A Look At Watts Water Technologies (WTS) Valuation After RBC Capital’s New Sector Perform Coverage

RBC Capital’s fresh coverage of Watts Water Technologies (WTS) with a Sector Perform rating has put the stock on more investor radars and is prompting a closer look at how its fundamentals line up with current pricing.

See our latest analysis for Watts Water Technologies.

RBC Capital’s fresh coverage comes as Watts Water’s share price sits at $284.39, with a 30 day share price return of 4.30% and a 1 year total shareholder return of 43.27%. This indicates that momentum has been building over the longer term, even if shorter term moves have been steadier.

If recent attention on water infrastructure has you thinking more broadly about opportunities, this could be a useful moment to widen your lens with healthcare stocks.

With the shares at $284.39, sitting about 3% below the average analyst target and with an intrinsic value estimate roughly in line with the market price, investors may need to consider whether there is meaningful upside remaining or whether the market has already priced in future growth.

Most Popular Narrative: 2.8% Undervalued

With Watts Water Technologies trading at $284.39 against a narrative fair value of about $292.50, the current setup centers on whether earnings and margins can support that gap.

The accelerating rollout and success of Nexa, Watts' intelligent water management platform, positions the company to capture the growing demand for advanced, data-driven water conservation, efficiency, and regulatory compliance solutions, which is expected to drive higher-margin, recurring revenue and support long-term earnings and margin expansion.

Curious what kind of revenue lift and margin profile would justify this valuation edge, especially with a richer future P/E and specific growth runway baked in? The narrative leans on a detailed path for earnings, cash flows and required return, all tied to how quickly higher margin products scale. If you want to see which assumptions really carry the fair value, the full story sets them out clearly.

Result: Fair Value of $292.50 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can change quickly if European demand stays weak or if changes in tariffs and slower smart water adoption start to pressure margins and growth expectations.

Find out about the key risks to this Watts Water Technologies narrative.

Another View: Earnings Multiple Sends A Different Signal

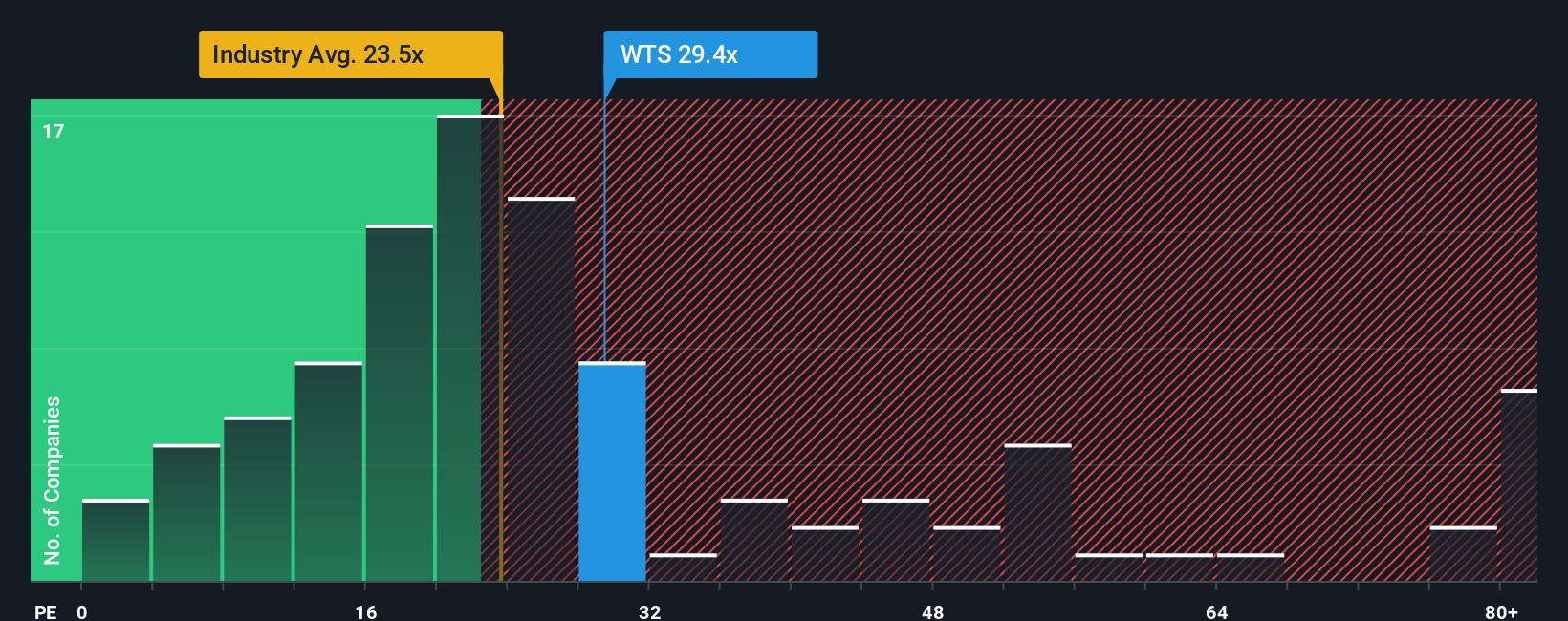

While the narrative fair value sits close to the current price, the earnings multiple tells a more cautious story. Watts Water trades on a P/E of 29.2x, above the US Machinery industry at 25.4x and its own fair ratio of 22.5x. This points to richer pricing and less room for error. How comfortable are you paying that kind of premium?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Watts Water Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Watts Water Technologies Narrative

If you see the numbers differently or prefer to stress test your own assumptions, you can build a complete, data-driven story in just a few minutes: Do it your way.

A great starting point for your Watts Water Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Watts Water is on your radar, do not stop there. Use this moment to line up a few other opportunities that could suit your style.

- Target income potential with these 11 dividend stocks with yields > 3%, focusing on companies that currently offer yields above 3% and may fit a cash flow focused approach.

- Spot potential mispricings with these 877 undervalued stocks based on cash flows, where stocks are filtered using cash flow based metrics instead of headline stories.

- Lean into growth themes by checking out these 25 AI penny stocks, highlighting companies tied to AI trends that might not yet be widely followed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal