3 European Stocks Estimated To Be Up To 49.9% Below Intrinsic Value

Amidst a buoyant economic environment, the European markets have experienced notable gains, with the STOXX Europe 600 Index reaching new highs and major indices like Germany's DAX and France's CAC 40 posting significant increases. In this context of rising market performance, identifying undervalued stocks becomes crucial for investors seeking opportunities that may offer potential value relative to their intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Streamwide (ENXTPA:ALSTW) | €73.00 | €142.58 | 48.8% |

| Recupero Etico Sostenibile (BIT:RES) | €6.58 | €12.93 | 49.1% |

| Ottobock SE KGaA (XTRA:OBCK) | €69.50 | €138.74 | 49.9% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.465 | €4.88 | 49.4% |

| NEUCA (WSE:NEU) | PLN835.00 | PLN1637.27 | 49% |

| LINK Mobility Group Holding (OB:LINK) | NOK33.75 | NOK66.18 | 49% |

| Jæren Sparebank (OB:JAREN) | NOK383.55 | NOK759.10 | 49.5% |

| Fodelia Oyj (HLSE:FODELIA) | €5.48 | €10.72 | 48.9% |

| Benefit Systems (WSE:BFT) | PLN3615.00 | PLN7067.18 | 48.8% |

| ArcticZymes Technologies (OB:AZT) | NOK22.90 | NOK45.44 | 49.6% |

Let's uncover some gems from our specialized screener.

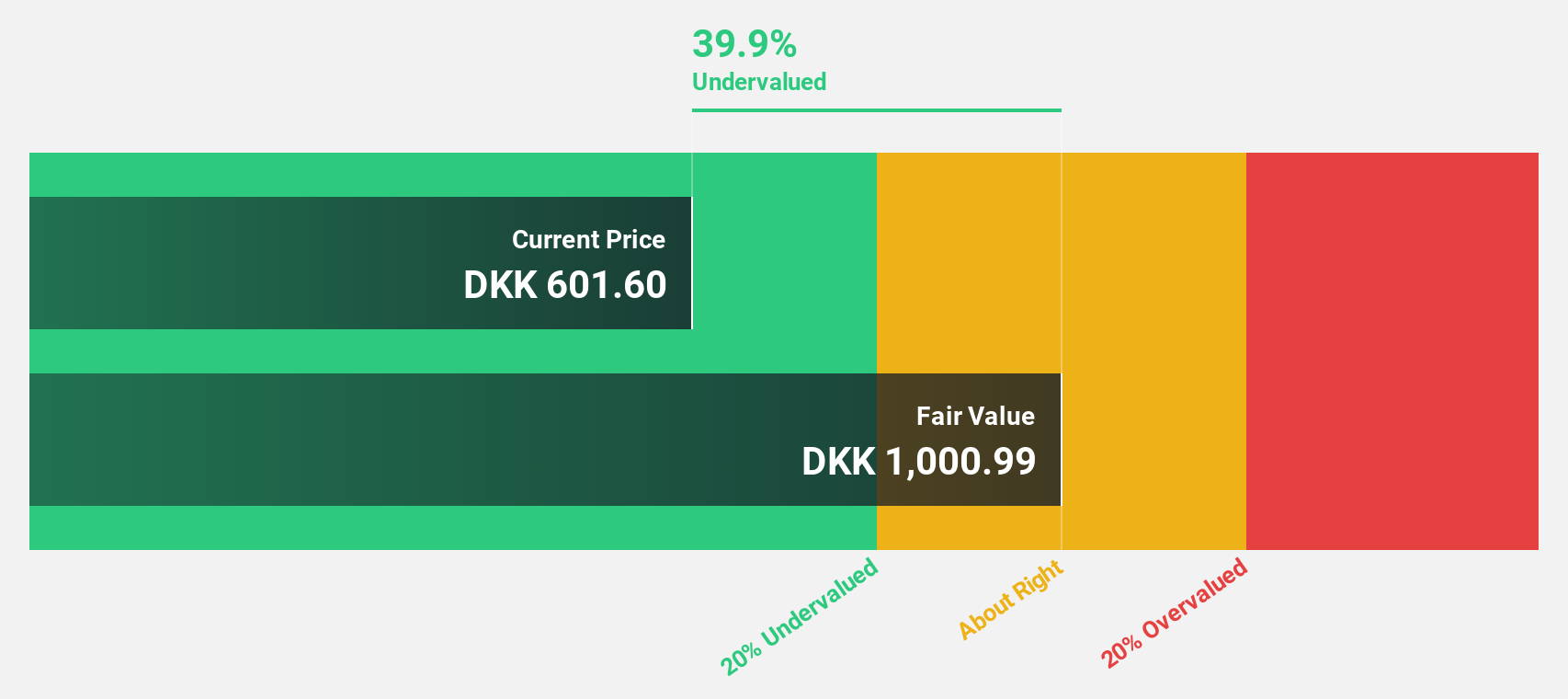

Coloplast (CPSE:COLO B)

Overview: Coloplast A/S develops and sells intimate healthcare products and services across Denmark, the United States, the United Kingdom, France, and internationally with a market cap of DKK126.66 billion.

Operations: The company's revenue segments include Chronic Care (DKK18.88 billion), Interventional Urology (DKK2.78 billion), Advanced Wound Dressings (DKK2.68 billion), Voice and Respiratory Care (DKK2.28 billion), and Biologics (DKK1.25 billion).

Estimated Discount To Fair Value: 30.4%

Coloplast is trading at DKK 562, significantly below its estimated fair value of DKK 807.44, suggesting it may be undervalued based on cash flows. Despite a decline in profit margins from 18.7% to 13%, earnings are projected to grow at 14.6% annually, outpacing the Danish market's growth rate of 6.1%. However, the dividend yield of 4.09% is not well covered by earnings or free cash flows, and the company carries a high level of debt.

- Our growth report here indicates Coloplast may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Coloplast.

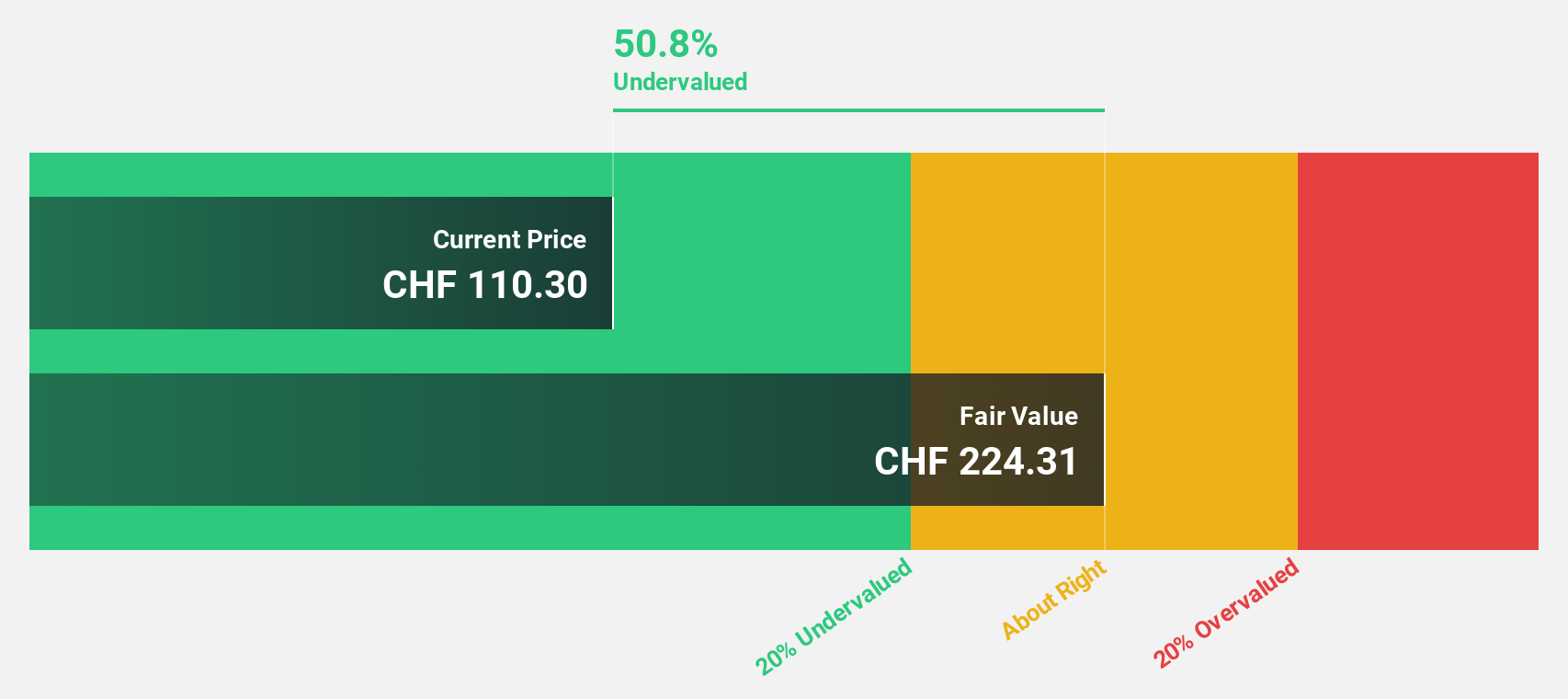

Galderma Group (SWX:GALD)

Overview: Galderma Group AG is a global dermatology company with a market cap of CHF39.31 billion.

Operations: The company's revenue is primarily derived from its dermatology segment, totaling $4.69 billion.

Estimated Discount To Fair Value: 47%

Galderma Group is trading at CHF 165.6, well below its estimated fair value of CHF 312.45, highlighting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 26.9% annually, outpacing the Swiss market's growth rate of 10.3%. Recent developments include L'Oréal increasing its stake to 20%, and promising clinical data for nemolizumab enhancing its therapeutic dermatology segment, which could bolster future revenue streams despite a forecasted low return on equity of 14.1%.

- In light of our recent growth report, it seems possible that Galderma Group's financial performance will exceed current levels.

- Get an in-depth perspective on Galderma Group's balance sheet by reading our health report here.

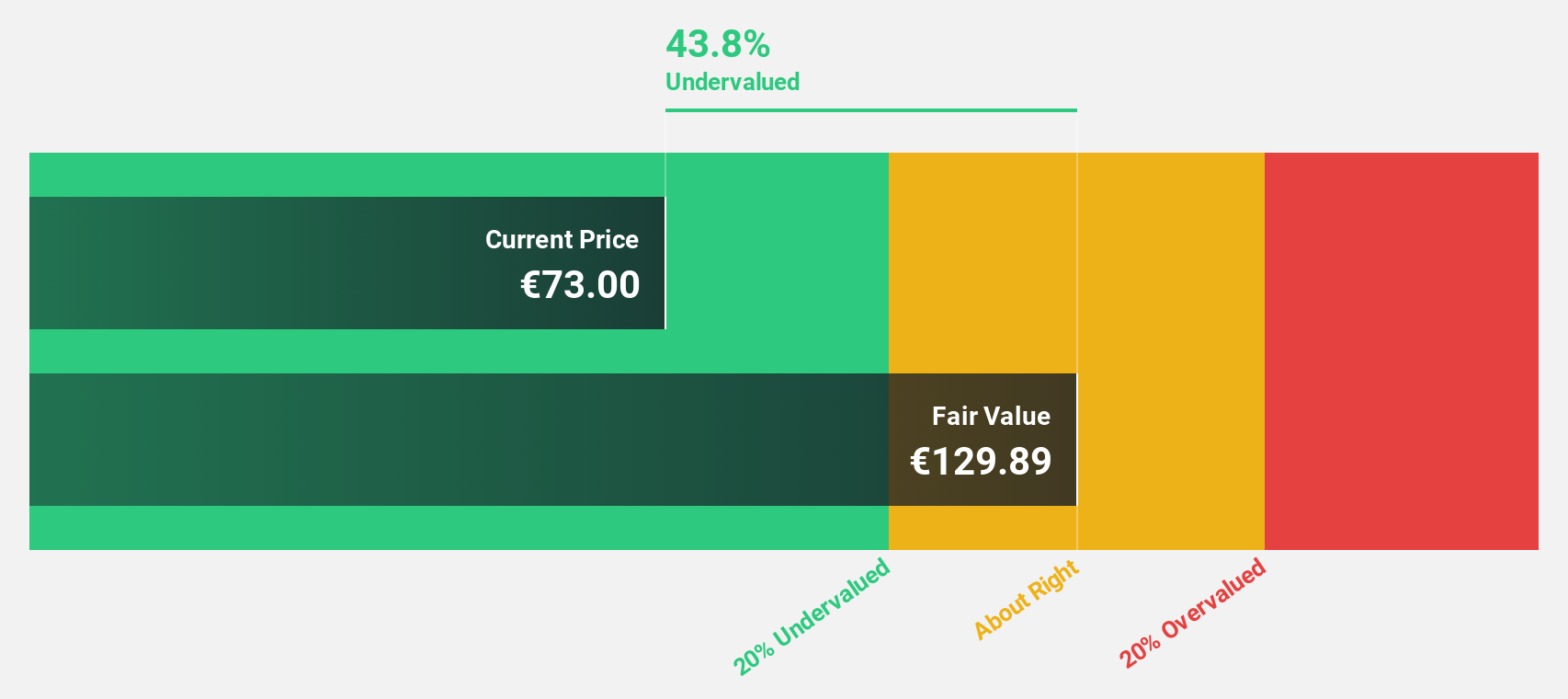

Ottobock SE KGaA (XTRA:OBCK)

Overview: Ottobock SE & Co. KGaA specializes in designing and developing medical technology products and solutions for individuals with limited mobility, focusing on prosthetics, orthotics, human mobility, and medical care globally, with a market cap of €4.45 billion.

Operations: The company's revenue segments are divided into Europe, Middle East and Africa (EMEA) with €1.17 billion, North and South America (Americas) with €379.10 million, and Asia and Pacific (APAC) with €113.80 million.

Estimated Discount To Fair Value: 49.9%

Ottobock SE KGaA, trading at €69.5, is significantly undervalued with a fair value estimate of €138.74. The company's earnings grew by 69.6% last year and are projected to rise 30.1% annually, surpassing the German market's growth rate of 16.4%. Despite high debt levels, its return on equity is forecasted to reach a robust 34.4% in three years, reflecting strong financial prospects amidst slower revenue growth compared to industry expectations.

- According our earnings growth report, there's an indication that Ottobock SE KGaA might be ready to expand.

- Navigate through the intricacies of Ottobock SE KGaA with our comprehensive financial health report here.

Next Steps

- Investigate our full lineup of 201 Undervalued European Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal