Discovering Undiscovered Gems in Global Markets January 2026

As global markets navigate the complexities of a new year, recent data highlights both challenges and opportunities: U.S. stocks have seen mixed performances amid geopolitical tensions and economic shifts, while European indices have reached new highs buoyed by an improving economic backdrop. In this dynamic environment, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking to uncover undiscovered gems in the global market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 5.00% | 14.21% | 13.26% | ★★★★★★ |

| Xiamen Jihong | 17.57% | 6.86% | -18.83% | ★★★★★★ |

| HG Metal Manufacturing | 3.31% | 8.66% | 5.62% | ★★★★★★ |

| Grade Upon Technology | NA | 21.73% | 65.67% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| AblePrint Technology | 7.13% | 15.97% | 15.61% | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| Ajman Bank PJSC | 53.89% | 16.11% | 18.02% | ★★★★☆☆ |

| Fengyinhe Holdings | 9.39% | 53.36% | 74.10% | ★★★★☆☆ |

| Billion Industrial Holdings | 33.11% | 16.86% | -16.10% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Jiangxi Jiangnan New Material Technology (SHSE:603124)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangxi Jiangnan New Material Technology Co., Ltd. operates in the new materials industry, focusing on the production and development of advanced materials, with a market cap of CN¥12.64 billion.

Operations: Jiangxi Jiangnan New Material Technology generates revenue primarily from the production and development of advanced materials. The company has a market cap of CN¥12.64 billion, indicating its significant presence in the industry.

Jiangxi Jiangnan New Material Technology shows promising potential with its earnings growth of 22.9% over the past year, outpacing the Electronic industry’s 9%. The company reported sales of CNY 7.57 billion for the first nine months of 2025, up from CNY 6.40 billion a year earlier, while net income rose to CNY 165.24 million from CNY 135.49 million. Despite a volatile share price in recent months, it has more cash than total debt and covers interest payments well at a ratio of 7.9 times EBIT, suggesting financial resilience amidst its rapid expansion trajectory in the market.

Nanjing Vishee Medical Technology (SHSE:688580)

Simply Wall St Value Rating: ★★★★★★

Overview: Nanjing Vishee Medical Technology Co., Ltd specializes in providing rehabilitation meditation products and solutions both in China and internationally, with a market cap of CN¥6.67 billion.

Operations: The company generates revenue primarily from its rehabilitation meditation products and solutions. It has a market cap of CN¥6.67 billion, indicating its significant presence in the industry.

Nanjing Vishee Medical Technology, a smaller player in the medical equipment field, has shown notable financial performance. Over the past year, its earnings grew by 11.7%, outpacing the industry's 0.6% growth rate. The company is debt-free now, having reduced its debt from a ratio of 0.3 five years ago, which likely contributes to its high-quality earnings profile. For the nine months ending September 2025, sales reached CNY 325.53 million (US$), up from CNY 291.76 million (US$) year-over-year, while net income rose to CNY 102.15 million (US$) compared to CNY 78.17 million (US$).

GCH Technology (SHSE:688625)

Simply Wall St Value Rating: ★★★★☆☆

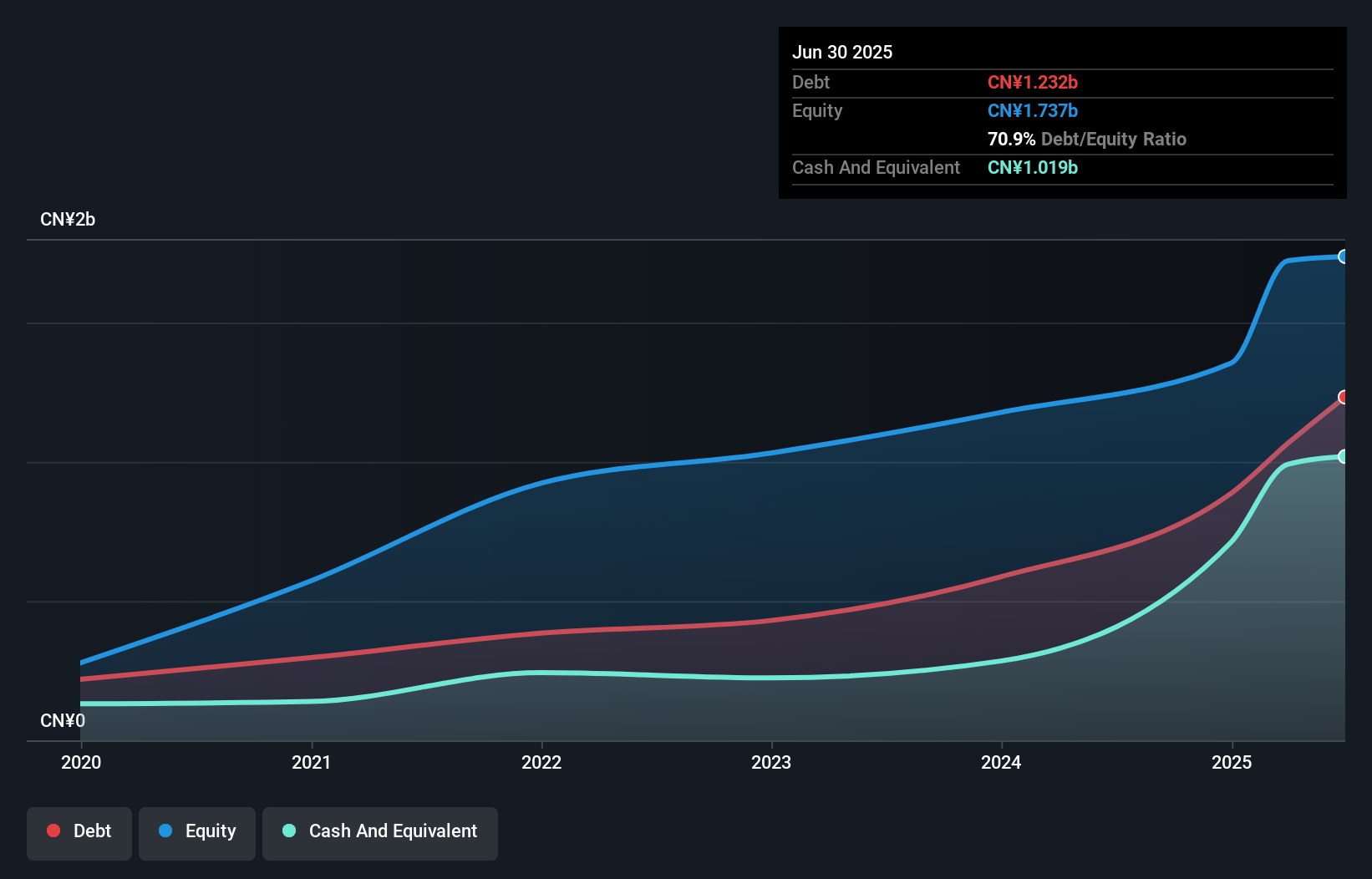

Overview: GCH Technology Co., Ltd. is engaged in the research, development, production, and sale of nucleating agents, synthetic hydrotalcites, and composite additives both in China and internationally with a market cap of CN¥8.54 billion.

Operations: GCH Technology generates revenue primarily from its Chemical Raw Materials and Chemical Products Manufacturing segment, amounting to CN¥973.82 million. The company's market capitalization stands at approximately CN¥8.54 billion.

GCH Technology, a smaller player in the tech sector, has shown robust financial growth with earnings increasing by 9.3% over the past year, outpacing the Chemicals industry average of 6.1%. The company boasts high-quality earnings and is projected to continue this trajectory with an expected annual growth rate of 20.18%. Despite a rise in its debt-to-equity ratio from 19.2% to 75.6% over five years, GCH remains financially sound as it earns more interest than it pays out and holds more cash than total debt. Recent reports highlight a revenue increase to CNY739 million from CNY648 million year-on-year, reflecting solid operational performance amidst industry challenges.

- Click here to discover the nuances of GCH Technology with our detailed analytical health report.

Evaluate GCH Technology's historical performance by accessing our past performance report.

Next Steps

- Take a closer look at our Global Undiscovered Gems With Strong Fundamentals list of 2995 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal