Hesai Group (NasdaqGS:HSAI) Valuation Check As Lidar Capacity Expansion And NVIDIA Partnership Take Shape

Hesai Group (NasdaqGS:HSAI) is back in focus after announcing plans to double its annual lidar production capacity to over 4 million units in 2026, alongside a new lidar partnership with NVIDIA’s DRIVE AGX Hyperion 10 platform.

See our latest analysis for Hesai Group.

These production and partnership updates arrive after a sharp rebound in the short term, with a 33.33% 1 month share price return and an 81.57% 1 year total shareholder return, suggesting improving momentum after a softer 90 day patch.

If this lidar story has caught your attention, it could be a good moment to see what else is happening across high growth tech and AI. You can start with high growth tech and AI stocks.

With Hesai trading at US$26.80 and sitting at roughly a 12% discount to its average analyst target and DCF estimate, the key question is whether that gap signals mispricing or indicates that the market is already pricing in future growth.

Most Popular Narrative: 10.8% Undervalued

Against the last close of US$26.80, the most followed narrative points to a higher fair value, built on aggressive lidar volume and earnings projections.

The projection of 2025 LiDAR shipments reaching 1.2 million to 1.5 million units, with nearly 200,000 high-margin robotic LiDAR units, is expected to significantly boost revenue. The growth of the ADAS market and LiDAR adoption in EVs is expected to rise from 8% in 2023 to 20% in 2025 and 56% by 2030, potentially increasing future revenue and market share.

Curious how this shipment ramp, margin lift, and future P/E all connect? The narrative relies on projected revenue growth, expanding profitability, and a higher earnings multiple to link today’s price to its estimated fair value.

Result: Fair Value of $30.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can change quickly if key clients reduce orders, or if aggressive lidar pricing and capacity expansion squeeze the profit margins analysts are banking on.

Find out about the key risks to this Hesai Group narrative.

Another View: High P/E Tells a Different Story

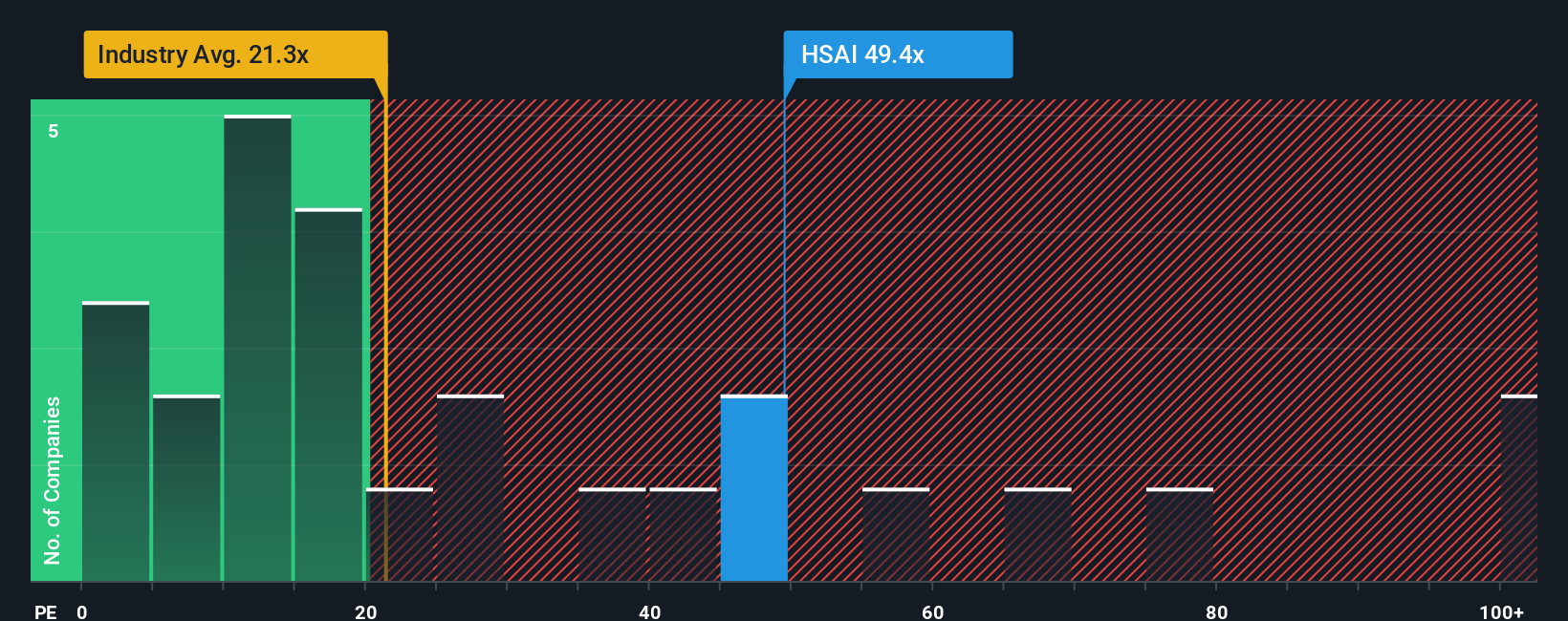

If you step away from fair value models and just look at the current P/E, Hesai trades at 68x earnings. That is well above the US Auto Components industry at 20.9x, the peer average at 17.9x, and even the fair ratio estimate of 46.4x.

This gap suggests the market is already paying a premium for Hesai, which could mean less room for error if growth or margins fall short, or a reset if expectations cool. The real question is whether you think the business can grow into that premium or not.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hesai Group Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a fresh Hesai story in just a few minutes, starting with Do it your way.

A great starting point for your Hesai Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Hesai has sparked your interest, do not stop here. The next strong idea you find using a targeted screener could matter more than the one you just read about.

- Spot potential bargains early by scanning these 877 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Zero in on future-facing themes by searching these 25 AI penny stocks that are tied to advancements in artificial intelligence.

- Add some higher risk, higher reward names to your watchlist by checking out these 3553 penny stocks with strong financials that still show solid financial underpinnings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal