Phillips 66 (PSX.US) CEO: Venezuelan crude oil may return to the market, and US heavy crude oil refiners will face significant benefits

The Zhitong Finance App learned that Phillips 66 (PSX.US), one of the largest refiners in the US, said that the potential restart of the Venezuelan oil industry will provide a significant boost to fuel producers that rely on heavy crude oil.

Phillips 66 CEO Mark Rahill said at the Goldman Sachs Energy, Cleantech and Utilities conference on Tuesday that Phillips 66 and other refiners that can process heavy oils may benefit from increased Venezuelan exports and changes in global trade flows.

“Venezuela used to produce 3 million barrels of heavy crude oil per day. “We have refineries designed to process this type of crude oil for a long time,” Rahill said, “but to fully unlock its potential, upstream companies will need to invest heavily, which may take years or even decades.”

Oil producers, refiners, investors, and US Secretary of Energy Chris Wright gathered in Miami for the conference this week as the US captured Venezuelan President Nicolas Maduro and the country's oil industry is expected to recover.

Phillips 66 shares soared 8.8% on Monday, and shares of other refiners such as Valero Energy also rose. Analysts believe that heavy crude oil refiners are in an advantageous position and are expected to benefit from increased exports from Venezuela.

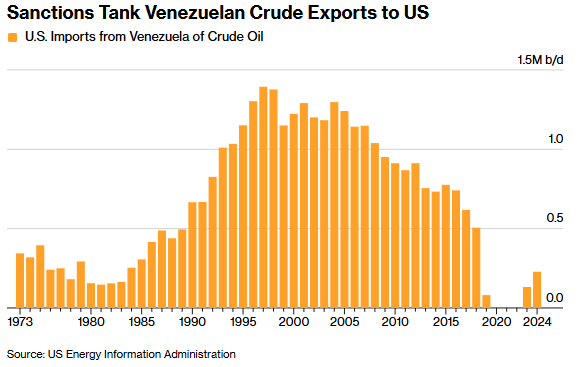

According to US government data, before 2000, US refiners processed 1.4 million barrels of Venezuelan oil every day. Many companies located along the Gulf Coast have reconfigured their plants and added special equipment to handle heavy oil refining residue.

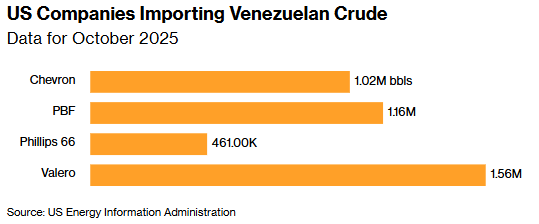

A subsidiary of CNPC has participated in a number of joint ventures, including collaborating with Phillips 66's refinery in Sweeney, Texas to directly supply crude oil to the plant and operate its own facilities under the Citgo brand. Currently, a small portion of these imports still goes to the US, with recent purchases from Chevron, PBF, Phillips 66, and Valero.

Rahill predicts that in the short term, more South American crude oil may flow to refining centers along the US Gulf Coast. He added that this will compete with heavy Canadian crude oil and increase the water margin for this North American oil type, while Midwestern refineries designed to process such crude oil will also benefit.

Phillips 66 chief financial officer Kevin Mitchell said at the meeting that the company's refineries in Sweeney and Lake Charles, Louisiana can process hundreds of thousands of barrels of Venezuelan crude every day. He added that in total, all of the company's refineries can process about 500,000 barrels of heavy crude oil per day, including Venezuelan and Canadian oils.

If Venezuelan oil, which originally went to China, is transferred to the US, the shift in trade flow may increase competition for Canadian crude oil.

“China will have to look for other crude oil to fill the gap. They will get their crude oil from the TMX pipeline as much as possible,” Rahil said when referring to the cross-mountain pipeline. The pipeline transports crude oil from Canada's inland oil fields to the west coast for export.

However, since the TMX pipeline has reached its maximum capacity, Canadian crude oil may be transported south through the US.” “We may go back to the days of exporting hundreds of thousands of barrels of crude oil from the Gulf Coast to China every day,” Rahil said.

Rahil pointed out that in any case, Venezuela will need more naphtha (a refined product used by drillers to dilute heavy oil), and the US may have an opportunity to export more of this type of fuel to the region.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal