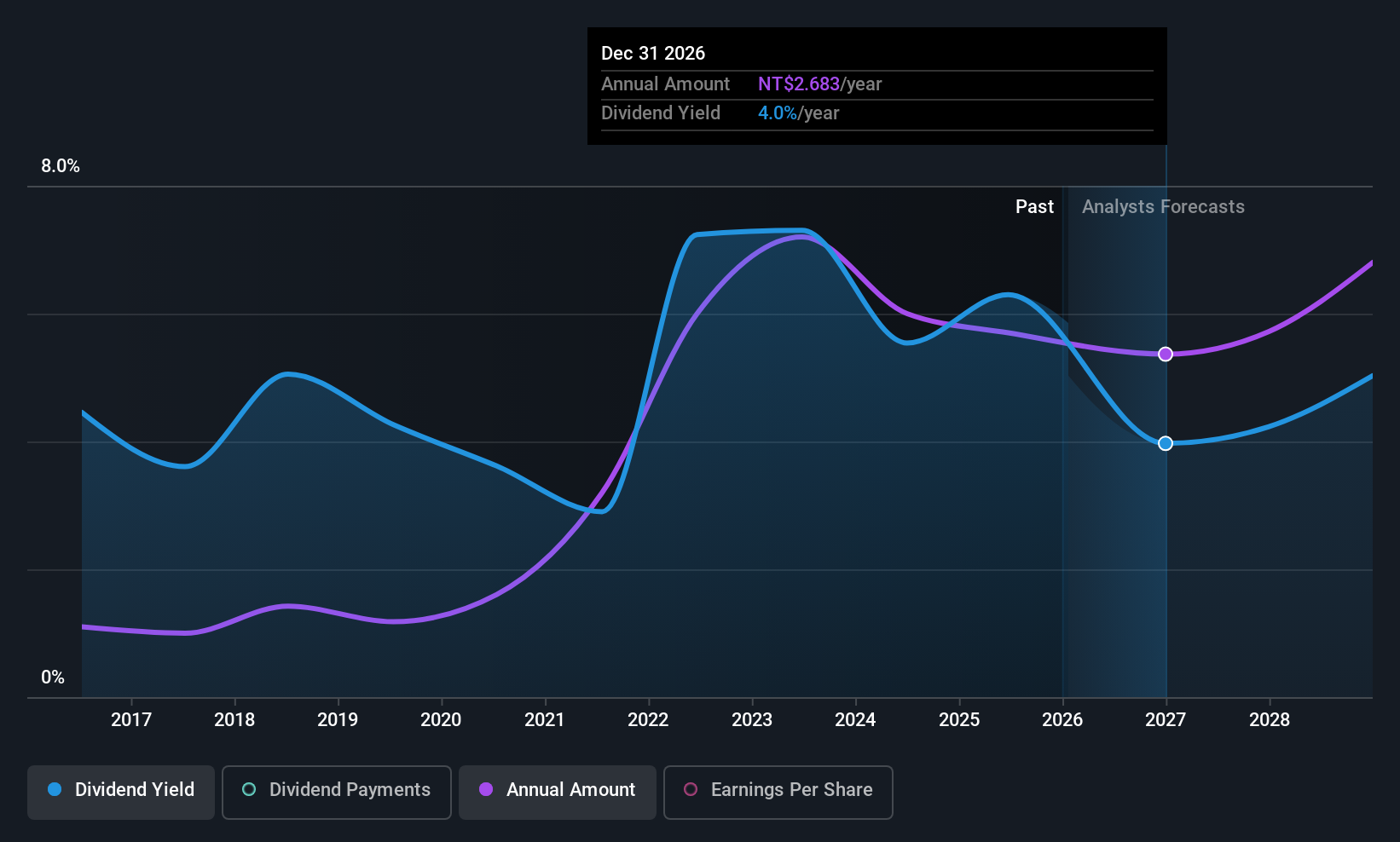

United Microelectronics (TWSE:2303)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Microelectronics Corporation is a semiconductor wafer foundry with operations across Taiwan, China, Hong Kong, Japan, Korea, the United States, Europe and internationally; it has a market cap of approximately NT$617.72 billion.

Operations: United Microelectronics Corporation generates its revenue primarily from wafer fabrication, totaling NT$236.13 billion.

Dividend Yield: 5.3%

United Microelectronics Corporation's dividend payments are covered by earnings at an 88.6% payout ratio and cash flows at a 78.7% cash payout ratio, indicating reasonable sustainability despite a historically unstable track record. The company's dividends have grown over the past decade but remain volatile, with their yield of 5.27% slightly below Taiwan's top quartile payers. Recent sales growth and strategic partnerships, such as with Polar Semiconductor, may support future financial stability and potential dividend reliability improvements.

- Take a closer look at United Microelectronics' potential here in our dividend report.

- The analysis detailed in our United Microelectronics valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Embark on your investment journey to our 1251 Top Global Dividend Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal