Promising UK Penny Stocks To Watch In January 2026

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interdependencies. Despite these broader market pressures, investors may find intriguing opportunities in penny stocks—smaller or newer companies that can offer a mix of affordability and growth potential. While the term 'penny stocks' might seem outdated, their potential remains significant for those seeking financial strength and resilience in emerging sectors.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.43 | £508.75M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.91 | £154.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.85 | £138.03M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £1.11 | £16.76M | ✅ 2 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.70 | $406.93M | ✅ 4 ⚠️ 2 View Analysis > |

| Michelmersh Brick Holdings (AIM:MBH) | £0.835 | £75.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.518 | £183.85M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.46 | £39.65M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.165 | £187.48M | ✅ 6 ⚠️ 1 View Analysis > |

| Billington Holdings (AIM:BILN) | £3.50 | £45.69M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 293 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Asiamet Resources (AIM:ARS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Asiamet Resources Limited, with a market cap of £58.40 million, is involved in the exploration and development of mineral properties in Indonesia through its subsidiaries.

Operations: Asiamet Resources Limited does not have any reported revenue segments.

Market Cap: £58.4M

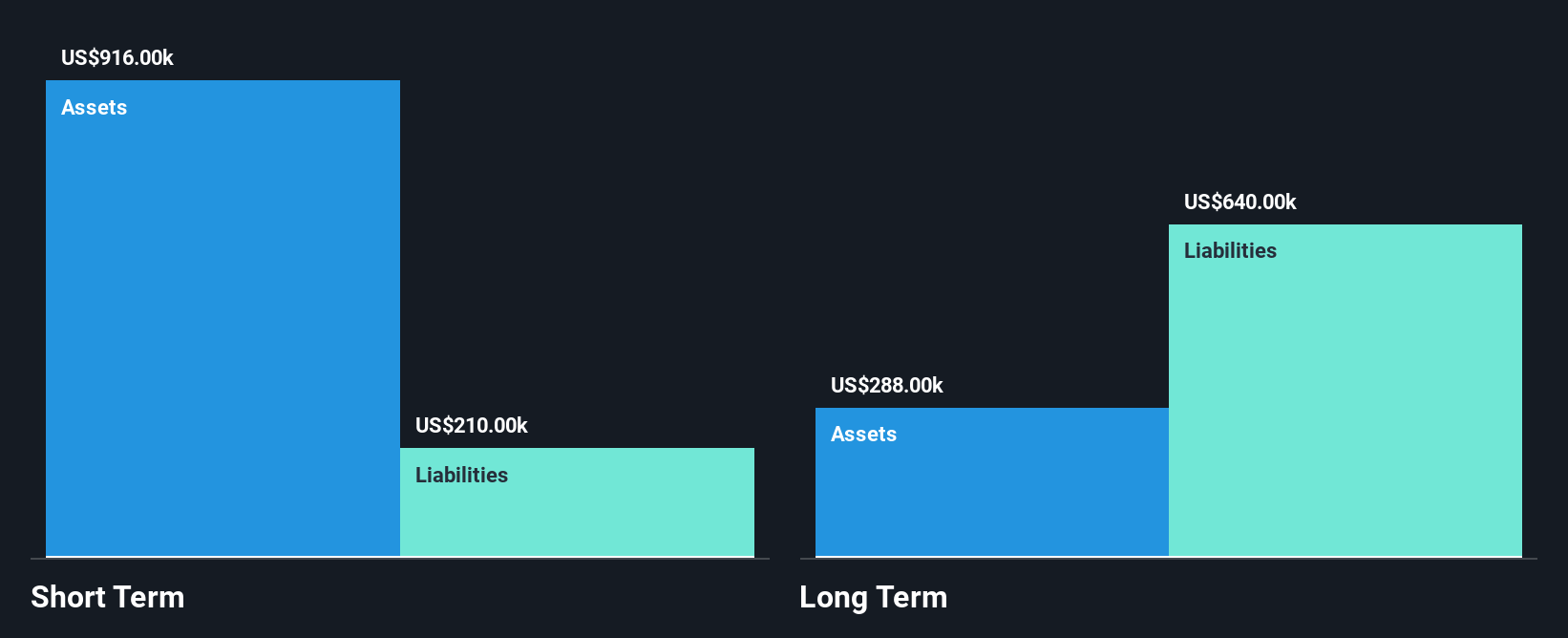

Asiamet Resources Limited, with a market cap of £58.40 million, operates as a pre-revenue entity focused on mineral exploration in Indonesia. Despite its seasoned management team and debt-free status, the company faces challenges such as high share price volatility and negative return on equity due to its unprofitability. The recent follow-on equity offering raised £2.32 million, potentially extending its cash runway beyond the current two-month estimate based on free cash flow projections. While short-term assets cover both short and long-term liabilities, Asiamet's earnings have declined over recent years without significant revenue generation.

- Navigate through the intricacies of Asiamet Resources with our comprehensive balance sheet health report here.

- Gain insights into Asiamet Resources' historical outcomes by reviewing our past performance report.

Creo Medical Group (AIM:CREO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Creo Medical Group PLC focuses on the research, development, manufacture, and sale of medical devices and instruments for clinics and hospitals in the United Kingdom, with a market cap of £43.27 million.

Operations: The company generates revenue of £4.6 million from its segment focused on the research, development, and distribution of electrosurgical medical devices.

Market Cap: £43.27M

Creo Medical Group, with a market cap of £43.27 million, has transitioned to profitability this year, supported by its seasoned management and board. The company's financials were notably impacted by a large one-off gain of £25.2 million in the last 12 months ending June 2025. Despite this non-recurring item, Creo's revenue from electrosurgical medical devices stands at £4.6 million, and it maintains more cash than total debt with short-term assets covering liabilities effectively. However, earnings are forecast to decline significantly over the next three years despite current profitability and stable weekly volatility over the past year.

- Take a closer look at Creo Medical Group's potential here in our financial health report.

- Review our growth performance report to gain insights into Creo Medical Group's future.

Windar Photonics (AIM:WPHO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Windar Photonics PLC develops light detection and ranging wind sensors and related software for electricity-generating wind turbines across Europe, China, the Americas, and the rest of Asia, with a market cap of £44.81 million.

Operations: The company generates revenue primarily from the sale of LIDAR wind measurement systems, totaling €4.98 million.

Market Cap: £44.81M

Windar Photonics, with a market cap of £44.81 million, is navigating through executive changes following the departure of its CEO and board member Jørgen Korsgaard Jensen. The company forecasts record revenue between €6.5 million and €6.8 million for 2025, although this falls short of market expectations of €9.45 million. Despite being unprofitable, Windar has reduced its losses by 26.8% annually over the past five years and maintains a strong financial position with more cash than debt and short-term assets exceeding liabilities significantly. Its management team is experienced, though the board's average tenure suggests inexperience.

- Click to explore a detailed breakdown of our findings in Windar Photonics' financial health report.

- Understand Windar Photonics' earnings outlook by examining our growth report.

Next Steps

- Take a closer look at our UK Penny Stocks list of 293 companies by clicking here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal