Royal Bank Of Canada (TSX:RY) Valuation Check As Quantum Tech And Sports Deals Draw New Attention

Royal Bank of Canada (TSX:RY) is drawing fresh attention after backing quantum technology firm Photonic and naming professional golfer Shane Lowry as a multi year brand ambassador, moves that sit alongside its traditional banking operations.

See our latest analysis for Royal Bank of Canada.

Those moves come as the share price sits at CA$235.45, with a 30 day share price return of 4.77% and a 90 day gain of 16.27%. The 1 year total shareholder return of 39.70% and 5 year total shareholder return of 161.95% point to strong longer term momentum.

If this mix of banking, quantum tech and sports branding has your attention, it could be a good moment to look at fast growing stocks with high insider ownership for other fast moving ideas beyond the big banks.

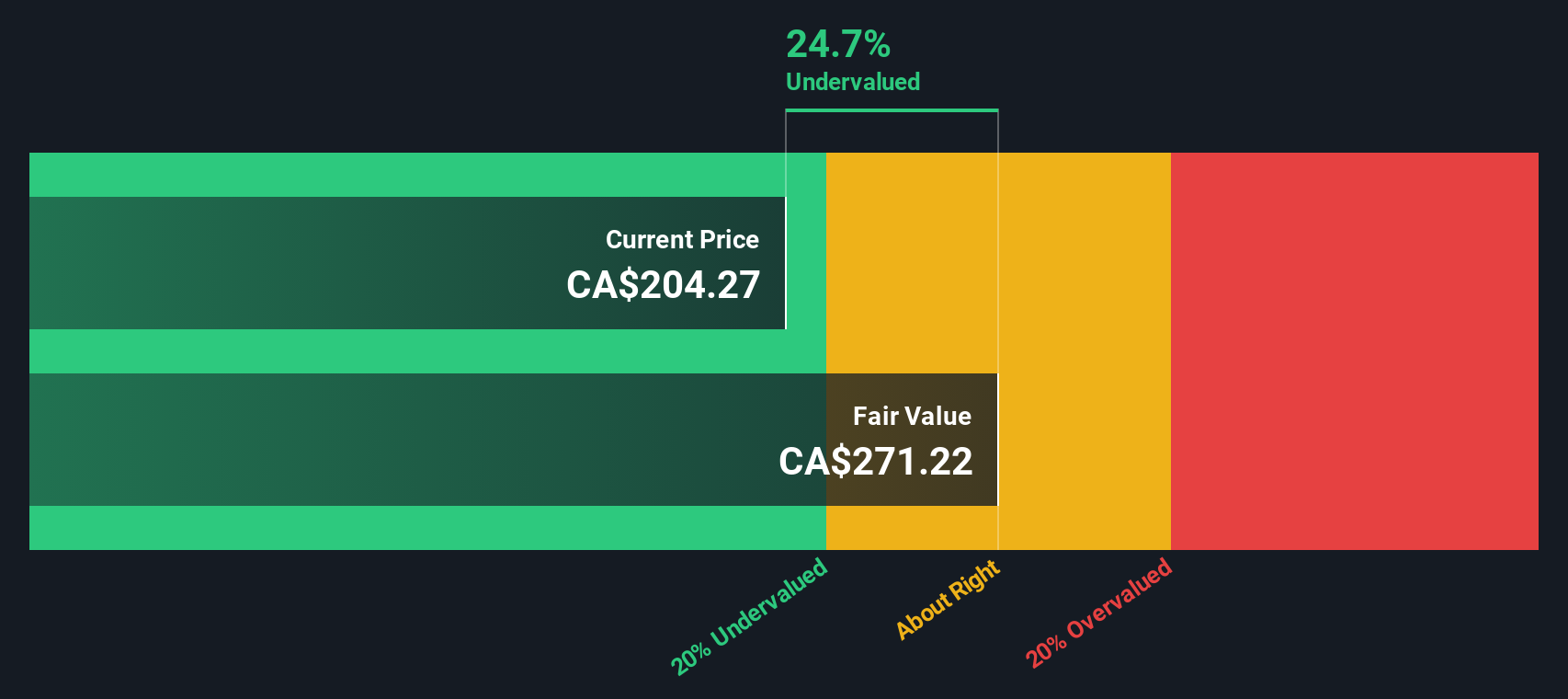

With the share price close to its analyst target but an indicated intrinsic value gap of about 26%, the key question is whether RBC still trades at a discount or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 1% Overvalued

With Royal Bank of Canada closing at CA$235.45 against a narrative fair value of about CA$233.13, the current price sits slightly above that estimate, and the gap comes down to how you view its future earnings mix and capital strength.

Strategic investments in AI and digitalization such as the ATOM Foundation and Lumina platform, expanded use of data analytics, and digital banking product launches are driving cost efficiencies, deeper customer engagement, and higher transaction volumes, which should support future revenue and net margin growth. Growing demand for wealth management and retirement solutions, evidenced by double digit growth in assets under administration across Canadian and U.S. Wealth Management, positions RBC to benefit from global wealth accumulation and the aging population, fueling long term, higher margin, recurring fee income streams and AUM growth.

Want to see what earnings path and margin profile are baked into that fair value? The narrative leans on steady top line growth, resilient profitability and a higher future P/E than the wider banks group. Curious which specific revenue and earnings milestones need to be hit to support that premium? The full breakdown joins those moving parts into one valuation story.

Result: Fair Value of $233.13 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could be knocked off course if credit losses remain elevated for an extended period or if real estate exposures result in meaningful impairments.

Find out about the key risks to this Royal Bank of Canada narrative.

Another View: Our DCF Points To Undervaluation

While the narrative fair value suggests Royal Bank of Canada is about 1% overvalued at CA$235.45 versus CA$233.13, our DCF model paints a different picture. It puts fair value nearer to CA$317.94, which is roughly 26% above the current price and implies a margin of safety that the narrative does not.

If one framework says the shares sit slightly rich and another says they trade well below fair value, which set of assumptions do you find more realistic for earnings, growth and risk over the next few years?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Royal Bank of Canada for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Royal Bank of Canada Narrative

If you would rather evaluate the numbers yourself and come to your own conclusion, you can build a custom view in just a few minutes with Do it your way.

A great starting point for your Royal Bank of Canada research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If RBC has sharpened your focus, do not stop here. The Screener can surface other opportunities that fit your style before the market moves on without you.

- Hunt for value by scanning these 877 undervalued stocks based on cash flows that line up current prices with underlying cash flows.

- Lean into future facing themes by checking out these 25 AI penny stocks that sit at the intersection of AI and listed equities.

- Target income potential by reviewing these 11 dividend stocks with yields > 3% that offer yields above 3% alongside listed market exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal