A Look At Expand Energy (EXE) Valuation After Its Recent Rebrand And Share Price Pullback

Why Expand Energy Is On Investors’ Radar

Expand Energy (EXE) has been drawing attention after its recent rebrand from Chesapeake Energy Corporation, shifting the focus to its natural gas production footprint across key US shale plays.

See our latest analysis for Expand Energy.

Since the rebrand, the share price has eased back, with a 1 month share price return of a 14.19% decline and a year to date share price return of a 3.95% decline. However, the 3 year total shareholder return of 32.41% still reflects earlier gains, suggesting recent momentum has been fading.

If EXE’s recent pullback has you rethinking your energy exposure, it could be a good moment to widen your search with fast growing stocks with high insider ownership.

With EXE trading at a discount to the average analyst price target and carrying a high implied intrinsic discount, the central question is whether the recent weakness signals undervaluation or whether the market already views future growth as fully priced in.

Most Popular Narrative: 21% Undervalued

With Expand Energy’s fair value in the narrative set at about $133.39 versus a last close of $105.43, the valuation hinges on some punchy long term assumptions.

The analysts have a consensus price target of $132.154 for Expand Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $154.0, and the most bearish reporting a price target of just $98.0.

Curious what has to happen between today’s earnings and those future numbers to support that higher value, and which profit and revenue assumptions carry the most weight? The narrative sets out a detailed path of expanding margins, rising earnings, and a valuation multiple that shifts over time. The full story is in how those pieces fit together, and which scenarios do the heavy lifting in the model.

Result: Fair Value of $133.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could be knocked off course if tighter decarbonization policies hit long term gas demand, or if mature shale assets drive higher costs and thinner margins.

Find out about the key risks to this Expand Energy narrative.

Another View: Earnings Multiple Paints A Tougher Picture

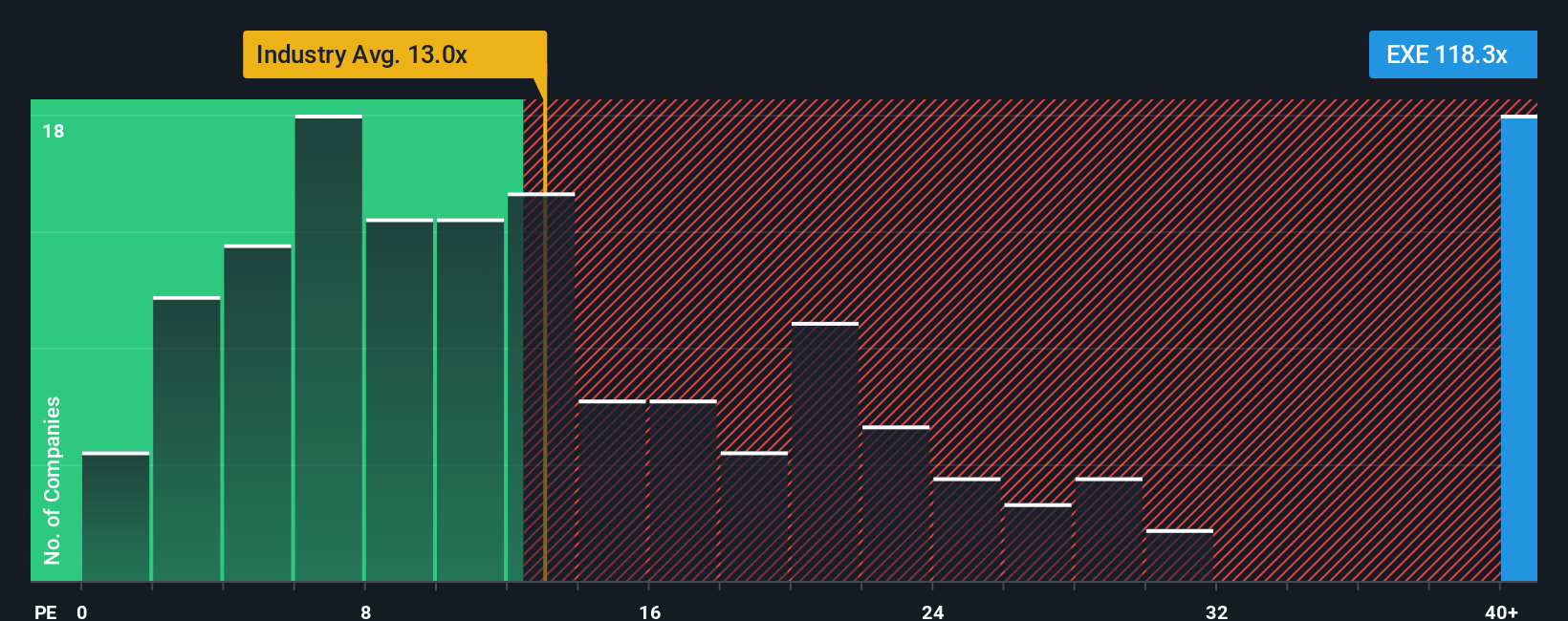

While the narrative points to a 21% undervaluation, our multiples work tells a different story. At a P/E of 29x versus a fair ratio of 23.4x, the market is pricing Expand Energy above where that ratio could settle, and well above the US Oil and Gas industry average of 13.2x and peer average of 13.9x. That gap raises a simple question for you: is the growth story strong enough to justify paying such a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Expand Energy Narrative

If you are not fully on board with this view or prefer to lean on your own analysis, you can stress test the assumptions, rebuild the forecasts to match your outlook and Do it your way.

A great starting point for your Expand Energy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If EXE is only one piece of your watchlist, do not stop here. Broaden your opportunity set now so you are not late to the next idea.

- Scan for potential mispriced opportunities by checking out these 877 undervalued stocks based on cash flows grounded in cash flow based insights.

- Hunt for growth linked to artificial intelligence by reviewing these 25 AI penny stocks that are already aligned with this theme.

- Balance your portfolio income by considering these 11 dividend stocks with yields > 3% that focus on yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal