Visa (V) Valuation Check As Digital Currency And Crypto Initiatives Gain Traction

Recent headlines around Visa (V) have centered on its push into digital currency and stablecoin payments, the wider use of Tap to Phone, and very large growth in crypto linked card spending.

See our latest analysis for Visa.

Visa’s push into stablecoins, Tap to Phone, and crypto linked spending comes as the share price trades at US$357.56, with a 30 day share price return of 7.95% and a 1 year total shareholder return of 15.54%. This suggests momentum has been building recently on top of strong multi year total shareholder returns.

If you are looking beyond payments to see what else is shaping the future of transactions and digital services, it could be a good moment to check out high growth tech and AI stocks.

So with Visa shares at US$357.56, recent returns in positive territory, and only a small intrinsic discount showing on some models, is there still an attractive entry point here, or is the market already pricing in future growth?

Most Popular Narrative: 9.6% Undervalued

Visa’s most followed narrative puts fair value at about US$395.44 per share compared with the last close of US$357.56. This frames the current price as a discount that rests on specific growth and profitability assumptions.

Rapidly accelerating adoption of value added services (VAS), with VAS revenue up 26% year over year and expanding into areas such as AI, risk solutions, and open banking, is increasing Visa's mix of higher margin business lines, which should lift net margins and improve overall earnings quality.

Curious what turns today’s transaction network into that higher margin story? Revenue growth, fatter margins, and a punchy future earnings multiple sit at the core. Want to see exactly how those elements stack up to reach that fair value?

Result: Fair Value of $395.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh up risks such as real time payment systems and stablecoins chipping away at card fees, as well as tighter interchange rules pressuring margins.

Find out about the key risks to this Visa narrative.

Another View: Rich On Earnings

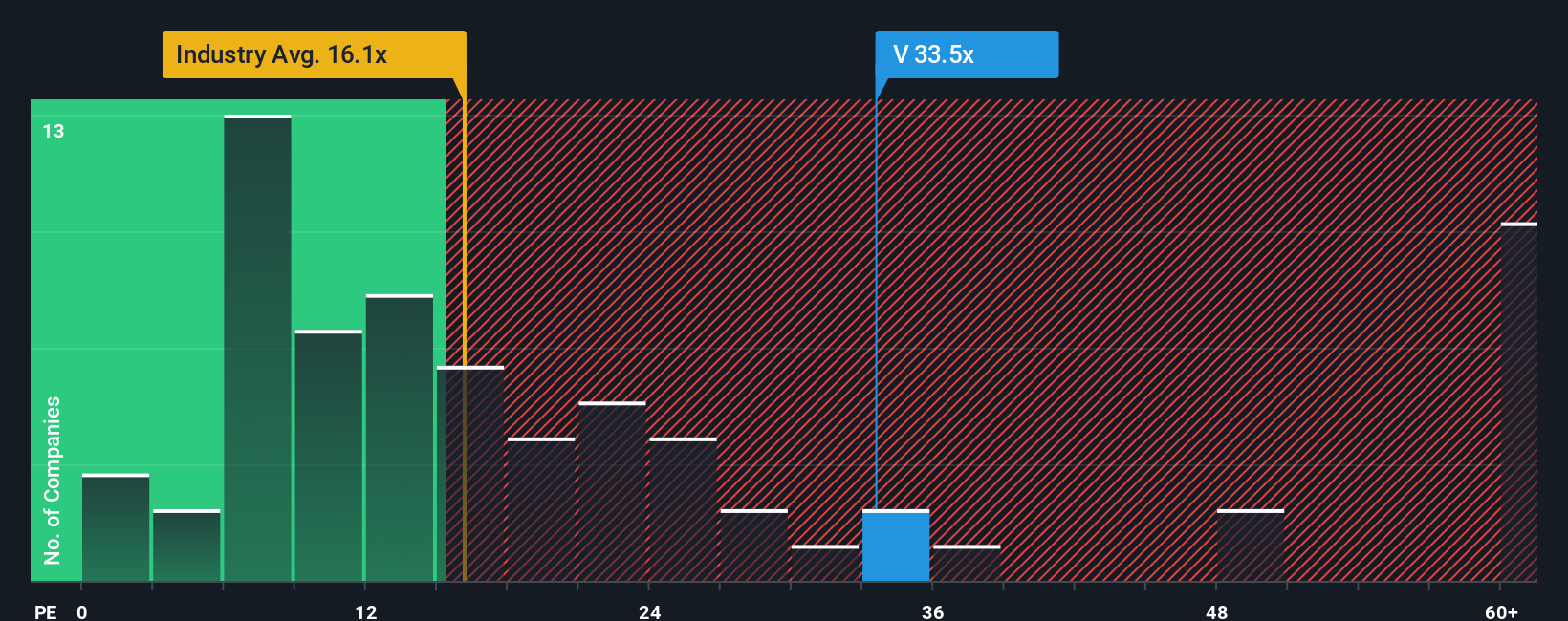

That 9.6% “undervalued” narrative sits awkwardly next to Visa’s current P/E of 34.4x, which is far higher than both the US Diversified Financial industry at 14.1x and peers at 17.9x, and also above the fair ratio of 20.6x. That kind of gap can limit upside if sentiment cools. How comfortable are you paying up here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Visa Narrative

If you see the numbers differently or prefer to piece together your own thesis from the raw data, you can build a complete Visa storyline in just a few minutes by starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Visa.

Looking for more investment ideas?

If Visa has sharpened your thinking, do not stop here. Broaden your watchlist with a few focused screens that surface very different kinds of opportunities.

- Spot potential high risk, high reward plays by scanning these 3552 penny stocks with strong financials that already show stronger balance sheets and fundamentals than many of their peers.

- Zero in on future facing themes by reviewing these 25 AI penny stocks that are building real businesses around artificial intelligence rather than just headlines.

- Focus on price tags that look more reasonable by working through these 873 undervalued stocks based on cash flows that stand out on cash flow based assessments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal